HDBank Shares Surge to All-Time High, Masan Consumer Becomes Vietnam’s Largest Food and Beverage Company

HDBank’s shares surged to an all-time high on December 30, 2023, with a closing price of VND 26,650 per share, marking a 6.81% increase from the previous session. The trading volume reached nearly 10.6 million units, showcasing strong investor confidence in the bank’s performance.

This upward momentum pushed the market capitalization of HDBank to over VND 93,143 billion, reflecting a significant growth in the bank’s value.

The rise in share price also positively impacted the wealth of its shareholders. Notably, billionaire Nguyen Thi Phuong Thao’s holdings in HDBank are now valued at nearly VND 3,485 billion, witnessing an increase of more than VND 222 billion in a single day.

Additionally, Sovico Holdings owns over 501 million HDBank shares, further emphasizing the confidence in the bank’s prospects.

HDBank’s financial reports revealed impressive results, with a 42.7% year-over-year increase in pre-tax profit for Q3 2023, amounting to VND 4,490 billion. The 9-month cumulative profit reached VND 12,655 billion, surpassing the yearly plan by 79.8% and reflecting a 46.6% year-over-year growth.

Masan Consumer’s Stock Surges, Becoming Vietnam’s Largest Food and Beverage Company

In a remarkable display of financial prowess, Masan Consumer, a subsidiary of Masan Group, has seen its market capitalization soar to over VND 188,400 billion (approximately USD 7.4 billion), surpassing that of Vinamilk and solidifying its position as the largest company in the food and beverage industry on the Vietnamese stock market.

This achievement is a testament to the company’s exceptional performance and strategic vision. At the 2024 Annual General Meeting of Shareholders, billionaire Nguyen Dang Quang, Chairman of Masan Group, likened Masan Consumer to a priceless family heirloom, underscoring its invaluable contribution to the group’s success.

The surge in Masan Consumer’s stock price can be attributed to a combination of factors, including impressive financial results and a high dividend payout. For the full year 2023, the company distributed approximately VND 19,000 billion in cash dividends, equivalent to a staggering payout ratio of 268%.

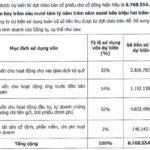

As Masan Consumer sets its sights on a listing on the Ho Chi Minh Stock Exchange (HoSE) in 2025, it also plans to raise additional capital through a rights issue, offering existing shareholders the opportunity to purchase new shares at a ratio of 100:45.1 at a price of VND 10,000 per share. This move is expected to bring in VND 3,268 billion, which will be primarily allocated to debt repayment, further strengthening the company’s financial position.

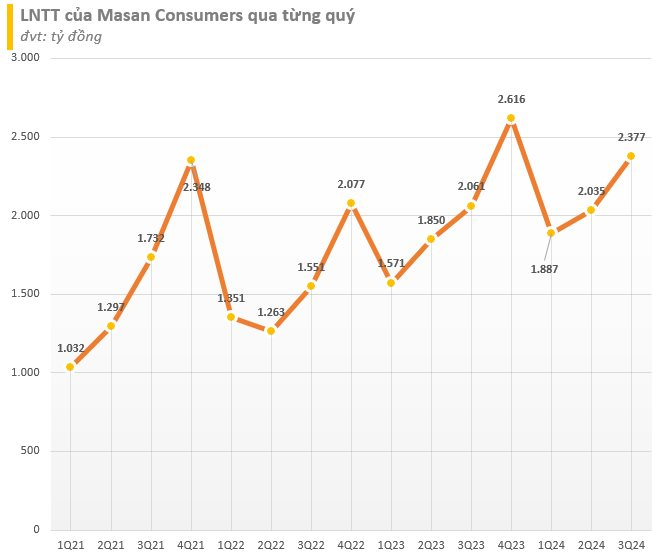

Masan Consumer’s Q3 2024 financial results demonstrated robust growth, with an 11% year-over-year increase in revenue and a 14% rise in after-tax profit. This performance underscores the company’s resilience and ability to navigate market challenges, positioning it for continued success in the dynamic food and beverage industry.