I. MARKET ANALYSIS OF THE STOCK MARKET FOR BASIC DAY 12/02/2024

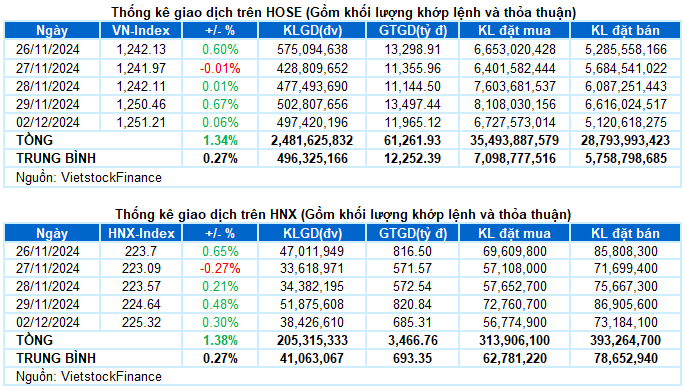

– The main indices closed the 12/02 session in a light green color. VN-Index ended the session up 0.06%, reaching 1,251.21 points; HNX-Index increased by 0.3% compared to the previous session, reaching 225.32 points.

– The matching volume on HOSE reached nearly 389 million units, down 9.2% compared to the previous session. The matching volume on HNX decreased by 22%, reaching nearly 34 million units.

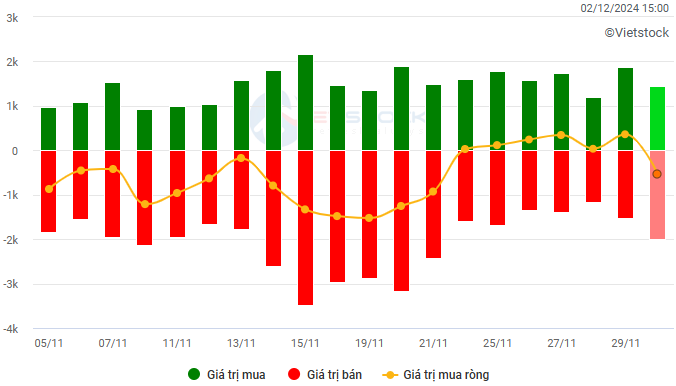

– Foreigners returned to net sell on the HOSE floor with a value of more than 421 billion VND and net sold more than 408 million VND on the HNX floor.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

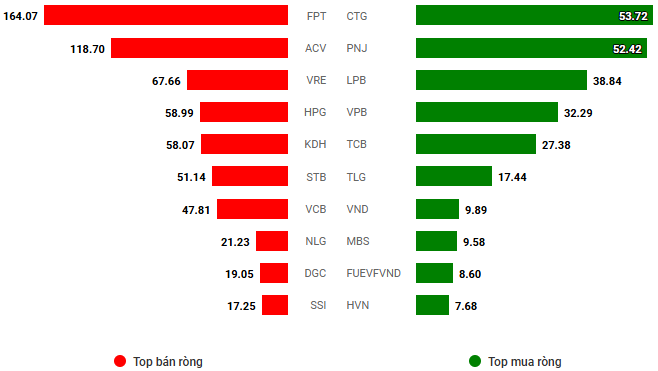

Net trading value by stock code. Unit: Billion VND

– After a short-lived excitement at the beginning of the session, the market started to slow down and slide when buying force weakened. From an increase of more than 7 points, VN-Index only slightly increased by nearly 2 points at the end of the morning session. Entering the afternoon session, the market still showed no signs of excitement, the main indices continued to fluctuate around the reference level in the context of low liquidity. Notably, foreigners returned to net selling after a week of net buying. At the end of the 12/02 session, the VN-Index closed near the reference level, reaching 1,251.21 points.

– In terms of impact, VCB, LPB and BVH led in terms of positive impact, helping VN-Index increase by more than 2 points. On the contrary, FPT, BID and GAS exerted the most significant pressure today, taking away nearly 1 point from the general index.

– VN30-Index ended the session down 0.19%, to 1,308.83 points. The breadth was biased towards selling with 17 stocks decreasing, 9 increasing, and 4 standing.

Groups of industries that attracted good buying power at the end of the previous week continued to maintain a positive increase today, including telecommunications, healthcare, and insurance. However, the cash flow started to be more selective, focusing on outstanding stocks such as VGI (+2.87%), VNZ (+1.15%), YEG (+1.36%); DHT and TTD hit the ceiling price, IMP (+1.45%), DBD (+2.13%); BVH (+3.16%), PVI (+1.62%), MIG (+2.76%) and BLI (+2.06%).

Stocks related to public investment were also a notable highlight when they made a strong voice after a long silence, typically HHV (+3.65%), PLC (+6.83%), VCG (+3.45%), C4G (+5.26%), KSB (+2.01%) and FCN (+1.22%). Most of the remaining industry groups were also polarized, with stocks fluctuating slightly around the reference level.

