Bitcoin surged past the $106,493 mark during Asian trading hours on December 16, reaching an all-time high. This rally not only marked a significant milestone for Bitcoin but also created a positive ripple effect across the entire cryptocurrency market.

The main catalyst for this surge was the positive policy signals from President-elect Donald Trump. Unlike the outgoing Biden administration’s tight regulatory approach, Trump is advocating for a more crypto-friendly legal framework. An ambitious idea of a national Bitcoin reserve has also been floated by the Republican Party, despite skepticism about its feasibility.

“People are expecting a much more favorable administration,” said Aya Kantorovich, co-founder of the August crypto platform, on Bloomberg Television. She added that this optimism is reflected in the demand for crypto-focused ETFs.

On December 13, Nasdaq Global Indexes announced that MicroStrategy Inc., a major player in the Bitcoin market, would be joining the Nasdaq 100 index. MicroStrategy’s success with its Bitcoin bet has caught the attention of Wall Street. The company has raised capital to invest billions of dollars in this digital asset.

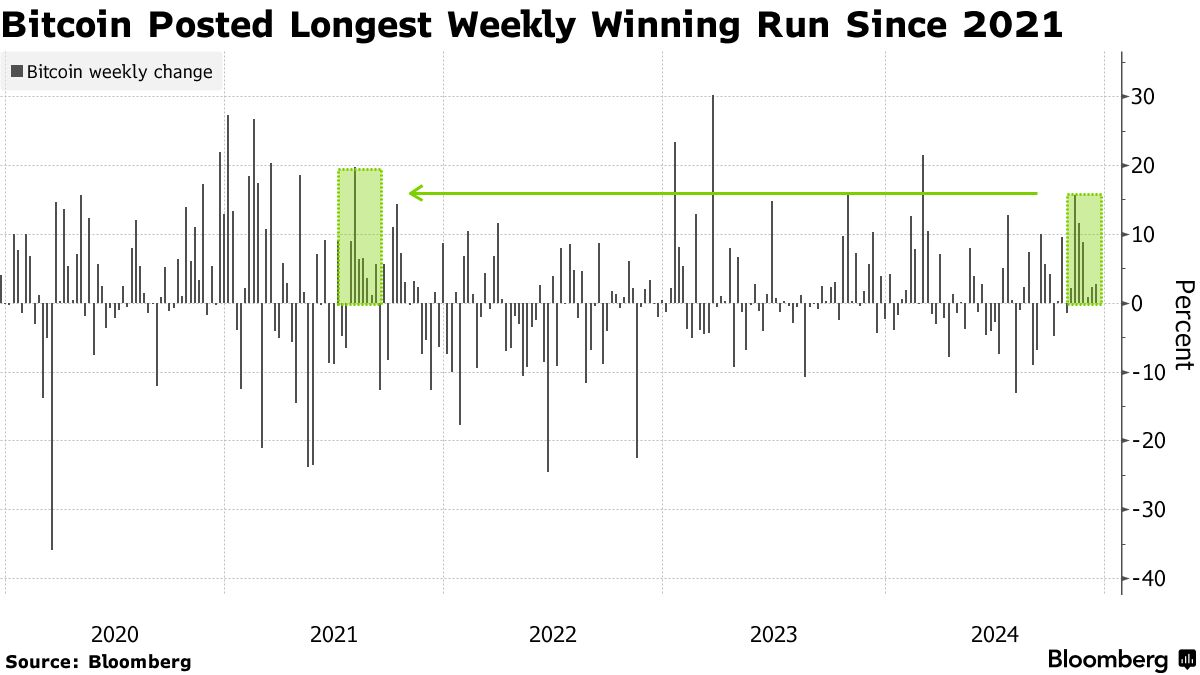

Bitcoin has been on a remarkable seven-week winning streak, the longest since 2021. However, the recent pace of gains has slowed, which could signal “a correction is coming,” according to Tony Sycamore, market analyst at IG Australia Pty, in a report.

Smaller cryptocurrencies like Ethererum, XRP, and Dogecoin also saw gains.

The Bitcoin boom is further evidenced by the inflows into crypto ETFs. Since Trump’s election victory on November 5, Bitcoin ETFs have attracted a net inflow of $12.2 billion, while similar Ether products have garnered $2.8 billion.

Vu Hao (According to Bloomberg)

A Historic Milestone: Bitcoin Surpasses $100,000

Bitcoin has officially surpassed the $100,000 mark, ushering in a new era for the world’s leading cryptocurrency. This milestone signifies a pivotal moment in the evolution of digital currencies, solidifying Bitcoin’s position as a prominent player in the global financial landscape. As Bitcoin continues to break records and captivate the world, its impact on the future of money and the potential for decentralized finance becomes increasingly evident.

Trump’s Personnel Appointment Reduces Risk for Vietnam’s Market

Michael Kokalari, Director of Macroeconomic Analysis and Market Research at VinaCapital, believes that President Donald Trump’s recent appointments reduce risks for investors in Vietnam.