As expected by investors interested in PDV, the Company has officially submitted a listing application for its entire 66 million shares to the HOSE on November 20.

|

PDV has filed for listing on the HOSE

Source: HOSE

|

The submission came shortly after the Company’s Board of Directors passed a resolution on October 21, 2024, to move the listing from the UPCoM to the HOSE, based on a plan approved by the Annual General Meeting of Shareholders in 2022, 2023, and 2024. According to the plan, PDV aims to be listed on the HOSE in 2024 – 2025.

PDV was established on April 20, 2007, initially named Petroleum Product Transport Joint Stock Company, with the English name abbreviated as PDC Shipping JSC.

On October 2, 2008, the Company officially operated as Vietnam Oriental Oil Transport Joint Stock Company, with the English name abbreviated as PV Oil Shipping JSC. On June 16, 2011, the Company changed its English name to PVTrans Oil JSC. On March 28, 2022, the Company officially changed its name to Petroleum Transport and Logistics Joint Stock Company, abbreviated as PVT Logistics as it is known today.

Currently, the Company’s main business activities include petroleum, chemical, and vegetable oil transportation; maritime services and logistics; and ship management and crew supply services.

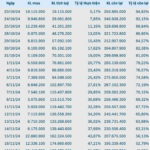

PDV shares officially listed on the UPCoM on April 20, 2017, with a reference price of VND 10,200/share. After several capital increases, PDV‘s capital scale officially reached nearly VND 661 billion in November 2024. In the current ownership structure, PDV has a parent company, the Petroleum Transport Joint Stock Company (PV Trans, HOSE: PVT), which directly holds 51.87% of the capital.

PVT Logistics successfully raises VND 230 billion to purchase a new ship

| PDV’s Capital Increase Process |

In terms of business results, in the first nine months of 2024, PDV recorded nearly VND 1,025 billion in net revenue and over VND 223 billion in net profit, up 52% and 335%, respectively, compared to the same period last year.

In the third quarter of 2024 alone, PDV reported a net profit of nearly VND 167 billion, an increase of 811%. The Company attributed this impressive performance to the contribution of the newly purchased PVT Topaz vessel in September and the bareboat-chartered PVT Pearl vessel since October 2023. Additionally, the sale of the PVT Synergy vessel also brought in significant revenue.

| PDV’s Extraordinary Profit in Q3/2024 |

In recent developments, on November 4, 2024, PDV announced the receipt of a bulk carrier named Kibali, part of the project to purchase a 55,000 – 65,000 DWT cargo ship. The new vessel, built in South Korea in 2011, has a deadweight tonnage of 57,260 DWT and has been renamed PVT Coral.

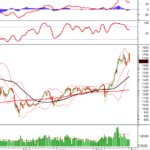

The VN-Index Surges Past 1,240: Rising Liquidity and Continued Foreign Net Buying

The morning session saw an even greater acceleration in the upward trend, with many bottom-fishing investors reaping impressive profits. The VN-Index performed well and entered the 1240-point region, which was previously a breached support level. This triggered a wave of profit-taking, although buying pressure remained strong, resulting in high liquidity.

The Final Countdown: Vinhomes Makes History with Over 211 Million Treasury Shares Sold

Vinhomes is set to purchase an enormous amount of treasury stock, making it the largest such deal in the history of the Vietnamese stock market. While they may not be able to purchase all the registered shares, this move underscores their commitment to making a significant impact.

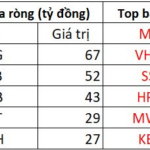

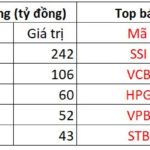

The Great Foreign Turnaround: Overseas Investors Go on a Buying Spree After 30 Sessions of Intense Selling, Spending 250 Billion on a Real Estate Stock

After 30 consecutive selling sessions, foreign investors finally turned net buyers, bringing some balance back to the market.