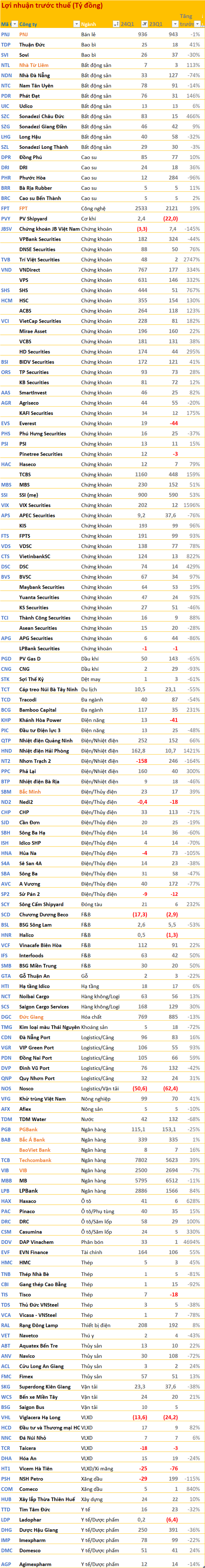

Newly announced Q1/2024 Financial Statements on April 23rd:

TPBank (TPB) reported pre-tax profit of VND 1,829 billion in Q1/2024, a 7% increase year-on-year. The bank expects to reach over VND 2,500 billion by the end of April. Its bad debt ratio is also decreasing.

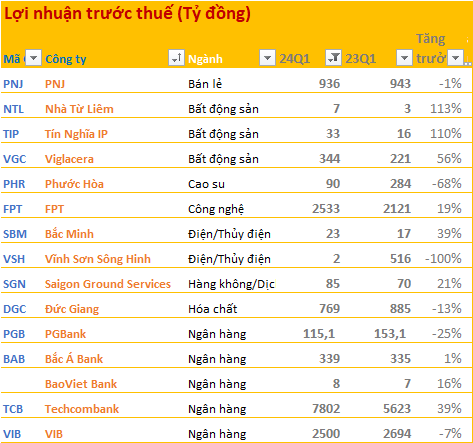

Tín Nghĩa (TIP) reported a pre-tax profit of VND 33 billion in Q1/2024, representing an 110% increase compared to the same period last year.

Vĩnh Sơn – Sông Hinh (VSH) reported a 99.9% decrease in pre-tax profit to VND 2 billion in Q1/2024. The decline in revenue is the major cause of this significant drop in profit.

Vincom Retail (VRE) estimates Q1/2024 revenue to be VND 2,250 billion, of which rental revenue accounts for 80%, real estate revenue accounts for 10-12%, and the remainder is other revenue. Net income after tax reached over VND 1,080 billion, a 6% increase year-on-year.

MSB estimates its pre-tax profit to exceed VND 1,500 billion, a slight increase compared to last year. CIR decreased to 33%, overall NIM to 3.87%; CASA increased by 14.64% and accounted for 29% of total deposits, showing growth compared to the same period last year.

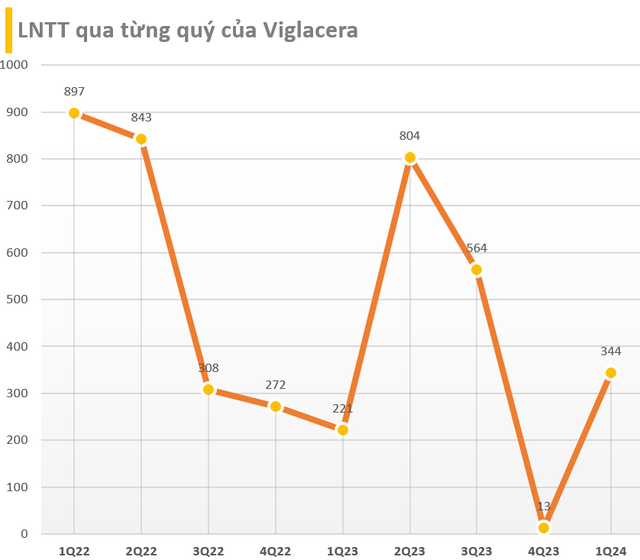

Viglacera (VGC) announced its Q1/2024 financial statements with pre-tax profit reaching VND 344 billion, a 56% increase. Reduced expenses are the main factor behind this company’s increased profits, marking a return to growth after four consecutive quarters of decline.

