Leadership Transition at REE: A New Chapter for the Company

Alain Xavier Cany takes over as the new Chairman of REE.

Refrigeration Electrical Engineering Corporation (REE) has announced that Nguyen Thi Mai Thanh will step down as Chairman of the Board, effective November 22nd, to take on the role of General Director. Alain Xavier Cany, representing Platinum Victory, has been appointed as the new Chairman of the Board.

This leadership transition occurs as Platinum Victory, a Singaporean company specializing in automobile distribution in Southeast Asia, has been consistently investing in REE’s shares.

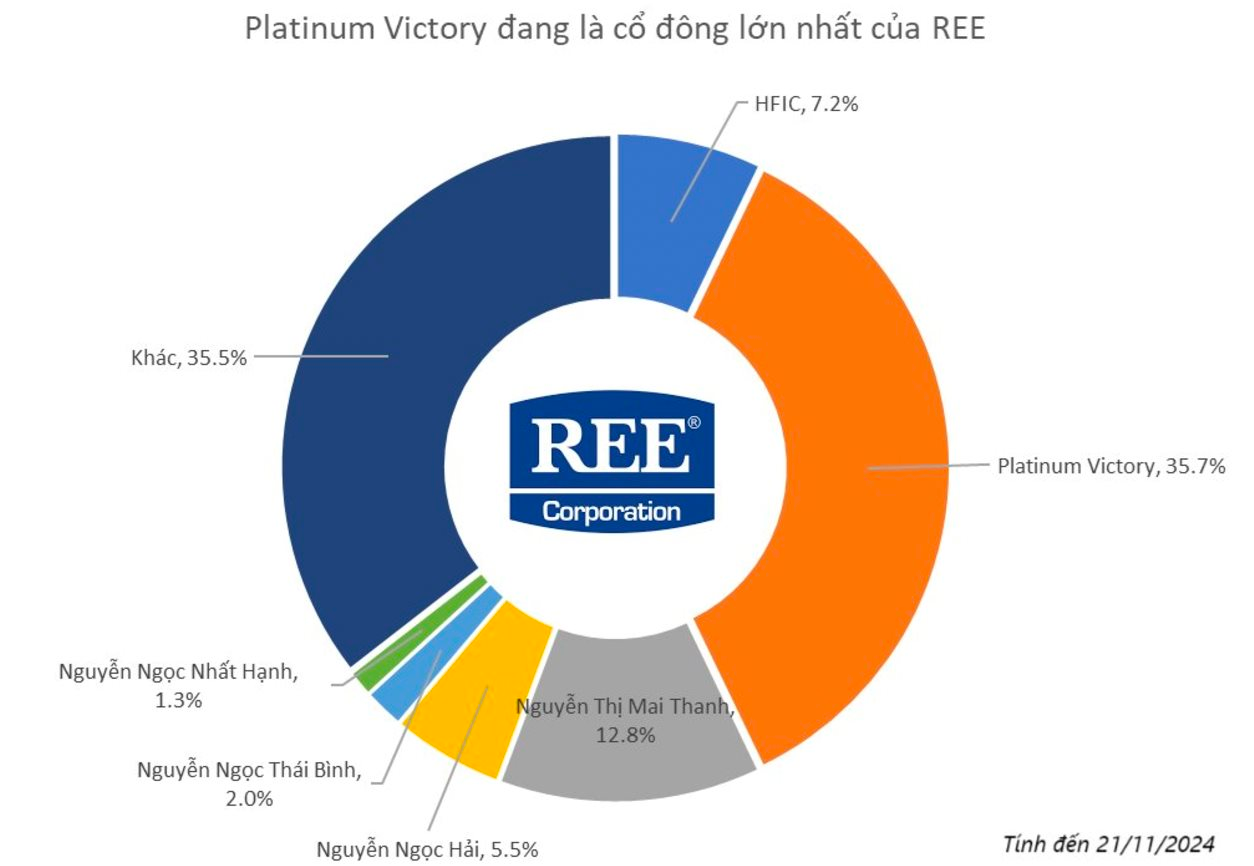

Platinum Victory, a subsidiary of Jardine Cycle & Carriage (JC&C), has been a long-term investor in REE for over a decade. In 2012, the organization, through Platinum Victory, invested in REE by purchasing convertible bonds worth over VND 557 billion from Mai Thanh’s company. Platinum Victory later converted these bonds into a 18.58% stake in REE and gradually increased its ownership to over 35% as of today.

