For those unfamiliar with Wall Street’s long history, the 2024 market frenzy may seem novel and daunting. But for Bill Gross, who recently turned 80, this kind of mania has been an inevitable reality in the investment world since before his time.

“Will Rogers is famously quoted as saying, ‘Don’t gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don’t go up, don’t buy it,'” shared Bill Gross, co-founder of Pacific Investment Management and dubbed the “bond king,” in an email to Bloomberg on December 5th. He highlighted the speculative spirit that has been sweeping the market.

Bill Gross, co-founder of Pacific Investment Management, dubbed the “bond king”

|

The late comedian’s joke inadvertently became an early testament to the momentum investing strategy, which has proven effective this year and gained further momentum from the possibility of Donald Trump’s reelection.

“I’m paying attention to this wave but also cautious of scenarios that could slow down or end this party,” Gross said. He favors defensive trades, focusing on high-dividend-paying companies and banks.

The risk rally intensified on December 6th as U.S. employment data beat forecasts. The S&P 500 ended the week at a new record high, and the Nasdaq 100 has surged more than 28% this year. The credit market continued to send positive signals as borrowing costs fell to their lowest level in over two decades.

In this context, the remaining short-sellers are bearing heavy losses. Out of 126 ETFs seeking to profit from falling prices, only 14 gained this year, with an average loss of 27%, according to Bloomberg Intelligence.

“It’s hard to be pessimistic about risk right now,” said Cayla Seder, a multi-asset strategist at State Street. “Liquidity remains abundant, the Fed has started the cutting cycle, and economic data continues to generally surprise to the upside.”

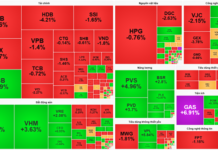

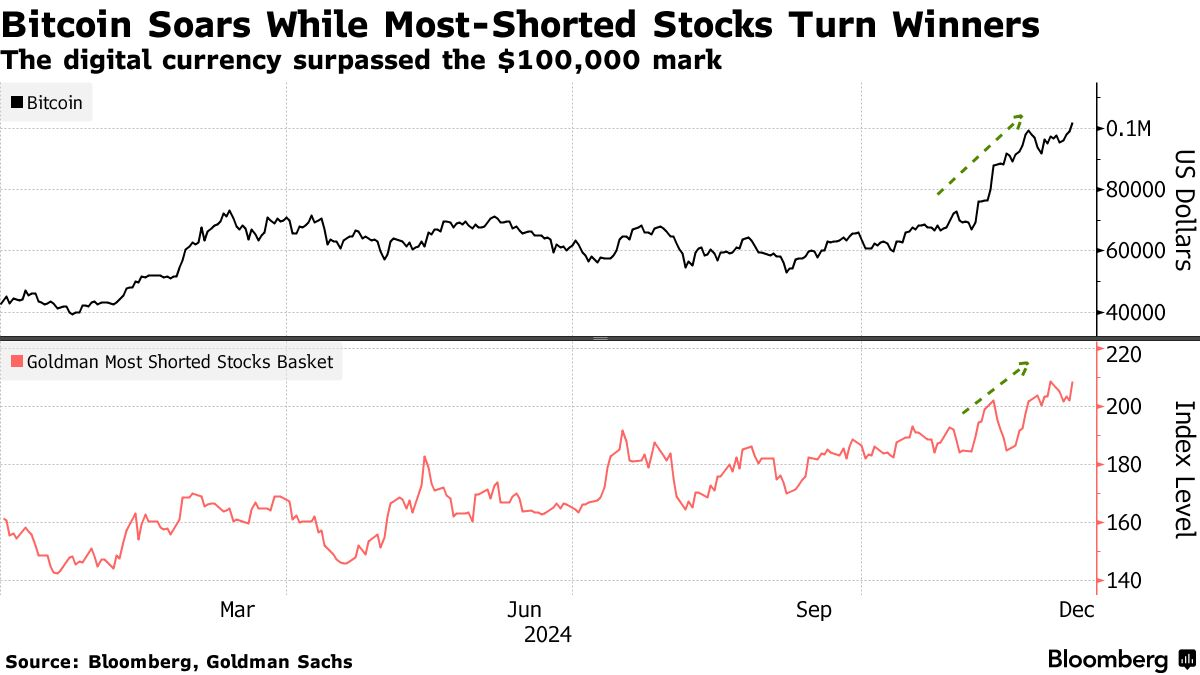

However, signs of overheating are becoming increasingly apparent. Most recently, Bitcoin surpassed the $100,000 mark earlier this week in a broad-based rally, sparking a strong speculative spirit.

Richard Bernstein, who heads Richard Bernstein Advisors LLC, opined that the top seven large-cap stocks are overvalued, while the broader market is not. He believes Bitcoin is in a bubble, and “nothing fundamental is going on. It’s all about liquidity.”

Whether there’s a bubble or not, this crypto frenzy is occurring simultaneously with a broader risk-on rally. Unprofitable tech companies have surged 20% this quarter, while junk bond funds are heading toward a record year for inflows. All of this is creating new impetus for wealth creation. The number of 401(k) millionaire accounts at Fidelity Investments reached a record 544,000 in Q3. Household net worth for Americans also peaked in Q2 at $163.8 trillion, according to Fed data.

Investor confidence in the U.S. stock market is at an all-time high, according to The Conference Board. The cost of hedging against a 10% drop in the S&P 500 has declined in the past two months, reflecting the peak optimism of investors. A recent testament to this: one of the few ETFs designed to handle “black swan” events filed for liquidation this week after years of losses.

Lindsay Rosner, who heads multi-sector fixed-income investments at Goldman Sachs Asset Management, believes there are valid reasons to be optimistic right now, but it’s also important to buy insurance along the way.

“We believe that tail-risk hedging will continue to play an important role in portfolio management,” she said. “We are optimistic about the short-term risk environment while awaiting clarity on U.S. policies and continue to monitor the risk of inflation returning.”

Vu Hao (According to Bloomberg)

Unlocking the Potential: Rediscovering Dong Trieu’s Real Estate Renaissance

Nestled in the province of Quang Ninh, Dong Trieu is blossoming like a “seed of potential”, emerging as a shining star in the economic development landscape of Northern Vietnam. Having only recently gained city status on November 1, 2024, Dong Trieu has already proven its allure, attracting astute investors who are eager to explore the opportunities that this burgeoning city has to offer.

The Ultimate Real Estate Opportunity in Binh Thuan: A $520 Million Venture

Phan Thiet Sun Limited, a leading investment and development company, is proud to introduce its flagship project – the Ham Tien – Mui Ne New Commercial Services Urban Area in Phan Thiet City, Binh Thuan Province. Spanning across 219 hectares, this ambitious project sets a new standard in urban living, offering a vibrant blend of commercial and residential opportunities.

Deputy Minister Tran Quoc Phuong: On Targeting 8% Economic Growth in 2025 and Beyond.

At the regular Government press conference for November 2024, held on the afternoon of December 7th, Deputy Minister of Planning and Investment, Tran Quoc Phuong, elucidated queries pertaining to economic growth in the final month of 2024 and the rationale behind the growth targets set for 2025.