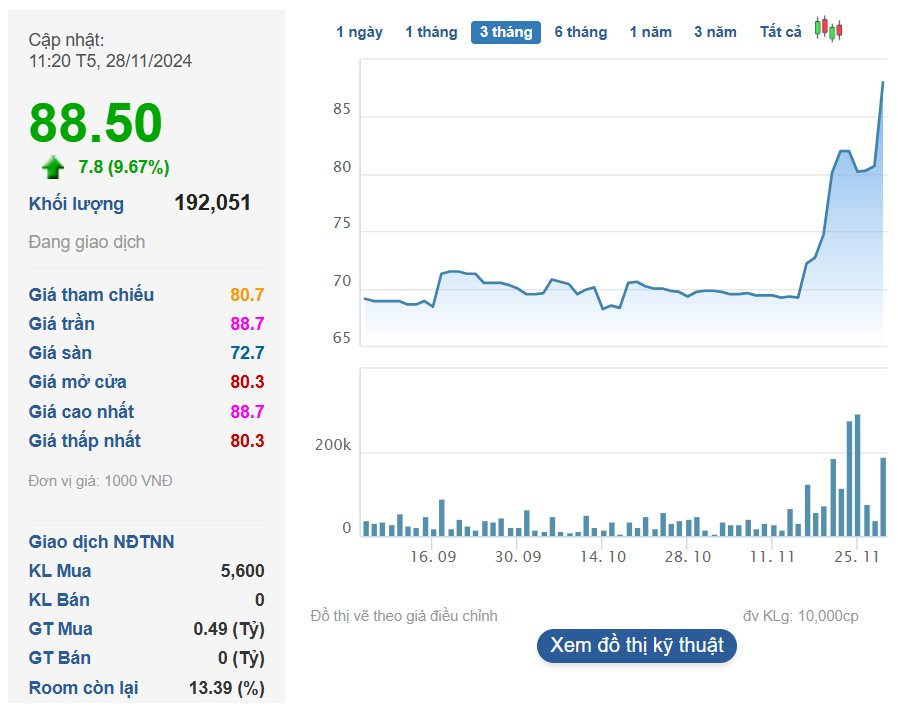

DHT Pharmaceuticals’ shares soared nearly 10% to an all-time high of VND 88,500 per share during the morning trading session on November 28. At one point, the stock touched its daily limit. DHT’s market price has surged almost fourfold since the beginning of the year.

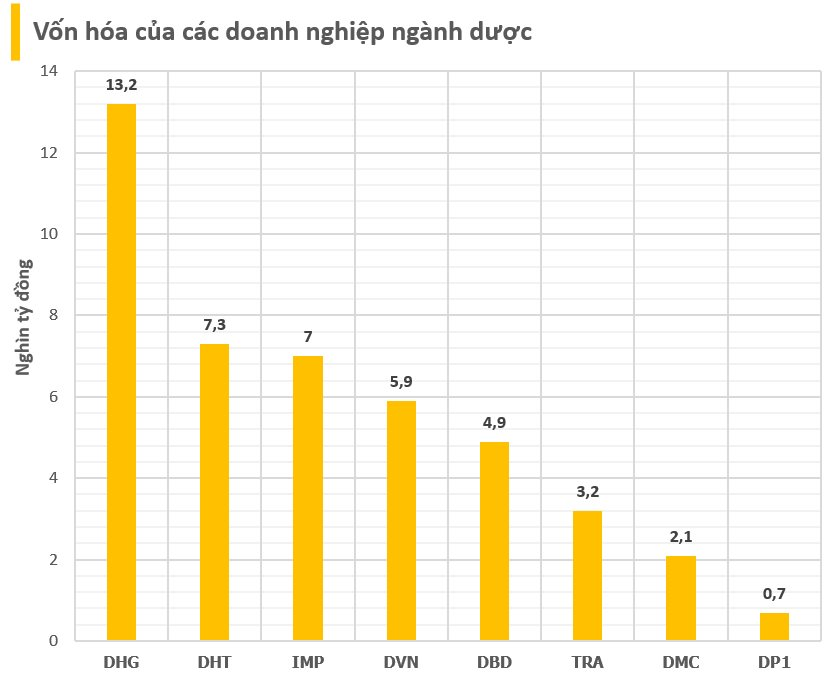

With the current price, DHT’s P/E ratio stands at 79. The company’s market capitalization has reached nearly VND 7,300 billion, surpassing Imexpharm and Vietnam Pharmaceutical Corporation to become the second-largest pharmaceutical company in Vietnam.

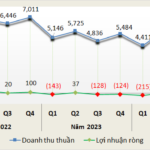

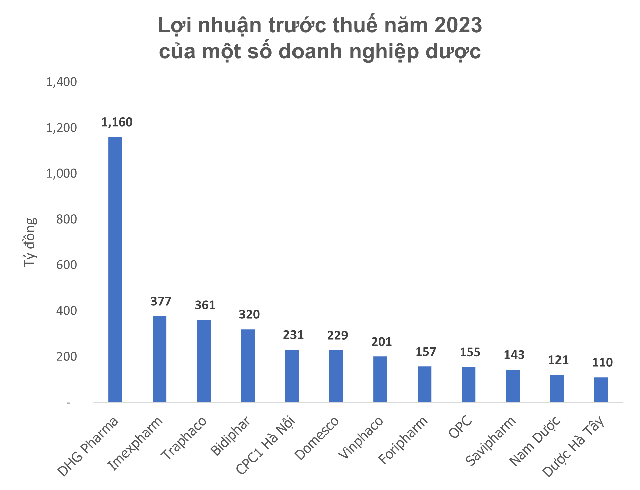

However, compared to most companies in the pharmaceutical industry, DHT’s revenue and profit are not particularly remarkable.

DHT’s stock, along with several other pharmaceutical stocks, has been on a strong upward trend recently due to amendments made to certain pharmaceutical laws. On November 21, the 15th National Assembly officially passed the Law Amending and Supplementing a Number of Articles of the Law on Pharmacy with seven basic new groups of points.

Meanwhile, the Japanese strategic shareholder, ASKA Pharmaceutical, has been consistently increasing its ownership in the context of DHT’s current concentrated shareholder structure. After completing a public offering to increase its ownership to 35%, the investor registered to buy an additional 500,000 shares from November 20 to 26.

VinFast Unveils Smaller, More Affordable Model than VF3: Stock Surges as $10 Billion Valuation Nears Top 5 Global EV Makers

This product is designed for service-based businesses, such as taxi companies and ride-sharing platforms. With its cutting-edge features and intuitive design, it revolutionizes the way these businesses operate, helping them streamline their services and elevate the customer experience to new heights.

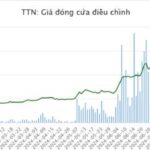

Top 10 UPCoM Companies for Effective Disclosure and Transparency: VNTT Excels

On November 8, at the “Annual Enterprise Conference 2024” organized by the Hanoi Stock Exchange (HNX), VNTT (stock code: TTN) was honored among the top 10 large-scale public companies on UPCoM that excelled in information disclosure and transparency for the year 2023-2024.

“Vingroup Pledges Assets to Secure Vinhomes’ Issuance of up to VND 4,000 Billion in Bonds”

Previously, Vingroup’s Board of Directors passed a resolution to provide payment guarantees and utilize the Group’s owned assets as collateral for bonds issued by its subsidiary. This resolution pertains to privately placed bonds with a maximum face value of VND 6,500 billion to be issued by the subsidiary this year.