Along with the change in chairmanship, REE also experiences a shift in the position of General Director. One of the biggest concerns of REE’s shareholders is the successor who will accompany Chairman Mai Thanh in leading the company.

Looking back at 2020, when most non-listed public companies complied with the new regulation of separating the roles of Chairman and General Director, Mai Thanh diligently searched for a suitable candidate. REE eventually appointed Huynh Thanh Hai, the Deputy Director, as the new General Director.

The handover ceremony for Hai was held grandiosely, with the presence of numerous partners, clients, and all REE employees. However, REE recently decided to relieve Hai of his duties amid challenging business conditions, as the company faced losses in its fourth quarter of 2023 in the refrigeration, electrical, and mechanical engineering sector.

REE’s journey from a small enterprise to a diversified conglomerate.

Currently, Platinum Victory is the largest shareholder of REE, followed by Mai Thanh’s family, who holds 21.6% of the company’s charter capital. Mai Thanh herself holds over 60.4 million REE shares, equivalent to 12.83% of the company’s charter capital.

Reflecting on her 31-year tenure as Chairman, Mai Thanh is undoubtedly one of the most prominent female leaders in Vietnam’s business landscape. Under her leadership, REE has transformed from a small enterprise into a diversified conglomerate with one of the highest market capitalizations.

Two Pioneering Achievements: From a Small Enterprise to a Diversified Conglomerate

Established in 1977, shortly after the country’s liberation, REE was the first company to transition from a state-owned enterprise to a public company through privatization in 1993. In 1996, REE launched Vietnam’s first air conditioner product under the Reetech brand.

