The Vietnamese coffee industry has witnessed a remarkable growth in exports of processed coffee, particularly ground roasted and instant coffee, amidst record-high raw material prices and a decrease in raw exports.

A closer look at the industry’s statistics from recent years reveals that while price surges have grabbed market attention, the growth in the processed segment has been a surprising bright spot.

Surprising Growth

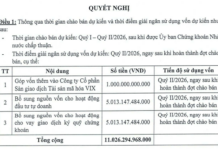

According to the Vietnam Coffee-Cocoa Association (VICOFA), Vietnam’s exports of processed coffee during the 2022-2023 crop year reached 89,941 tons, with a turnover of US$511 million. This production volume accounted for 5.4% of total exports (not converted to coffee beans) while its value contributed a significant 12.5%. The average export price during this crop year stood at US$5,676 per ton.

In the 2023-2024 crop year, export volume witnessed a robust increase of 42%, reaching 127,543 tons, making up 8.8% of total exports. Moreover, its value contribution neared 18%, thanks to an improved average export price of US$7,616 per ton.

Specifically, in November 2024, businesses exported 10,004 tons of processed coffee, with a turnover of over US$100 million. Although the volume accounted for only 16.5%, its export value represented a substantial 26.8% thanks to an exceptional export price of US$10,025 per ton, the highest ever.

These figures highlight the impressive growth of Vietnam’s processed coffee industry and reflect its immense potential in enhancing its position in the international market.

Commenting on this new development, Mr. Do Ha Nam, Chairman of the Board of Directors and General Director of Intimex Joint Stock Company, and Vice Chairman of VICOFA, attributed this positive trend to the favorable conditions created by the high price environment for processed coffee from new brands. “When the price level is low, importers tend to favor processed coffee from well-established companies. However, the current situation presents an opportunity for new players to enter the market by offering more competitive prices, leveraging their advantages in raw materials and maintaining comparable quality,” Mr. Do Ha Nam analyzed.

Intimex, for instance, has expanded its customer base from primarily domestic to international clients. The company is now among the top 50 leading exporters of processed coffee in Vietnam, boasting an impressive 50% growth rate. “Our factory is operating at full capacity and is in the process of expansion. Intimex aims to become one of the top manufacturers and exporters of processed coffee in Vietnam, with a target capacity of approximately 20,000 tons of instant coffee per year. Currently, our instant coffee processing capacity stands at 4,000 tons, and we plan to double it next year,” shared Mr. Do Ha Nam.

Coffee processing enterprises are actively promoting and introducing their products abroad to boost exports.

Booming Exports

Recently, numerous Vietnamese coffee enterprises have ventured into processed coffee exports. For instance, the Miss Ede brand, owned by Ede Farm Trading Services Co., Ltd. from Dak Lak, announced the export of its first container of ground roasted coffee to the US on December 1st.

Similarly, in December, the Vietnam Coffee Corporation exported its first batch of deeply processed coffee products under the brand name “Vietnam Coffee” to China. The exported products included roasted coffee beans, ground roasted coffee, and instant coffee with various flavors. This enterprise aims to increase the proportion of deeply processed products in its total export revenue.

Mr. Nguyen Ngoc Luan, Director of Meet More Global Trading Linkage Co., Ltd., asserted that instant coffee is experiencing robust growth, reaching 30%, attributed to its convenience, diverse flavors, and affordability for the majority of consumers. Meet More offers unique instant coffee options, such as sea salt coffee, banana, mango, strawberry, and taro-flavored coffee, which have gained popularity among international customers.

However, for ground roasted coffee, the competition is more challenging due to the distinct coffee preferences of Vietnamese consumers compared to the global market. According to Mr. Luan, only by promoting deep processing and associating products with corporate brands can Vietnamese coffee truly establish its identity in the international market. Previously, Vietnam primarily exported raw coffee, resulting in foreign consumers enjoying Vietnamese coffee without knowing its origin.

Mr. Do Ha Nam further shared that Vietnamese processed coffee is witnessing robust growth in the Chinese market. In recent years, export prices to this market have remained high, mainly due to the sales of processed products. “China represents a new potential market for Vietnamese coffee, especially with the younger generation and Gen Z shifting their beverage preferences from traditional tea to coffee. Although China produces coffee, its domestic production is very limited and fails to meet the ever-increasing consumer demand,” Mr. Nam remarked.

High Profit Margin

According to Mr. Nguyen Nam Hai, Chairman of VICOFA, Vietnamese enterprises previously faced challenges in exports due to factors such as high initial capital investment for factories (approximately US$35 million for an instant coffee factory with a capacity of 3,000 tons per year), difficulties in finding buyers, especially in European and American markets, and the lengthy time required for marketing and brand establishment. However, these obstacles have gradually been overcome, leading to the emergence of new Vietnamese brands among the leading exporters of deeply processed coffee. In addition to Trung Nguyen, there are newcomers like Intimex, An Thai, Vinh Hiep, Simexco DakLak, Vinacafe Bien Hoa, and King Coffee TNI. Exports of deeply processed coffee boast higher unit prices, better profit margins, and higher sustainability.

Raw Exports Remain Dominant

According to the International Coffee Organization (ICO), coffee exports worldwide are predominantly raw coffee beans, accounting for over 89%, while instant coffee makes up more than 10%, and roasted coffee stands at 0.5%. Brazil, the world’s largest coffee producer, also exports mostly raw coffee beans, approximately 88%. This is because raw materials are more convenient for transportation and storage, making them the preferred choice for importers who wish to process the coffee according to market preferences. Additionally, in the past, markets like Europe protected their domestic processing plants by imposing import taxes on processed coffee while keeping taxes low for raw materials. This hindered the growth of processed coffee exports for an extended period.

Regarding coffee prices, on December 10, the price of Arabica coffee surged to 348.35 US cents per pound, the highest since 1977 when a snowstorm devastated Brazil’s coffee fields. Arabica is the most popular coffee globally, dominating the consumption market.

The primary reason for this price hike is the severe drought, high temperatures, and the concentration of supply in a few producing countries, especially Brazil. In 2023, Brazil experienced its worst drought in 70 years in August and September, followed by heavy rains in October, negatively impacting the growth of coffee trees.

According to CNBC, coffee is the second most traded commodity after oil. The unpredictable weather has investors worried about a potential poor harvest in 2025. David Oxley of Capital Economics predicts that coffee prices will only decrease when supply stabilizes and reserves are replenished, which could take years. Carlos Mera from Rabobank warns that extreme weather conditions increasingly threaten the coffee industry, and if this trend persists, prices may climb even higher than the current record levels.

X.Mai – N.Ánh

The Bitter Truth: Coffee Prices Plummet

Closing the first trading session of the week, two coffee commodities shocked the market as their prices plummeted drastically.

The Eroding Manufacturing Industry in Vietnam: Strategies for Revival

Coffee is a source of great pride for Vietnam, and promoting sustainable farming practices that combat climate change is essential to preserving this legacy.