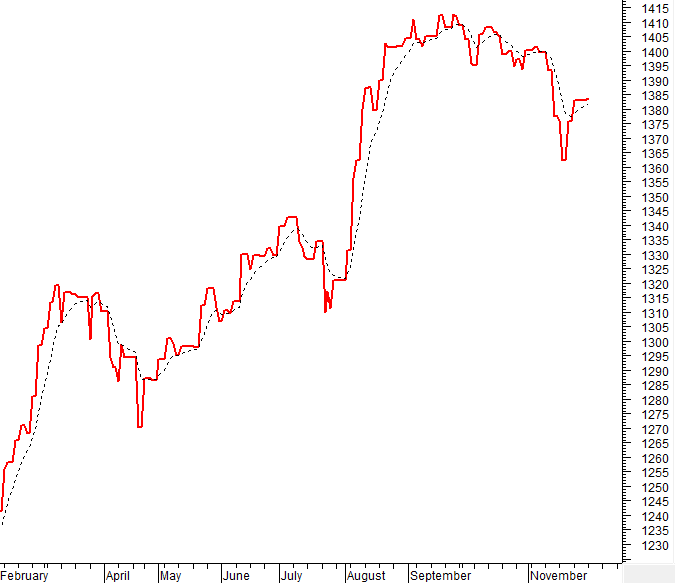

VN-Index has continuously maintained an uptrend since breaking above the Middle line of the Bollinger Bands. If in the coming sessions, the index stays above the SMA 200-day line, accompanied by an improvement in trading volume, the uptrend will be further strengthened. Currently, the Stochastic Oscillator and MACD indicators continue to point upwards after giving buy signals. If this state continues to hold, the short-term optimistic outlook will be maintained.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Maintain above the Middle line of Bollinger Bands

VN-Index has continuously maintained an uptrend since breaking above the Middle line of the Bollinger Bands. If in the coming sessions, the index stays above the SMA 200-day line, accompanied by an improvement in trading volume, the uptrend will be further strengthened.

Currently, the Stochastic Oscillator and MACD indicators continue to point upwards after giving buy signals. If this state is maintained, the short-term optimistic outlook will be sustained.

HNX-Index – Trading volume fluctuates erratically

HNX-Index increased slightly while trading volume continuously fluctuated erratically around the 20-day average level. This reflects the instability in investors’ psychology.

However, the Stochastic Oscillator indicator continues to point upwards since leaving the oversold zone. At the same time, the MACD indicator gave a buy signal again after cutting above the Signal Line. If this continues in the coming time, the situation will become more optimistic.

Analysis of Money Flow

Fluctuation of smart money flow: The Negative Volume Index indicator of VN-Index broke above the EMA 20-day line. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuation of foreign capital flow: Foreigners returned to net selling in the trading session on 12/02/2024. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

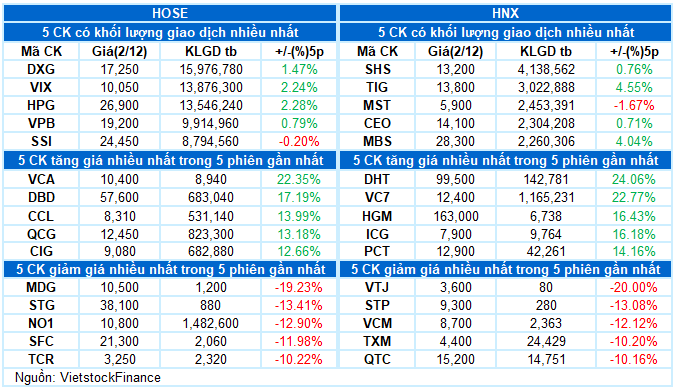

III. MARKET STATISTICS ON 12/02/2024

Department of Economic Analysis & Market Strategy, Vietstock Consulting

“Insurance Stocks Surge: Foreign Investors Maintain Net Buying Throughout the Week”

The stock market was awash with a sea of green today (November 29th) as insurance stocks surged and blue-chip companies provided solid support. A further boost came from foreign investors who maintained their net buying streak throughout this week.

The Power of Persuasive Writing: Crafting Compelling Headlines

“The Week Ahead: Uptrend Momentum Sustained”

The VN-Index extended its gains from the previous week, forming a bullish White Marubozu candlestick pattern. This indicates strong buying pressure as the index closed near its high. Additionally, the VN-Index has crossed above the 200-week SMA, reflecting a positive long-term outlook and an increasingly optimistic investor sentiment. However, the MACD indicator is currently showing a sell signal, and a drop below the zero line could trigger a short-term correction. If this occurs, the likelihood of a downward adjustment increases.

![[IR AWARDS] December 2024: A Month of Revealing Insights](https://xe.today/wp-content/uploads/2024/12/Screenshot_01-150x150.png)