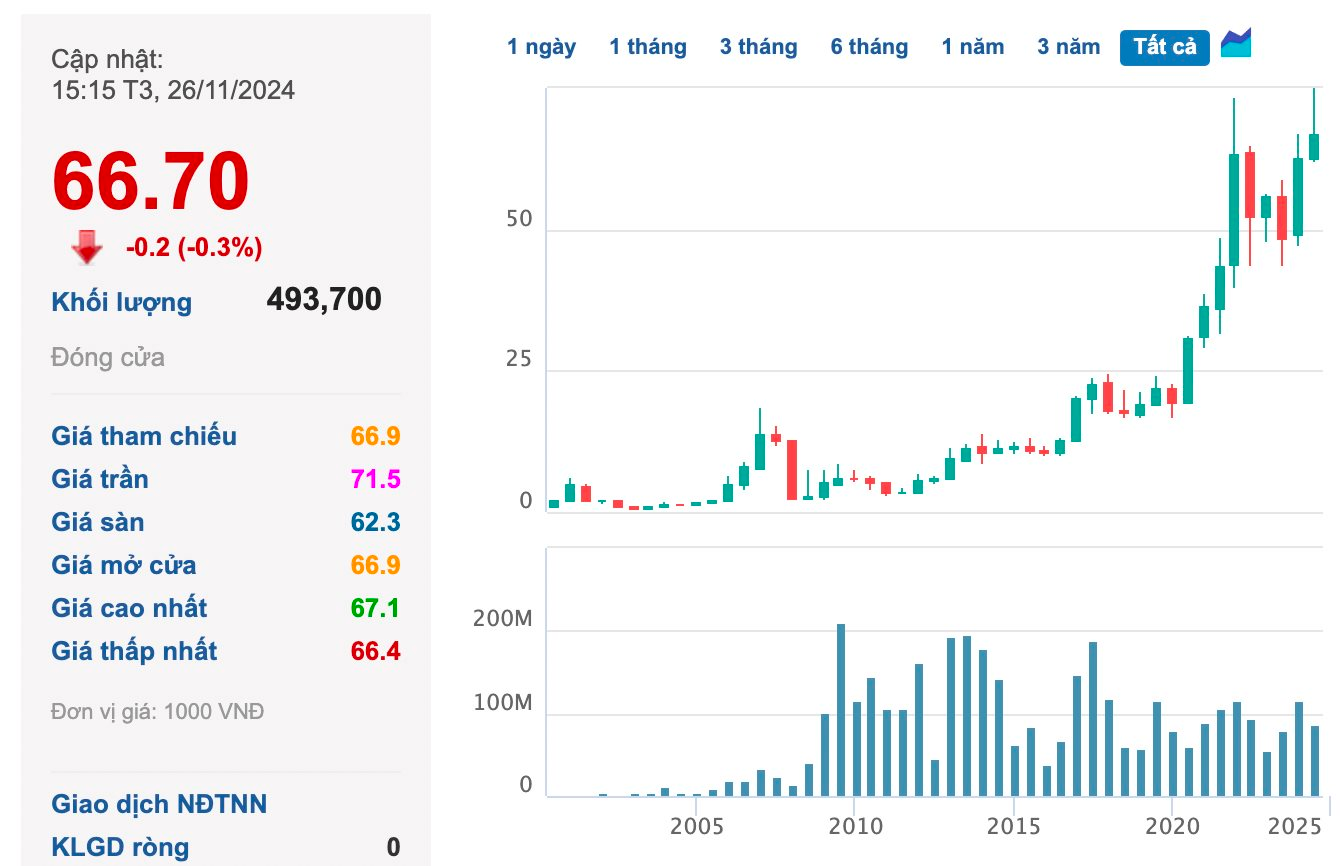

In 2000, as Vietnam’s stock market commenced operations, REE was one of the first two companies to list its shares on the stock exchange (along with SAM).

Today, after nearly half a century, REE has evolved into a diversified conglomerate with three main business areas: refrigeration, electrical, and mechanical engineering; real estate; and electricity and water infrastructure. On the stock exchange, REE boasts a market capitalization of nearly VND 31,500 billion.

Some notable projects that bear the mark of REE include:

+ In the refrigeration, electrical, and mechanical engineering sector: REE M&E is a leading provider of technical services, equipment supply, and mechanical and electrical contracting for key national projects such as the Ben Thanh Metro Station and the Terminal 2 Passenger Terminal at Phu Bai International Airport.

+ In the real estate sector: REE is known for its E.town office complex, spanning 144,854 square meters and housing 220 tenant companies. The construction of e.town 6 is expected to be completed by the end of March 2024.

Additionally, the company develops real estate projects through its subsidiaries, Saigonres (code: SGR) and REE Land.

+ In the electricity and water infrastructure sector: REE has earned a reputation as a “shark” in the industry, actively acquiring businesses such as Vinh Son – Song Hinh, Thac Mo Hydropower, and Thac Ba Hydropower.

To date, REE has ventured into hydropower, solar energy, wind power, and thermal power, with a total power generation capacity of 1,051 MW according to its ownership ratio. The company also holds stakes in water supply companies, with a total production capacity of 450,000 cubic meters per day according to its ownership ratio.

