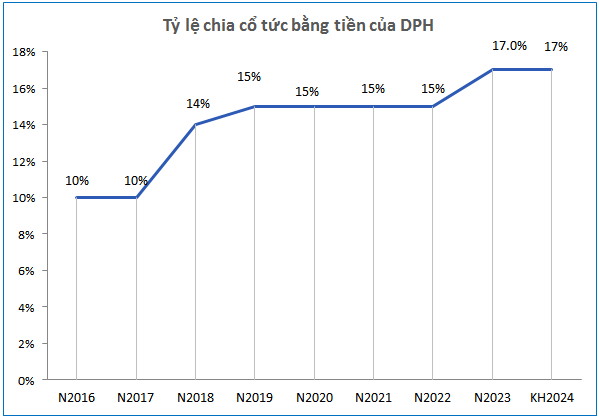

DPH has announced a cash dividend for the fiscal year 2024. The record date for the dividend has been set as January 3, 2025.

With a payout ratio of 17% (1 share receives VND 1,700) and 3 million shares outstanding, DPH is estimated to distribute approximately VND 5.1 billion in interim dividends for 2024. Payments will be made starting January 20, 2025.

Source: VietstockFinance

|

The Annual General Meeting of DPH for 2024 approved a dividend payout ratio of 17%, unchanged from 2023. This is also the highest dividend ratio the Company has offered in the past nine years. DPH increased the dividend ratio for shareholders due to record-high net profit in 2023.

| DPH’s Financial Performance over the Years |

In 2023, DPH’s net revenue decreased by 5% year-on-year to nearly VND 189 billion. However, thanks to a faster reduction in cost of goods sold (down 10%) compared to revenue, gross profit increased by 8% to over VND 51 billion. Moreover, financial income (interest income/expense) rose by 21% year-on-year to nearly VND 10 billion, contributing to a 14% increase in net profit to nearly VND 26 billion.

For the fiscal year 2024, DPH targets total revenue of VND 200 billion (including domestic business and industrial production), a modest 7% increase compared to 2023 results. However, the Company expects net profit to grow at a higher rate than revenue, aiming for a profit increase similar to that of 2023 (14%).

Source: VietstockFinance

|

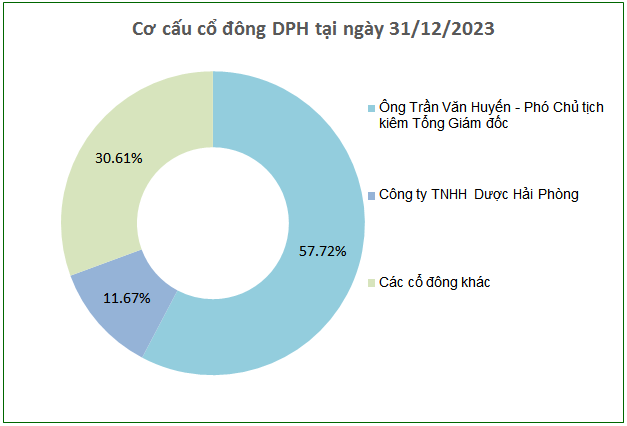

At DPH, Mr. Tran Van Huyen, Vice Chairman of the Board of Directors and General Director, is also the largest shareholder, owning 57.72% of the Company’s shares. He is estimated to receive nearly VND 2.95 billion in dividends for 2024. Following him, DPH Joint Stock Company Haiphong Pharmaceutical Company may receive VND 595 million, holding a stake of 11.67%.

DNSE Securities Delays Offering of $12.8 Million Bond Issue

DNSE Securities has announced a delay in the offering of its DSEH2426001 bonds, originally scheduled for Q3-Q4 2024. The new offering period will be from Q4 2024 to Q1 2025, with a total value of VND 300 billion.

Agribank Insurance Slashes Over 29% Off 2024 Profit Plan After Q3 Loss

The super typhoon Yagi has wreaked havoc on the operations of the Joint Stock Commercial Bank for Foreign Trade of Vietnam Insurance Corporation (UPCoM: ABI), casting doubt on the company’s ability to meet its revenue and profit targets for 2024.