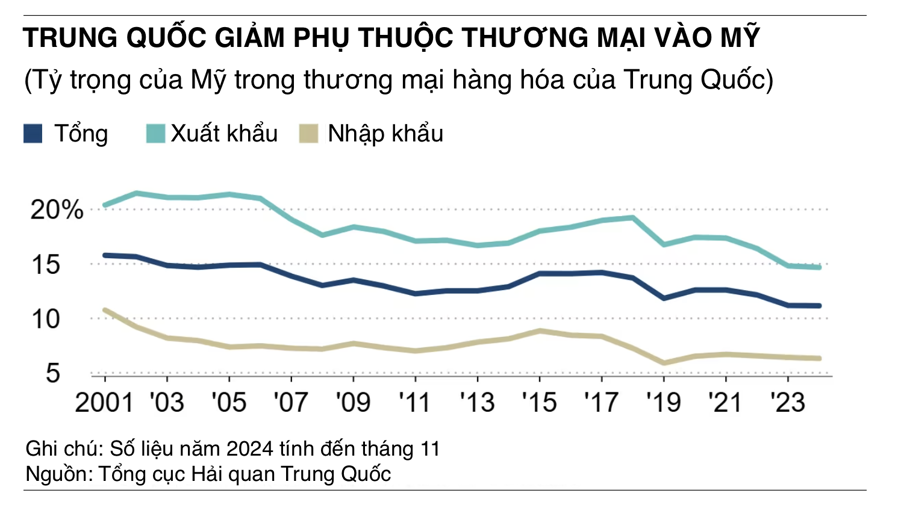

The US’s share of China’s trade has dropped to its lowest level since China joined the World Trade Organization (WTO) in 2001. This development comes as Beijing prepares for the scenario of facing tariffs from President-elect Donald Trump when he returns to the White House on January 20th.

According to data from Chinese customs, as reported by Nikkei Asia, in the first eleven months of this year, the US accounted for 11.2% of China’s total goods imports and exports in US dollar terms. This represents a 4.6-percentage-point drop compared to the year 2001.

China’s trade dependence on the US has decreased since Trump, during his first term, imposed tariffs on Chinese goods, prompting Beijing to retaliate with tariffs on US products in the 2019 US-China trade war.

During his 2024 presidential campaign, Trump threatened to impose a 60% tariff on all Chinese goods. After his reelection, he floated the idea of an additional 10% tariff on all Chinese imports. Regardless of the exact rate, China is facing a new phase of escalating trade tensions with the US.

The Japan Center for Economic Research (JCER) estimates that if Trump were to impose a 60% tariff on China, the country’s economic growth rate in 2025 would fall to 3.4%, compared to a potential 4.7% growth without tariffs. The growth rate would still be below 4% even if China retaliates with its own tariffs.

The US’s share of China’s trade has been declining significantly since around 2005, when China started to increase its exports to rapidly growing emerging economies. This share started to rise again in 2013 but fell by 2.5 points in 2019 due to the bilateral trade war.

In the first eleven months of 2024, 14.6% of China’s goods exports were destined for the US, marking the lowest level since 2001. The US’s share of China’s imports also dropped by 4.4 points in the eleven months, falling to 6.3%.

Currently, much of China’s exports go to Southeast Asia. In the first eleven months of 2024, China’s total exports to the Association of Southeast Asian Nations (ASEAN) exceeded $520 billion, accounting for 16% of China’s total exports. With this share, ASEAN has become China’s largest export market, surpassing any other country or bloc. Exports to Cambodia and Vietnam have both increased by nearly 20% this year.

However, some experts suggest that Chinese exporters routing their goods through third countries to avoid US tariffs may be a factor in these figures. Additionally, countries in Asia, Central America, and South America are concerned about Chinese companies engaging in “deflationary exports” by flooding their markets with cheap goods.

In terms of imports, China has reduced its reliance on agricultural commodities and basic goods from the US. Brazil, accounting for 70% of China’s soybean imports in the first eleven months of this year, has surpassed the US, which now accounts for only about 20%. In 2017, before the trade war, Brazil supplied nearly half of China’s soybean imports, with the US providing 30%.

The share of US wheat imports to China has also dropped below 20%, down from nearly 40% in 2017. Instead, Australia, Canada, and France have become larger suppliers.

Beijing has retaliated in the trade war by imposing tariffs on US soybeans, wheat, and other products. It is now diversifying its sources to ensure food security amid prolonged tensions with the US. Some analysts suggest that this trend could change if trade tensions escalate, as Trump is known for his negotiating tactics.

Naoki Tsukioka, an expert from Mizuho Research & Technologies, commented, “China may promise to import more goods from the US as part of some deal with Trump.”

Trump’s Tough Talk Leaves EU in a Bind: “Buy More American Energy or Face Higher Tariffs”

Former US President Donald Trump has threatened to impose tariffs on the European Union if its member states do not increase their purchases of American oil and natural gas. In a characteristic display of his aggressive trade policy approach, Trump is demanding that the EU boost its imports of US energy resources or face economic consequences. This bold ultimatum underscores Trump’s unwavering commitment to protecting and promoting American economic interests on the global stage.

The Sun Shines on a New Solar Power Trade War: US Imposes 271% Anti-Dumping Duties on Vietnamese Solar Panels.

The U.S. Department of Commerce has announced its preliminary conclusion that solar energy products imported from Southeast Asia are being dumped in the U.S. market, leading to proposed tariffs of up to 271%.