In a filing with the Philippine Stock Exchange (PSE), ACEN Corporation disclosed that its subsidiary, ACEN Vietnam Investments Pte. Ltd., has signed a Share Purchase Agreement (SPA) with Huntington Renewable Investments Limited to acquire a 49% stake in BIM Energy Holding Corporation.

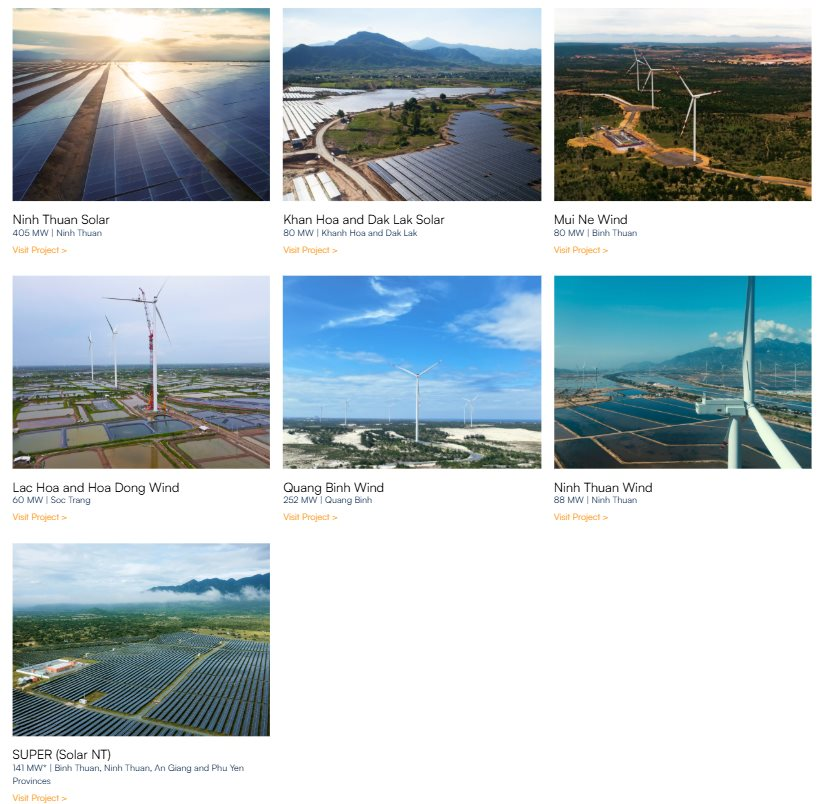

BIM Energy currently owns and operates renewable energy assets, including the Ninh Thuan Solar Power Plant (405MW) and the Ninh Thuan Wind Power Plant (88MW).

However, according to its website, ACEN Corporation currently holds 50% economic interest in the Ninh Thuan Solar Power Plant cluster and 65% economic interest in the Ninh Thuan Wind Power Plant of BIM Energy.

As introduced on its website, BIM Energy, a member of BIM Group, is one of the pioneering investors in renewable energy in Vietnam. The long-term goal by 2025 is to develop at least 1GW of clean energy (wind and solar power). In April 2019, BIM Energy inaugurated a solar power plant cluster with a total investment of VND 7,060 billion in Ninh Thuan Province. This was the largest solar energy project in Southeast Asia at that time. By 2020, the cluster had reached a total capacity of 405MWp. The BIM Wind Power Plant, with a total capacity of 88MW and a total investment of USD 158 million, was commenced in 2021 and completed in just 11 months. The plant’s annual output is approximately 317GWh.

In 2022, ACEN Corporation also acquired a 49% stake in Solar NT, owned by Super Energy (Thailand), through ACEN Vietnam Investment, with a total transaction value estimated at USD 165 million. As a result, Acen indirectly invested in nine solar energy projects with a total capacity of 837 MW in Vietnam. After the transaction with Super Energy, Acen’s complete portfolio in Vietnam will include 15 renewable energy projects.

ACEN has completed the first phase of the Solar NT acquisition, with an installed capacity of 141 MW. It is estimated that by the completion of all four phases, ACEN will increase the total capacity of its renewable energy investments in Vietnam to over 1,000 MW. This capacity makes ACEN the largest foreign investor in renewable energy in Vietnam.

According to the website, the total installed capacity of ACEN’s renewable energy projects under investment in Vietnam is 1,106 MW. Excluding Solar NT’s projects, ACEN is investing in six Vietnamese projects with a total installed capacity of 965 MW. Of this, ACEN holds approximately 613 MW of economic interest.

In addition to its renewable energy projects in Vietnam, ACEN also holds a 24% economic interest in the 600 MW Monsoon Wind Power Project in Laos. The project, upon completion in 2025, will export electricity to Vietnam. Thus, the total renewable energy capacity invested by ACEN serving the Vietnamese market amounts to approximately 1,200 MW.

ACEN, a subsidiary of the longstanding Ayala Group in the Philippines, currently has 6.8 GW of renewable energy capacity attributable to its operating, under-construction, and committed projects.

ACEN aims to expand its renewable energy capacity to 20 GW by 2030 and is on track to achieve its goal of 100% renewable energy production by 2025.

For the first nine months of the year, ACEN reported a 24% increase in consolidated net income attributable to the parent company’s shareholders, reaching PHP 8.14 billion (approximately VND 3,500 billion). Renewable energy output increased by 31% compared to the same period last year, despite seasonal declines in solar and wind resources.

Renewable Energy Vietnam: Reducing Losses, Bond Debt Cleared Under SP Group’s Stewardship

The Vietnam Renewable Energy JSC (VRE) has made significant strides in reducing its losses, yet it continues to face a cumulative deficit of over VND 126 billion. A notable achievement for the company was the successful repayment of bond debts in the first half of 2024, shortly after coming under the ownership of SP Group.