Gold prices surged during Thursday’s session (December 26) as investors sought safe-haven assets for the upcoming year 2025. However, trading volumes in the international gold market remained low as many traders were still enjoying the year-end holidays and awaiting new signals on economic policies from President-elect Donald Trump, as well as the interest rate trajectory of the Federal Reserve (Fed) in the coming year.

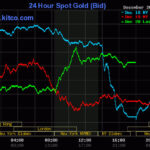

At the close of trading, spot gold prices on the New York market rose by $15 per ounce compared to the previous session’s close, equivalent to a 0.57% increase, settling at $2,634.20 per ounce, according to data from Kitco Exchange.

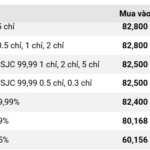

As of early Wednesday morning (December 27) Vietnam time, spot gold prices in the Asian market were up by $0.30 per ounce from the US close, trading at $2,634.50 per ounce. Converted at Vietcombank’s selling exchange rate, this price is equivalent to about VND 81 million per tael.

“The tension between Russia and Ukraine provided some impetus for gold’s rally,” said Daniel Pavilonis, senior strategist at RJO Futures.

On Wednesday, US President Joe Biden said he had directed the Department of Defense to continue providing weapons to Ukraine. This statement came after the US criticized Russia for launching attacks on several Ukrainian cities and their energy infrastructure on Christmas Day.

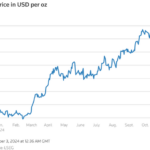

This year, geopolitical tensions, including wars in Eastern Europe and the Middle East, have played a significant role in driving up gold prices, along with a global environment of declining interest rates and central banks’ net gold purchases. Since the beginning of the year, gold prices have climbed 28% and have set more than 30 historical records. The all-time peak for spot gold was $2,790.15 per ounce, reached on October 31.

“Central banks will continue to buy gold. And if inflation persists, individual investors’ demand for gold holdings will also increase,” Pavilonis said, forecasting that gold prices could surpass $3,000 per ounce next year.

In an interview with Reuters, Ajay Kedia, director of Kedia Commodities, a commodities trading firm in Mumbai, India, predicted that 2025 would be a highly volatile year for gold prices. He suggested that gold prices could surge in the first half of the year due to heightened geopolitical tensions but might witness a correction in the second half as investors book profits.

In addition to the holiday lull, gold traders are also awaiting new policy signals from the US.

Trump, who will be inaugurated on January 20, carries a set of distinct policies, such as imposing tariffs on imports, deporting illegal immigrants, and cutting taxes. These policies, if implemented, could bring about significant changes in the US macroeconomic landscape, subsequently influencing monetary policies, exchange rates, and financial markets, including the gold market.

Regarding the Fed, the prospect of further interest rate cuts in 2025 has become more uncertain due to the potential impact of Trump’s policies. The Fed policymakers have maintained their data-dependent stance, so upcoming US economic data will be of particular interest to gold investors.

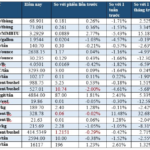

The Dollar Index, measuring the greenback’s strength against a basket of six major currencies, fell 0.16% to close at 108.08 on Thursday, not far from the two-year high of 108.54 reached the previous week.

The likelihood of fewer Fed rate cuts in 2025 and the strong upward momentum of the US dollar have exerted considerable downward pressure on gold prices recently, causing the precious metal to fluctuate within the $2,600-2,700 per ounce range.

According to the FedWatch Tool from the CME Exchange, the market is betting on an over 89% probability that the Fed will keep rates unchanged at its next meeting in January, down from nearly 100% a week earlier. The possibility of a rate cut in January rose to almost 11% after Thursday’s statistical release presented a mixed picture of the US job market.

According to the US Department of Labor’s weekly report, initial jobless claims for the week ending December 21 stood at 219,000, lower than the 225,000 predicted by economists in a Dow Jones poll. However, the number of people continuing to claim unemployment benefits rose to 1.91 million, the highest level since the week ending November 13, 2021.

The Curious Case of Gold’s Global Price Movement

The gold price hovers tentatively, awaiting a new catalyst to spark action. Investors are cautious ahead of impending U.S. economic data and the Federal Reserve’s interest rate trajectory. With markets holding their breath, all eyes are on the Fed’s next move, as they delicately balance inflation concerns with economic growth. This delicate dance has investors poised, ready to pounce or retreat, depending on the Fed’s forthcoming steps.

The Ultimate Guide to Financial Markets: Oil, Gold, and Robust Coffee on the Rise

As of the market close on November 28, 2024, oil prices edged higher, while gold rallied as investors sought safe-haven assets. Copper prices slipped, weighed down by a stronger U.S. dollar and concerns over softening demand.