Techcombank (TCB) recorded pre-tax profit of VND 7,802 billion in Q1/2024, a 38.7% increase year-on-year. Cost-to-income ratio (CIR) significantly decreased from 33.8% in the same period last year to 26.5%.

At the end of Q1/2024, Techcombank’s total assets increased by 4.3% compared to the end of 2023, reaching VND 885,700 billion.

BacABank (BAB) released its Q1/2024 financial report with pre-tax profit reaching VND 338.6 billion, a 1% increase year-on-year. The bank’s growth momentum comes from net interest income, while other business segments declined compared to the same period last year.

VIB (VIB) reported a 7% decrease in pre-tax profit in Q1/2024 compared to the same period last year, reaching VND 2,500 billion.

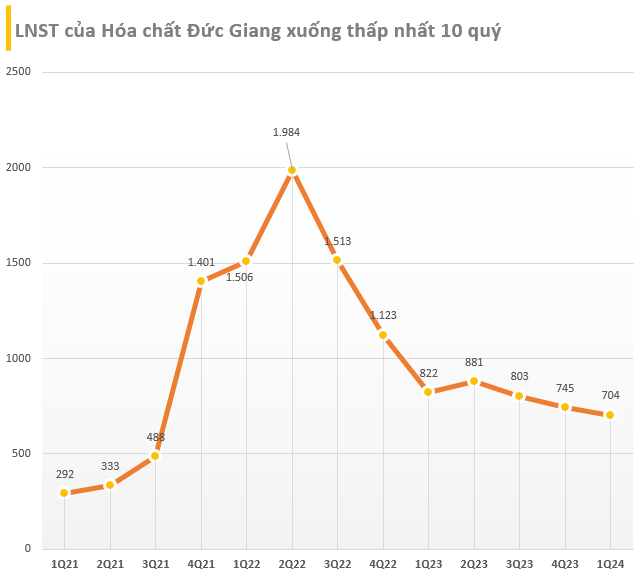

Duc Giang Chemicals Group Corporation (stock code: DGC) recorded net revenue of VND 2,385 billion in Q1, a 4% decrease year-on-year. Pre-tax profit for Q1 reached VND 769 billion, a 13% decrease year-on-year.

Phu Nhuan Jewelry JSC (PNJ) reported net revenue of VND 12,594 billion in Q1, a 29% increase year-on-year. However, due to increased cost of goods sold and general and administrative expenses, PNJ’s pre-tax profit decreased by 1% year-on-year to VND 936 billion.

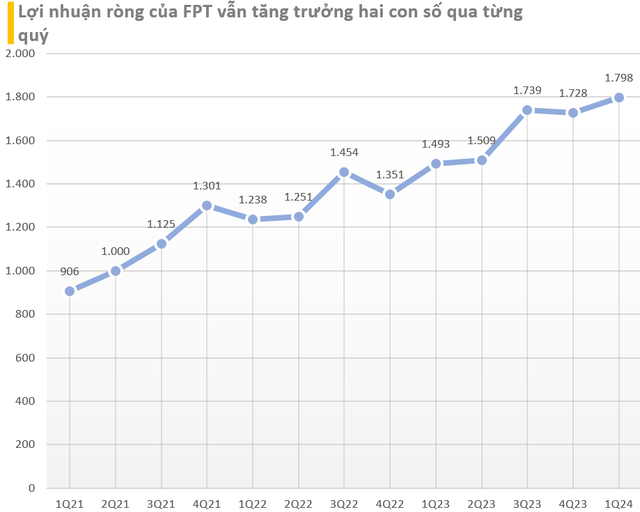

FPT Corporation (FPT) has just announced its preliminary business results for the first 3 months of 2024, with revenue estimated at VND 14,093 billion and pre-tax profit at VND 2,534 billion, increasing by 20.6% and 19.5% respectively compared to the same period in 2023.

Nha Tu Liem (NTL) reported a 113% increase in pre-tax profit to VND 7 billion. This is the second consecutive quarter of triple-digit growth in profit for the company.

The Century Fiber Corporation (STK) recorded revenue of VND 265.7 billion, a 7.6% decrease year-on-year. Combined with a decrease in financial revenue and an increase in financial expenses, the company’s pre-tax profit was a mere VND 1.1 billion, a 61% decrease.