The VN-Index ended October 2024 at 1,264.48 points, a decrease of 23.46 points or 1.82% from the previous month, with low liquidity persisting.

The average trading value of the three exchanges reached VND 17,763 billion in October. For matched orders alone, the average trading value was VND 15,435 billion, up 2.2% from the September average but down 17.4% from the 5-month average.

On a monthly basis, cash flow increased in Banking, Food, and Retail sectors while decreasing in other sectors, including Real Estate, Securities, Steel, Chemicals, Information Technology, Construction, Livestock & Fisheries, Oil & Gas, Textiles & Garments, and Building Materials.

In terms of capitalization, cash flow continued to rise in the large-cap VN30 group while falling to a low in the mid-cap VNMID group and remaining stagnant in the small-cap VNSML group.

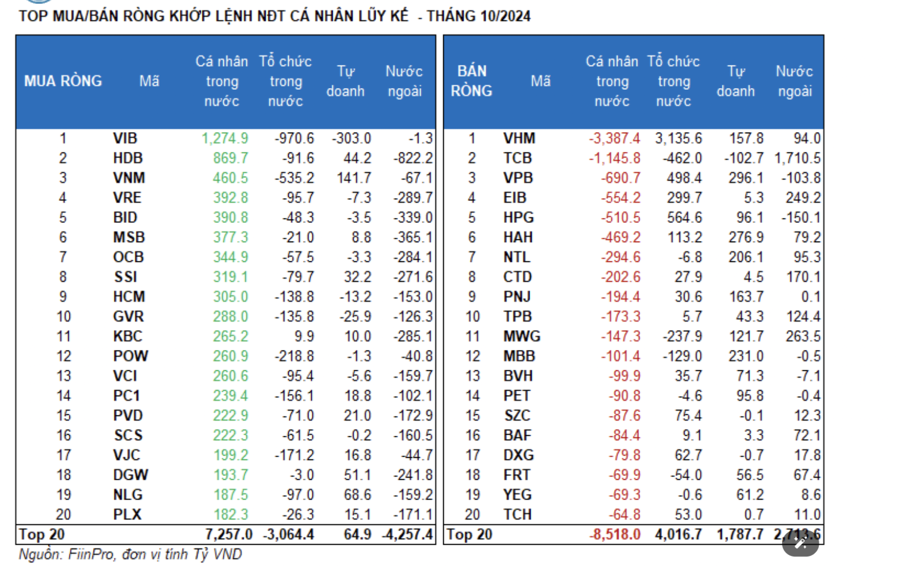

Foreign investors sold a net VND 9,834.9 billion, and for matched orders alone, they sold a net VND 1,040 billion. Their main net buying sectors were Information Technology and Healthcare. The top net bought stocks by foreigners were TCB, FPT, FUEVFVND, MWG, EIB, CTD, TPB, BMP, NTL, and VHM.

On the net selling side, foreigners focused on the Real Estate sector. The top net sold stocks included HDB, MSB, BID, VRE, KBC, SSI, DGW, KDH, and CTG.

Individual investors bought a net VND 4,109.4 billion, with a net sell of VND 263 billion for matched orders. For matched orders, they net bought 10 out of 18 sectors, mainly in Financial Services. The top net bought stocks by individual investors included VIB, HDB, VNM, VRE, BID, MSB, OCB, SSI, HCM, and GVR.

On the net selling side, they net sold 8 out of 18 sectors, mainly in Real Estate and Basic Materials. The top net sold stocks were VHM, TCB, VPB, EIB, HPG, HAH, CTD, PNJ, and TPB.

Proprietary trading bought a net VND 4,693.8 billion, with a net buy of VND 541.2 billion for matched orders alone.

For matched orders, proprietary trading net bought 15 out of 18 sectors, with Real Estate and Banking being the top sectors. The top net bought stocks by proprietary trading today were VPB, HAH, MBB, NTL, PNJ, VHM, STB, VNM, VCB, and MWG.

The top net sold sector was Financial Services. The top net sold stocks included FUEVFVND, VIB, ACB, TCB, FPT, E1VFVN30, MSN, LPB, GVR, and SAB.

Domestic institutional investors bought a net VND 1,031.7 billion, with a net buy of VND 761.8 billion for matched orders.

For matched orders, domestic institutions net sold 14 out of 18 sectors, with the highest value in Banking. The top net sold stocks were VIB, VNM, TCB, FPT, MWG, POW, GMD, VJC, STB, and PC1. The highest net buy was in Real Estate. The top net bought stocks included VHM, HPG, VPB, EIB, DBC, HAH, CTG, BWE, SZC, and KDH.

Cash flow to the Banking sector reached a 3-year peak of 27.89% in October, indicating that market liquidity was concentrated in this sector but failed to provide supportive momentum for stock prices. The Banking index fell by 0.88% in October.

Food, Retail, and Aviation sectors witnessed a slight improvement in cash flow, but the Retail index dropped more sharply than the overall market (-2.49%), suggesting significant selling pressure in this sector. In contrast, the Food and Aviation indices rose by 0.42% and 4.05%, respectively, thanks to the positive performance of leading stocks.

Cash flow decreased in Real Estate, Securities, Steel, and IT sectors, but only Steel and IT indices posted gains.

In terms of capitalization, cash flow continued to rise in the large-cap VN30 group, while it slightly fell in the mid-cap VNMID group and remained stable in the small-cap VNSML group.

The cash flow in the large-cap VN30 group increased to 54.4%, the highest level since January 2022. In contrast, it fell to a low in the mid-cap VNMID group (35.1%). The small-cap VNSML group saw negligible changes in cash flow (8.3%).

In terms of cash flow size, the average trading value of the large-cap group increased by 7.4%, or VND 512 billion. Meanwhile, liquidity decreased by 1.1% in the mid-cap VNMID group and slightly increased by 1% in the small-cap VNSML group.

Regarding price movements, all three indices declined, with the VNMID index leading the losses (-2.81%), followed by VNSML (-1.36%) and VN30 (-1.03%).

The Flow of Funds: Why Stockholders are Holding On – What Incentives are Driving the Money Holders?

The market climbed for another week, with indices outperforming the previous week’s numbers. However, liquidity took a significant dip, falling to a record low in the last one and a half years. Experts suggest that this upward trend is being supported by supply rather than cash flow, and even those with money are unsure whether to jump in at this point.

The VN-Index Soars Past 1,250 Points, Insurance and Tech Stocks in the Spotlight

An influx of investor buying overwhelmed selling pressure, propelling the VN-Index to a remarkable gain of over 8 points and surpassing the 1,250-point milestone. Insurance and technology stocks were the stars of the show, experiencing a veritable “renaissance” and attracting substantial capital inflows from discerning investors.