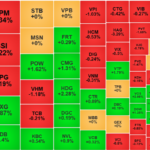

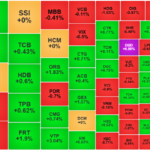

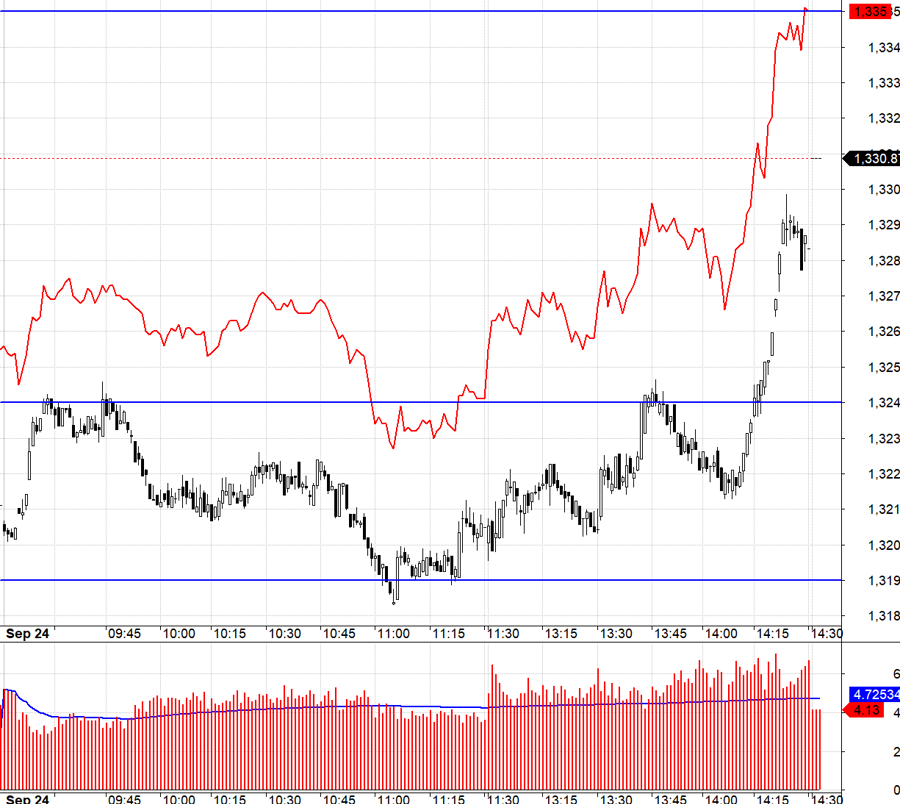

The market sentiment during today’s trading session (November 27) witnessed a slight stagnation with the emergence of cautious sentiments around the reference mark. The corrective movement spread widely, and the red color started to dominate as liquidity remained low. Selling pressure prevailed, but the adjustment range was relatively narrow thanks to several blue-chips maintaining their gains (FPT, HDB, and VCB), thus balancing the overall index.

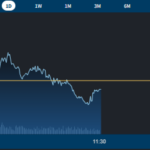

Liquidity weakened again, falling below the 20-session average.

