The HAIAN ALFA ship is the most modern and largest container ship in Vietnam.

|

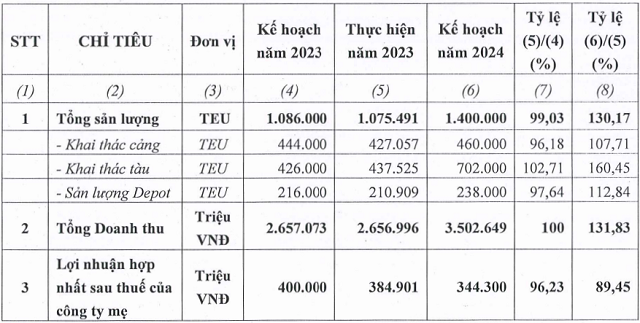

Hai An Transportation and Stevedoring Joint Stock Company (HOSE: HAH) is expected to bring in over VND 3.5 trillion in total revenue, a 32% increase compared to 2023, contributed mainly by the vessel operation with a production volume of 702 thousand TEUs, up to 60%. Although not detailed, the growth figure comes from HAH recently receiving the first newly built 1,800 TEU container ship from the Hoang Hai shipyard – China, named HAIAN ALFA. This is the most modern and largest container ship in Vietnam’s container fleet.

Recently, in the 2023 Business Plan, HAH announced that it will continue to receive 3 more newly built ships in 2024, helping to increase transportation capacity as well as finding suitable partners (foreign shipping lines) for joint operations, container exchange on domestic Asian routes in order to gradually expand operations on these routes.

For port and depot operations, the planned total production volume is 460 thousand TEUs and 238 thousand TEUs, an increase of 8% and 13% compared to 2023.

After deducting costs and expenses, HAH has a net profit of over VND 344 billion, a decrease of 11% compared to 2023, reflecting some of the ongoing difficulties.

|

HAH’s 2024 business plan

Source: HAH

|

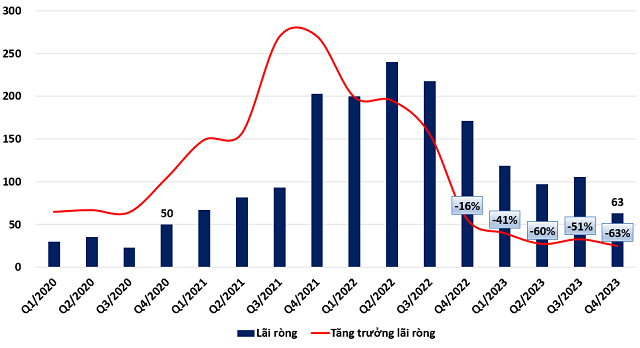

Reminiscing in 2023, HAH’s revenue was nearly VND 2,613 billion and net profit was nearly VND 385 billion, a decrease of 18% and 53% respectively compared to 2022. In the fourth quarter alone, net profit decreased by 63% to VND 63 billion, the lowest in 12 quarters and marked the fifth consecutive quarter with negative growth.

Explaining the results, HAH stated that ocean freight rates and charter rates both decreased compared to the same period, leading to a sharp decrease in ship operation profitability. In addition, HAH also recorded a business loss from the joint venture company Zim Hai An, which was only established and put into operation since March 2023.

|

HAH’s net profit performance from 2020-2023

Unit: Billion VND

Source: VietstockFinance

|