On the morning of 02/03, the price of Bitcoin fluctuated around 62,000 USD, reaching nearly 64,000 USD at one point and only about 8% away from the record level. In the past week, the world’s largest cryptocurrency has increased by over 22%.

|

Bitcoin price movement in the past week

|

Ethereum is not falling behind. In the past week, the second-largest cryptocurrency has increased by nearly 18% to 3,400 USD.

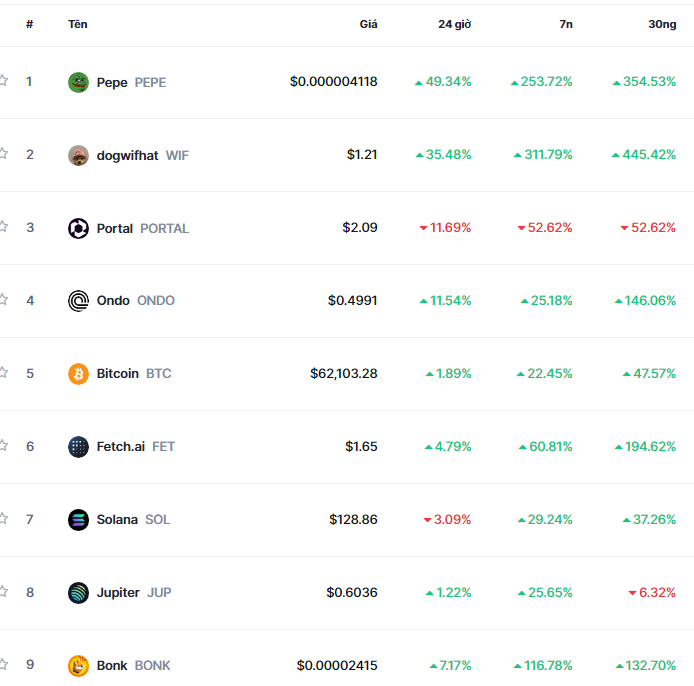

The bullish trend has also spread to other top 10 cryptocurrencies, with Dogecoin soaring nearly 70%, Solana and Cardano rising nearly 30%, and Ripple advancing by 18%. Several other meme coins have also experienced shocking price surges, with Shiba Inu soaring 125% in the past week, and Pepe skyrocketing by 250%.

|

Notable cryptocurrencies in the past week

Source: CoinMarketCap

|

Antoni Trenchev, co-founder of the Nexo cryptocurrency exchange, predicts some resistance as Bitcoin approaches the 69,000 USD mark. “Breaking the 60,000 USD mark will further increase the interest of investors, especially retail investors,” he said.

According to JPMorgan, investor interest in cryptocurrencies has recovered in February 2024 after a slowdown in the previous month.

Investors are eagerly awaiting a new all-time high for Bitcoin this year as the Bitcoin ETF fund launches and makes this asset more accessible to institutional investors.

|

Halving is an important event in the Bitcoin system that occurs once every 4 years. After the halving event, the number of new Bitcoins created through the mining process is halved. |

In addition, the upcoming Bitcoin halving event is also highly anticipated. The event is expected to take place in April 2024. Ryan Rasmussen, an analyst at Bitwise Asset Management, believes that the launch of Bitcoin ETF funds has exceeded the supply of Bitcoin.

“We have only seen the tip of the iceberg,” Rasmussen said, referring to the impact of ETF funds. “Institutional capital is flowing into Bitcoin ETF funds, and demand is still increasing.”

The sharp increase in the price of Bitcoin has created a boost for stocks related to cryptocurrencies. Shares of the Coinbase cryptocurrency exchange increased by more than 5%, while major players in the digital currency market, Microstrategy, surged 8%. Two cryptocurrency mining stocks, CleanSpark and Marathon Digital, increased by over 4%.

JPMorgan’s bitter words

In an enthusiastic context, JPMorgan made a pessimistic forecast that Bitcoin could fall to 42,000 USD.

JPMorgan believes that the high mining costs after the halving event could cause many miners to give up, leading to a decline in Bitcoin price. Some analysts and experts also predict that Bitcoin will experience short-term or medium-term corrections.

“The cost of producing Bitcoin is acting as a practical floor for the price of Bitcoin,” analysts at JPMorgan said in a report published on February 28th.

JPMorgan estimates that the cost of producing a Bitcoin after the halving could double to around 53,000 USD. As a result, the hashrate (the computing power of the Bitcoin network) could decrease by 20%, meaning fewer miners will compete to produce Bitcoin.

“This estimate of 42,000 USD is the level that we predict Bitcoin will target after the excitement surrounding the halving event subsides,” the report said.

El Salvador has made a 40% profit from Bitcoin gambling

El Salvador President Nayib Bukele announced that if all the Bitcoin held is sold, the country will make a profit of more than 40%.

Concerns have increased as the price of Bitcoin plunged, putting El Salvador on the brink of default. However, the Bitcoin-supporting President still refuses to acknowledge his mistake.

“When the price of Bitcoin dropped, they kept writing thousands of articles about our losses,” President Bukele shared on X. “Now that Bitcoin has soared, if we sell it now, we will make a profit of over 40%.”

Bukele also noted that recently, El Salvador has acquired more Bitcoin primarily through the citizen program. Under this program, people who “gift” Bitcoin to the government will be granted citizenship. However, he did not disclose the exact number. Bukele also stated that there are no plans to sell Bitcoin.

El Salvador currently holds a total of 2,381 Bitcoin with an average purchase price of 44,292 USD.