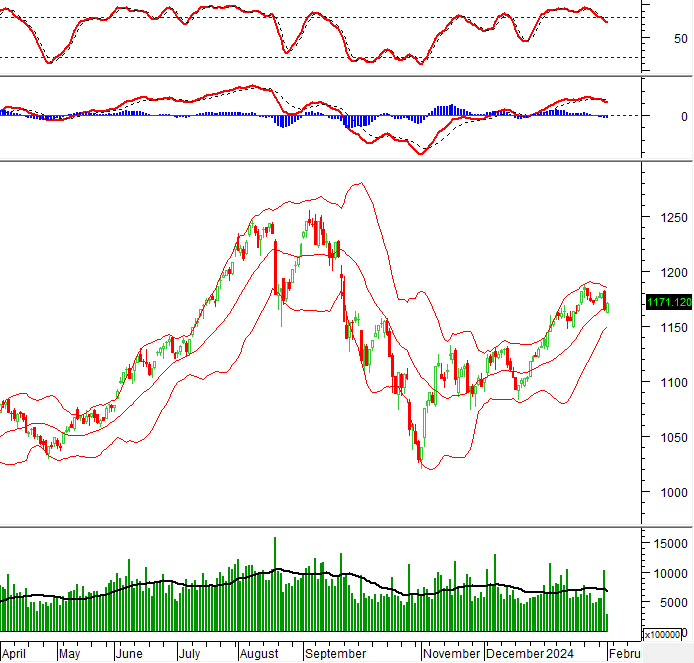

The VN-Index has been on an upward trajectory for almost a week since the 1,200 mark, indicating that investors are likely to take short-term profits or reduce investment to observe the market’s next move.

A cautious sentiment persisted, with investors opting to remain on the sidelines and observe the market’s familiar ups and downs around the reference mark. The lack of liquidity and leading sectors resulted in subdued trading throughout the session.

FPT stood out as the brightest spot on the electronic board today, contributing over 1.3 points to the VN-Index. At the closing bell, the stock rose 2.74% with more than 9.8 million matched orders. FPT also recorded the strongest gains among the VN30 group today.

Liquidity weakened again, falling below the 20-session average, with the total trading value on the three exchanges reaching approximately VND 12,730 billion.

Foreign investors maintained their net buying streak for the fourth consecutive session. Today, they net bought approximately VND 359 billion in the overall market, focusing on FPT, MSN, and VNM. On the other hand, HPC, DCM, and VRE were the top three sold-off stocks.

At the market close, the VN-Index lost 0.16 points, falling to 1,241.97 points, with 124 gainers and 237 losers. Total trading volume reached 428.8 million shares, and the value was VND 11,356 billion. Block deals contributed over 62.7 million shares, valued at VND 2,092 billion.

The HNX-Index decreased by 0.61 points to 223.00 points, with 59 gainers and 88 losers. Total trading volume reached 33.6 million shares, and the value was VND 570 billion. Block deals added another 23.8 million shares, valued at VND 2,601 billion.

The UPCoM-Index dropped 0.10 points to 91.96 points, with 151 gainers and 105 losers. Total trading volume reached 43 million shares, and the value was VND 806 billion. Block deals contributed an additional 18.6 million shares, valued at VND 489 billion.

In the derivatives market, VN30F2412 rose 0.8 points to 1,307.8 points, with more than 143,000 matched contracts.

The Stock Market in 2025: Forget Forex, Aim for a Breakthrough

“Unleashing the potential of the market requires a focus on public investment. By invigorating public investment, we can create a new impetus for economic growth and development, paving the way for a thriving future.”

The Big Sell-Off Hasn’t Happened Yet, Foreign Investors Bet Big on FPT

The afternoon session witnessed a slight uptick in liquidity, rising nearly 6% from the morning session, yet it remained relatively low. Trading was stable, and even the breadth was better than the morning. The VN-Index closed with a minor loss of 0.16 points, indicating a maintained balance. The market has not witnessed any significant selling pressure thus far.

Shake It Off: VN-Index Remains Resilient at 1240 Points

Pressure continued to weigh on the afternoon session, pushing the VN-Index down to 1240.91 points at one stage. However, buying support helped to balance out the market, and the index only experienced minor fluctuations on very low liquidity.

The Foreign Capital Net Buy, VN-Index Approaches 1240 Points

The market held its ground in the afternoon session, maintaining its highs without surging or plunging significantly. Notably, foreign investors turned net buyers again, with a net purchase value of over VND 165 billion on the HoSE, marking the second consecutive net buying session. Despite the continuous upward momentum offering attractive short-term gains, investors seem reluctant to offload their positions.