Surpassing VND 1,000 Billion in Profit in 2016: The Giant’s Quest for Growth

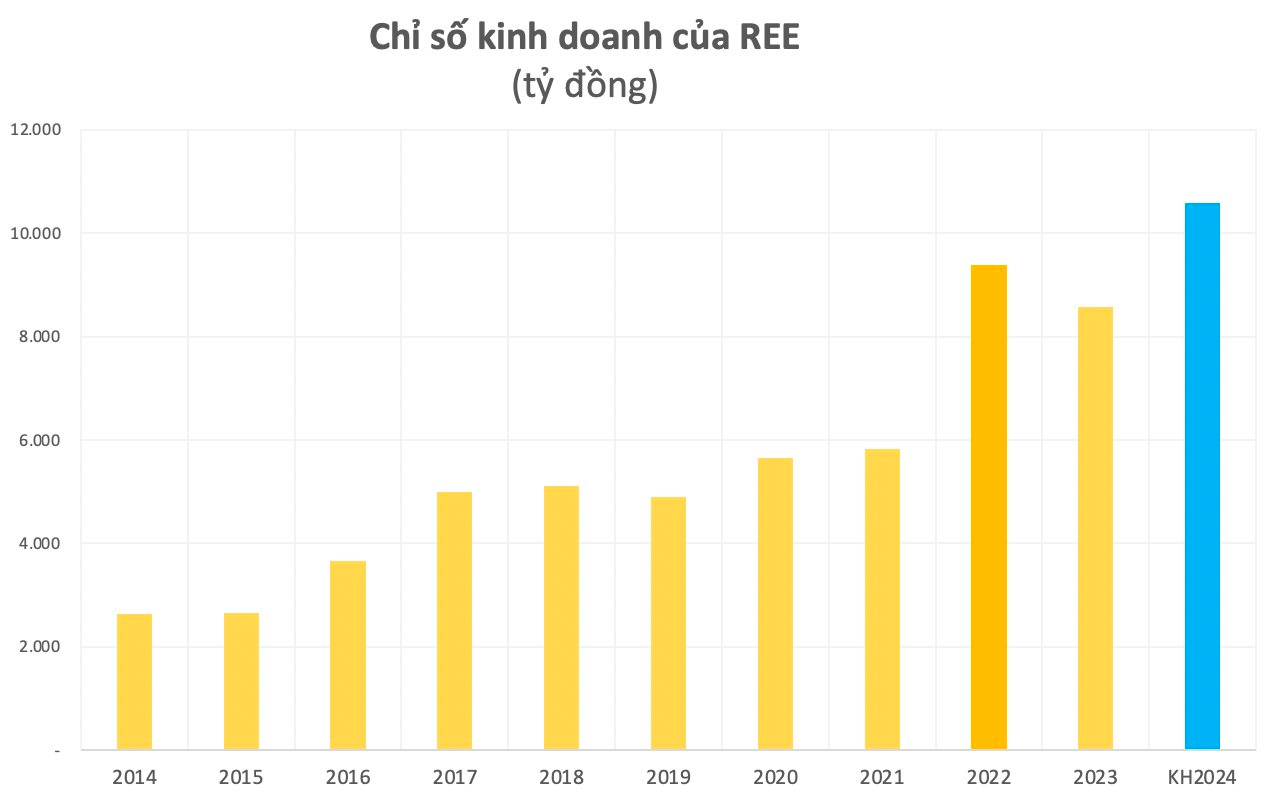

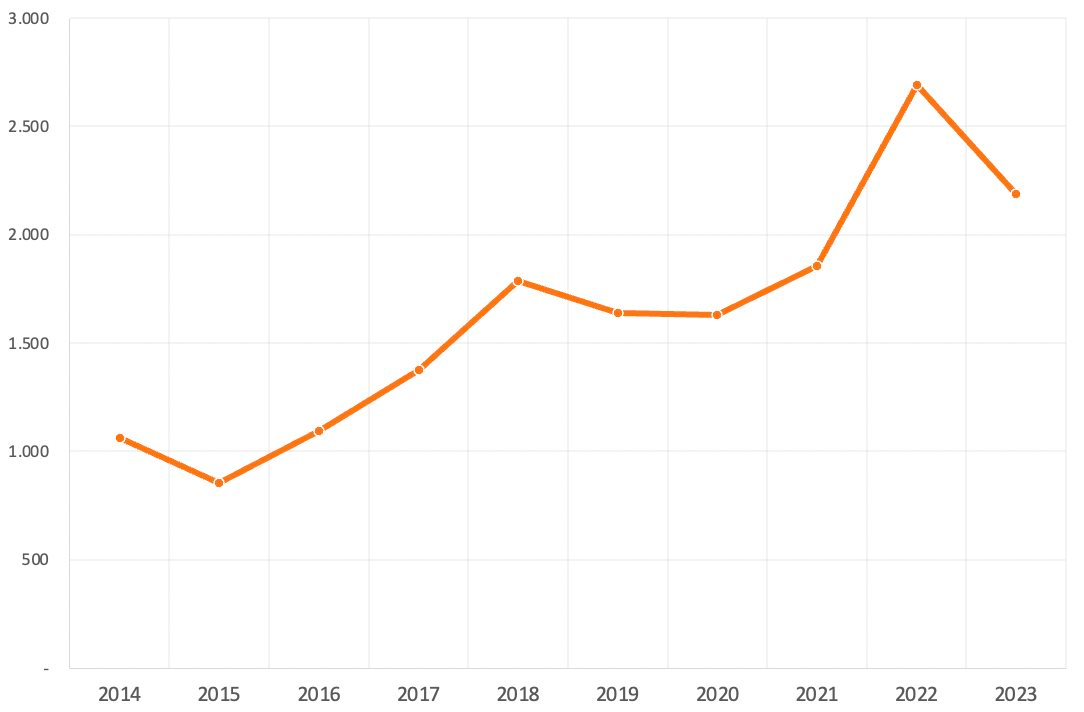

REE’s business performance has had its ups and downs, but the overall trend has been upward. In 2017, the company witnessed a significant jump in revenue, reaching VND 3,663 billion, a 37% increase from the previous year. This was the period when REE’s profit officially surpassed the VND 1,000 billion milestone.

By the end of 2017, REE’s total assets also increased significantly by VND 3,000 billion, reaching nearly VND 14,300 billion. Operating a diverse business portfolio and managing a vast asset base, REE confronted the challenge of sustaining “growth” from then on. For the next five years, REE’s revenue growth stagnated in the single digits.

In 2019, the company experienced a decline of more than 4% in revenue growth, with a corresponding decrease of 9% in net profit, which continued into 2020.

REE’s revenue and profit trends from 2017 to 2023.

Breakdown of REE’s business segments’ contribution to revenue and profit.

2022 marked a record year for REE, as favorable weather conditions boosted the energy segment, resulting in a revenue of VND 9,372 billion and a net profit of VND 2,693 billion, increases of 61% and 45%, respectively, compared to 2021. The energy segment emerged as a new pillar, surpassing the traditional refrigeration, electrical, and mechanical engineering segment, with revenue exceeding VND 5,000 billion.

However, “luck” did not persist, and in 2023, the company faced a series of challenges. In the fourth quarter of 2023, revenue decreased by 33% year-on-year, while profit declined by 32.5%.

The main reason for the profit decline was the refrigeration, electrical, and mechanical engineering segment, which reported a significant loss due to provisioning expenses amounting to VND 199.5 billion in the fourth quarter of 2023. This was the first time this segment incurred a loss of VND 76.3 billion, compared to a profit of VND 41.6 billion in the same period last year.

For the full year 2023, REE achieved revenue of nearly VND 8,600 billion, a decrease of 9%, and a net profit of VND 2,200 billion, a decline of 19% compared to the previous year.

Entering 2024, REE continues its quest for new growth opportunities.

At the 2024 Annual General Meeting of Shareholders, Mai Thanh revealed that the company is exploring opportunities in the waste-to-energy sector, aiming to address waste management issues while generating energy. REE is targeting the development of a waste-to-energy plant with a capacity of 2,000 tons of municipal solid waste per day in Ho Chi Minh City.

