Headquarters of the State Bank of Vietnam (Source: SBV)

On November 28, the State Bank of Vietnam (SBV) announced an increase in the credit growth target for 2024 for credit institutions (CIs). This adjustment was made based on specific principles, ensuring transparency and openness. The additional limit is a proactive measure by the SBV, and CIs do not need to make a request for it.

According to the SBV, this adjustment is made possible by the effective control of inflation, which remains below the target set by the National Assembly and the Government. It also aligns with the Government and Prime Minister’s directives on flexible, efficient, and timely credit institution management to meet the capital needs of the economy and support production and business development.

The SBV requires CIs to strictly adhere to the directives of the Government, its leaders, and the SBV. CIs are instructed to vigorously implement credit-related solutions to improve business efficiency, ensure system safety, and maintain stability in the monetary market. Credit growth should be directed towards production and business sectors, priority areas, and economic growth drivers as per the Government and Prime Minister’s policies. Close control should be maintained over areas with potential risks. CIs are also instructed to continue providing policies to facilitate access to credit for businesses and individuals, maintain stability in deposit interest rates, and make further efforts to reduce lending interest rates through cost reduction, administrative procedure simplification, and enhanced information technology application and digital transformation.

Moving forward, the SBV will closely monitor domestic and international market developments and stand ready to provide liquidity support to enable CIs to extend credit to the economy. It will also promptly implement appropriate monetary policy solutions.

Earlier, at the beginning of 2024, the SBV assigned a 15% credit growth target to CIs through Directive No. 01/CT-NHNN dated January 15, 2024. On August 28, 2024, the SBV proactively notified CIs of an adjustment to the 2024 credit growth target. As of November 22, 2024, system-wide credit increased by 11.12% compared to the end of 2023.

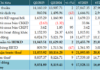

Positive Signals from the Vietnamese Banking Sector in Q3 2024

In a tumultuous economic climate, the Vietnamese banking sector in Q3 2024 demonstrated resilience and growth, with positive signals across the board. The latest financial reports indicate significant improvements in the financial performance of commercial banks, especially with the impending expiration of Circular 06. The CAMELS evaluation model paints a comprehensive picture of the current health and stability of the country’s banking system.

The Trillion-Dollar Bank: BIDV’s Monthly Loan Disbursements Surpass the Combined Total of 15 Other Banks

With a staggering monthly increase of VND 19.5 trillion in outstanding loans, this bank is on track to hit the VND 2 quadrillion mark by the end of the year. This unprecedented scale of lending portfolio solidifies its position as the leading lender in Vietnam, a remarkable feat that underscores its financial prowess and dominance in the industry.