River Gate Shipyard – SBIC’s Strange Subsidiary

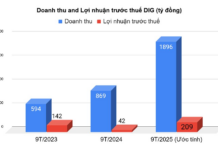

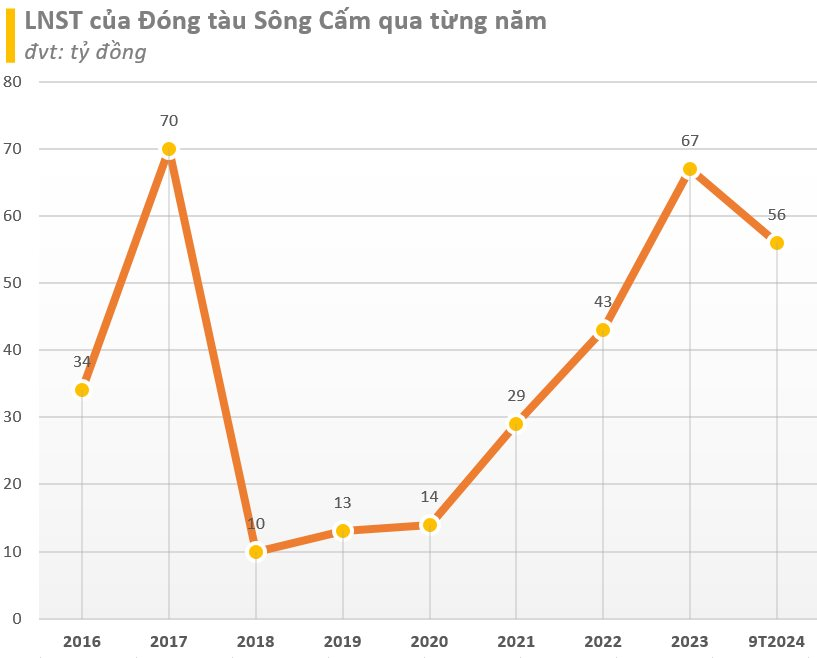

In Q3/2024, River Gate Shipyard Joint Stock Company (stock code: SCY) recorded a revenue of over VND 229 billion, a nearly 60% decrease compared to the same period last year. After deducting expenses, the company reported a 73% drop in net profit to over VND 12 billion.

For the first nine months of the year, the company achieved a revenue of VND 853 billion, a decrease of nearly 5% compared to the same period last year, and a net profit of over VND 56 billion, a decrease of nearly 3% from the previous year.

As of September 30, the company’s total assets stood at VND 1,447 billion, a decrease of VND 30 billion from the beginning of the year. Of this, the company holds over VND 522 billion in cash and cash equivalents, accounting for 36% of its assets. Fixed assets amounted to VND 204 billion.

Equity reached VND 905 billion, including VND 112.4 billion in undistributed post-tax profits and a charter capital of VND 619.6 billion. The company has no financial debt.

River Gate Shipyard – SBIC’s Strange Subsidiary

River Gate Shipyard, formerly known as “Hai Phong Mechanical,” was established in 1959 as a public-private joint venture. In March 1983, the company was renamed River Gate Shipyard.

On March 11, 1993, by decision of the Minister of Transport, the company came under the management of Vietnam Marine Industry Corporation. In April 2008, the company officially operated as a joint-stock company named River Gate Shipyard (River Gate Shipyard Joint Stock Company). The company has been trading on the UPCoM exchange since October 25, 2017.

River Gate Shipyard is a subsidiary of Vietnam Marine Industry Corporation (SBIC)

. However, contrary to its parent company’s struggling performance, River Gate Shipyard has maintained relatively good operations over the years. From 2018 onwards, the company’s net profit has consistently grown.

In late 2023, the government announced a resolution to approve the plan for handling SBIC, following the announcement by the Central Office of the Communist Party of Vietnam regarding the conclusion of the Political Bureau on handling this enterprise towards bankruptcy for the parent company SBIC and 7 subsidiaries.

However, the government will not allow the bankruptcy of River Gate Shipyard but will handle it towards recovering the capital contribution of the parent company.

River Gate Shipyard.

One of the significant factors contributing to River Gate Shipyard’s survival is its partnership with Damen Group from the Netherlands. According to River Gate Shipyard’s 2022 annual report, the two parties have been collaborating since March 2002. At that time, River Gate Shipyard signed a contract with this partner to build five maritime search and rescue vessels for the Vietnam Maritime Administration.

Since 2003, River Gate Shipyard has signed and executed numerous contracts for the construction of specialized export vessels for Damen Group. As of December 2019, the company had built and delivered over 300 products of various types to Damen – Netherlands.

In 2023, Damen Song Cam Shipyard Limited Company, a joint venture between River Gate Shipyard and Damen Group, in which River Gate Shipyard holds a 30% stake, recorded a pre-tax profit of VND 137 billion.

Foreign Partner Expressed Interest in Acquiring Shares

In 2014, Damen Group mentioned its intention to acquire a 70% stake in River Gate Shipyard. It wasn’t until late 2016 that SBIC announced that the Prime Minister had approved Damen’s proposal.

However, the most significant obstacle was the limit on foreign investor participation in Vietnam’s stock market, which could not exceed 49%.

Therefore, the government instructed the Ministry of Transport to direct Vietnam Marine Industry Corporation (SBIC) to renegotiate with the Dutch partner, committing to transfer a large portion of its stake in two phases: selling 49% first and then considering the sale of the remaining 21% later.

Nevertheless, during negotiations with the Vietnamese side, Damen Group insisted on acquiring a 70% stake in a single transaction.

SBIC, formerly known as Vinashin, was established in 1996. After a period of severe losses, on November 18, 2010, the Prime Minister signed a decision approving the restructuring plan for Vinashin to stabilize its production and business, gradually reduce losses, make profits, repay debts, and accumulate funds for development.

In October 2013, the Minister of Transport signed a decision to establish Vietnam Marine Industry Corporation (SBIC) based on the reorganization of the parent company and several members of Vinashin. However, its business operations remained inefficient.

Regarding the proposal for the bankruptcy of the parent company, SBIC, and seven subsidiaries (including the single-member limited liability companies: Ha Long, Pha Rung, Bach Dang, Thinh Long, and Cam Ranh Shipyards; Saigon Ship Industry and Marine Engineering single-member limited liability company; and Saigon Shipbuilding Industry and Marine Engineering single-member limited liability company), the government requested an urgent review and completion of the necessary procedures according to legal regulations before submitting a request to initiate bankruptcy proceedings. The expected timeline for implementation is from Q1/2024.

For River Gate Shipyard Joint Stock Company, the government plans to recover the capital contribution of the parent company, SBIC. Bach Dang Shipyard, a single-member limited liability company, will undergo a similar process following the procedures of the Enterprise Bankruptcy Law, regulations on state capital transfer, and other relevant legal provisions. The expected timeline for implementation is from Q2/2024.

For enterprises that were previously part of Vietnam Shipbuilding Industry Group (Vinashin) but are not retained in the SBIC structure and have not completed their restructuring, the government has directed the recovery of assets and property rights of SBIC and its seven subsidiaries during the bankruptcy and capital transfer processes. The expected timeline for implementation is from Q2/2024.