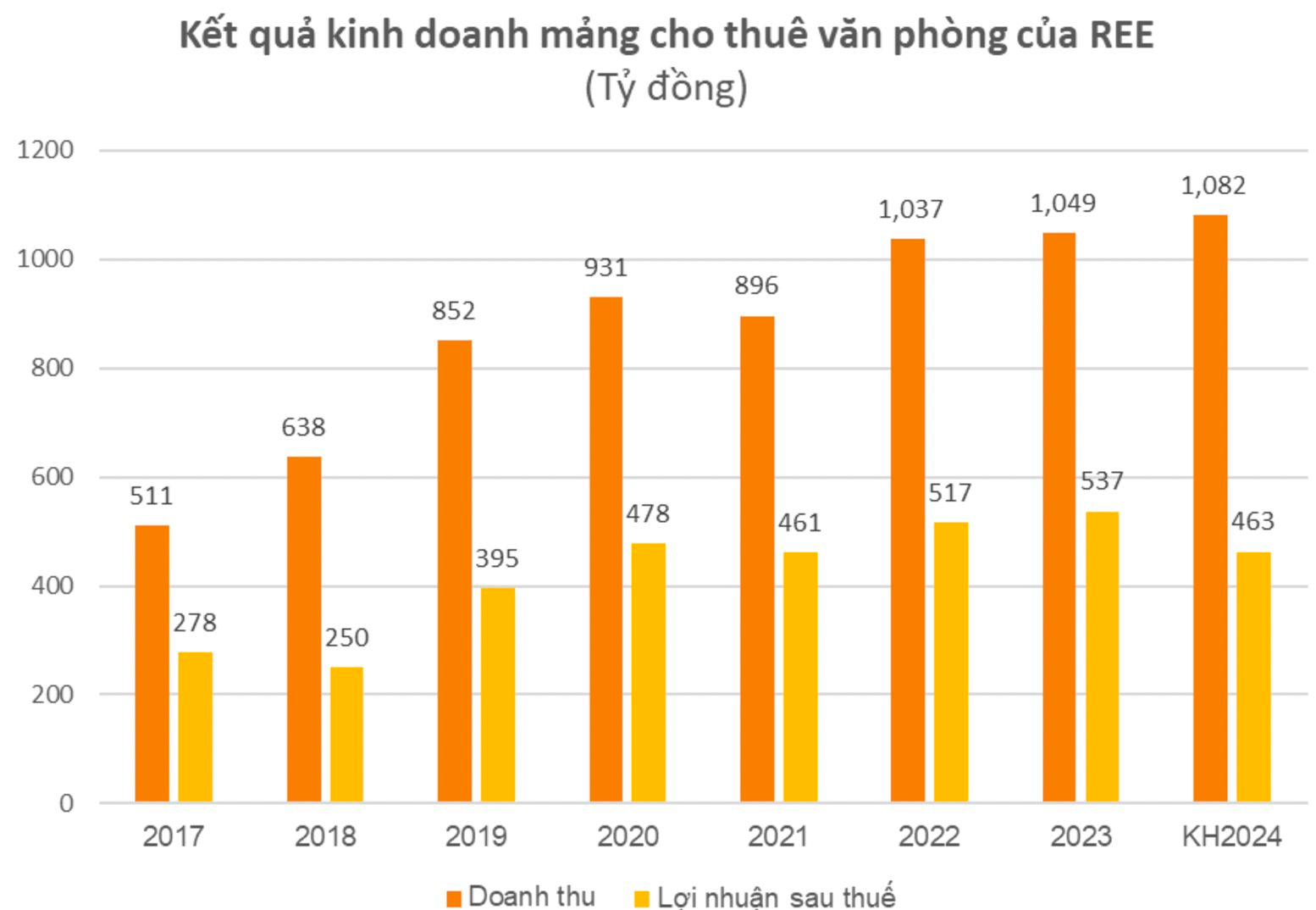

The company is also shifting its focus towards the real estate segment, which currently offers the highest profitability. Amid challenges in other segments, this segment is expected to provide stable revenue and profit, with a net profit margin of up to 51.2%.

Breakdown of REE’s real estate segment’s contribution to revenue and profit.

Currently, the company’s real estate segment is divided into two sub-segments: office leasing and real estate development. For the office leasing sub-segment, the revenue target for 2024 is VND 1,082 billion, a 3% increase from 2023. Conversely, the after-tax profit target decreases by nearly 14%, reaching VND 463 billion. The real estate development sub-segment is expected to bring in a revenue of VND 1,055 billion (no revenue was generated in the previous period) and a net profit of VND 389 billion, a fifteenfold increase compared to 2023.

This year, REE anticipates that the real estate market has weathered the most challenging phase and is poised to enter a period of stability.

A New Era for REE: Mrs. Nguyễn Thị Mai Thanh Steps Down as Chairwoman to Take on the Role of CEO

Effective November 22nd, Mrs. Nguyen Thi Mai Thanh stepped down from her role as Chairwoman of the Board of Management. Mr. Alain Xavier Cany, the former Vice Chairman, has been appointed as the new Chairman.

The Billion-Dollar Group That Invested in Vinamilk and THACO Gets Greenlit for a Public Offer to Acquire REE at a Premium Above Historical Peaks

In 2023, JC&C achieved an impressive revenue of over $22.2 billion, marking a 3% growth compared to the previous year.