The New York Times (NYT) reports that Swedish battery maker Northvolt, once seen as Europe’s strongest competitor to Chinese rivals, has now filed for bankruptcy protection in the US.

In fact, Northvolt has been facing financial difficulties for months, leading to job cuts and restructuring. Filing for bankruptcy in the US will allow the company to restructure its debt, scale its business to match current customer demand, and ensure a sustainable foundation for continued operations.

A Series of Setbacks

According to NYT, Northvolt has faced a string of challenges this year, starting with accidents at a plant in Sweden and losing a €2 billion contract with BMW in June 2024.

In September, Northvolt announced plans to temporarily halt the production of cathode material, a key component in electric vehicle batteries, at a plant in Skelleftea, Sweden.

Despite the bankruptcy filing, Northvolt’s plants in Sweden will remain open, and the company will continue deliveries and payments to suppliers and employees.

Northvolt expects to access new funding through the restructuring process, including $145 million in debtor-in-possession financing. Additionally, the company mentioned that one of its customers has committed to providing a $100 million loan.

In 2023, Northvolt posted a loss of $1.2 billion, a significant increase from the $285 million loss in 2022.

However, in January 2024, Northvolt received a €5 billion loan from the European Union, the bloc’s largest ever to promote green technology industries.

Nevertheless, NYT suggests that Northvolt’s struggles are symptomatic of widespread instability in the electric vehicle battery manufacturing industry, which could hinder US and European automakers’ efforts to catch up with their Chinese competitors.

Chinese battery manufacturers like CATL and BYD have thrived, while rivals in South Korea, Japan, and Europe struggle. While Chinese competitors benefit from booming domestic electric vehicle sales, where the technology accounts for half of new car sales, the same cannot be said for Europe.

This domestic market advantage gives Chinese battery manufacturers a clear edge over competitors like Northvolt, SK, LG Energy Solution, Samsung SDI, and Panasonic, who rely more heavily on the European and American markets, where electric vehicle sales remain sluggish.

A Northvolt plant in Sweden

Gloomy Outlook

In the EU, demand for electric vehicles has stagnated, with only a 1.3% increase in sales during the first half of 2024, a far cry from the previous year’s 14.6% growth.

This sales decline has impacted battery manufacturers, highlighting the extent to which the flood of cheap Chinese electric vehicles has shaped the industry.

Even within the electric vehicle battery space, China’s CATL is now the world’s largest manufacturer.

Some industry insiders argue that attempting to compete with Chinese manufacturers is a mistake due to their overwhelming advantages. China made the strategic decision to focus on electric vehicles years ago, providing a long period of subsidies for domestic battery makers.

However, Celina Mikolajczak, former CEO of Tesla and current CTO at Lyten, a Silicon Valley company developing sulfur-based batteries instead of expensive metals like nickel and cobalt, offers a different perspective.

“If you’re going to get into the battery business, you have to bring something different to the table,” says Mikolajczak, suggesting that investors and governments should focus their funds on new battery technologies to effectively compete with China.

It is important to note that battery manufacturing is incredibly challenging. The production process must be automated and performed in a dust-free environment using carefully handled metals and chemicals.

Even a small amount of impurities can ruin batches of batteries, costing companies millions of dollars.

Additionally, battery manufacturing plants require billions of dollars to build, and there is a shortage of workers with the necessary expertise.

“The world has underestimated how difficult it is to make batteries,” said Gene Berdichevsky, CEO of Sila, a company that produces advanced battery materials.

Returning to Northvolt, the company plans to close a research and development center near San Francisco and consolidate next-generation battery development in Sweden.

Northvolt’s strategic director, Patrik Andreasson, even warned that Europe and the US risk falling behind in electric vehicle technology.

*Source: NYT

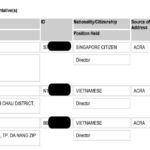

The Truth Behind the Allegations: Is Dat Bike Still a Proudly Vietnamese Enterprise?

“Instead of viewing the narrative as a business no longer being ‘purely Vietnamese’, let’s celebrate the success Dat Bike has achieved in building trust with international investors,” said CEO Son Nguyen.

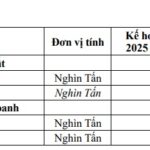

The Electric Vehicle Battery Exchange System by Selex Motors Expands to Da Nang, Now Available in Four Provinces

Prior to Danang, Selex Motors had established approximately 80 battery-swapping stations across Hanoi, Ho Chi Minh City, and Hue.

The All-New BYD MPV: Revolutionizing Road Trips in Vietnam with Unparalleled Efficiency

Introducing our newest all-electric vehicle, a direct competitor to the Toyota Innova Cross and Hyundai Custin. With sleek designs and innovative features, this car is set to revolutionize the automotive industry. Stay tuned for more information on this exciting new release, as we take you on a journey to explore the future of transportation.