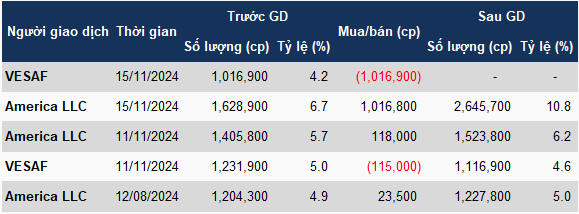

On November 11, a member owned by VinaCapital, the Vietnam Equity Holding Fund (VESAF), sold 115,000 ILB shares, reducing its ownership from over 5% to 4.6% and officially leaving its “large shareholder” position.

In contrast, America LLC (Nevis nationality) bought 118,000 shares, almost equal to the amount sold by VESAF, increasing its ownership from 5.7% to 6.2%.

By November 15, a similar scenario unfolded as VESAF sold all of its remaining over 1 million shares, bringing its ownership to 0%, while America LLC purchased a similar amount to increase its ownership to 10.8%.

|

America LLC and VESAF continuously traded in opposite directions with nearly identical volumes

Source: VietstockFinance

|

Most likely, the above transactions were agreed upon between America LLC and VESAF, as ILB shares witnessed similar negotiated transactions. These transactions involved volumes of nearly 115,000 shares, valued at over VND 3.7 billion on November 11, and over 1 million shares, valued at more than VND 33 billion on November 15, corresponding to a buying and selling price of approximately VND 32,500 per share.

|

ILB generated similar negotiated transactions

Source: VietstockFinance

|

At ILB, there are three other shareholders related to VESAF, which are also managed by a fund management company. These include the VinaCapital Wisdom Balanced Investment Fund (VIBF), holding nearly 1%, Hanwha Life Insurance Company Limited, holding over 0.1%, and Chubb Life Insurance Company Limited, holding nearly 0.3%. Collectively, this group currently owns nearly 328,000 ILB shares, equivalent to over 1.3%.

Recently, the share price of ILB has witnessed fluctuations in the range of VND 30,000-36,000 per share, with liquidity somewhat declining compared to previous months, which also marked a strong upward trend for the stock.

At the closing of the latest session on November 26, ILB was priced at VND 32,400 per share, reflecting a nearly 15% increase since the beginning of 2024, with an average daily trading volume of approximately 7,000 shares.

| Performance of ILB shares since the beginning of 2024 |

What Did the Investment Fund Buy and Sell Last Week?

Last week (November 18-22, 2024), the VN-Index staged a strong recovery, rebounding from the robust support level of 1,200 points after facing two weeks of intense downward pressure. Amid this positive market turnaround, no investment funds have disclosed any buy or sell transactions during this period.

What Will Fuel the VN-Index’s Growth in the Coming Period?

“A robust economy is the fundamental driver of a thriving stock market, and that’s precisely what we’re seeing. With impressive economic growth rates, Vietnam is poised for success. The government forecasts a remarkable 7% growth rate for this year, while VinaCapital predicts a still-healthy 6.5%. This bodes well for the stock market and investors alike.”

VinaCapital Registers to Sell Over 12 Million Khang Dien House Shares

The Vietnam Ventures Limited fund is offering nearly 12 million KDH shares for sale as part of a portfolio restructuring strategy. Should this transaction be successfully completed, Vietnam Ventures Limited’s holdings of KDH shares will be reduced to 6.75 million.