During a recent meeting with new investors of Saigon Cargo Service Joint Stock Company (SCS), the company’s leadership announced that Qatar Airways will switch from collaborating with Tan Son Nhat Cargo Service Joint Stock Company (TCS) to SCS starting from February 2024.

SCS is the cargo terminal operator at Tan Son Nhat International Airport. The company operates in an exclusive market with only one competitor, TCS – a subsidiary of Vietnam Airlines. SCS currently holds a 45% market share of international cargo volume at Tan Son Nhat International Airport.

An analysis report by VietCap Securities Company (VietCap) stated that Qatar Airways has been discussing this collaboration plan since 2022 when TCS began utilizing its available capacity. Qatar Airways could contribute 40,000 tons of cargo throughput per year.

In 2023, SCS handled 190,000 tons of cargo, including 137,000 tons of international cargo volume. Therefore, the new major client Qatar Airways could help SCS increase its cargo throughput by over 20% compared to 2023.

SCS aims to achieve a cargo throughput of 248,000 tons in 2024, including 190,000 tons of international cargo volume.

VietCap also evaluated that SCS is benefiting from the Red Sea crisis, which has led to higher sea transportation costs and reduced competition compared to air transportation.

The recently published Q4/2023 financial statements of SCS showed a slight 2% increase in net revenue to VND 199 billion compared to the same period last year.

According to VNDirect Securities Company’s update, in this quarter, SCS achieved an international cargo volume of 39,173 tons, a 15% increase compared to the previous quarter and a 6.4% increase compared to the same period, marking the expected start of the recovery trend. The domestic cargo volume maintained an impressive growth rate of 21% compared to the previous quarter and 27% compared to the same period, thanks to the domestic production recovery.

Although the total cargo volume grew by 11.2% compared to the same period, the average selling price decreased by 8.5%. This led to only a slight increase in revenue.

Notably, the cost of goods sold unexpectedly increased by 77% to VND 54 billion, causing the company’s gross profit to decrease by 12% to VND 144 billion. The gross profit margin narrowed from 84% to 73%, but it still remains one of the highest gross profit margins in the stock market. Net profit reached VND 128 billion, a decrease of 18%.

The narrowed gross profit margin of SCS is due to two reasons.

Firstly, according to the new franchise mechanism of the Ministry of Transport, SCS will have to pay an additional 1.5% – 4.5% of air transportation revenue to the State. However, SCS has recorded all franchise costs for air transportation operations in 2023 within Q4.

Secondly, the proportion of domestic cargo increased, while the domestic cargo handling fees are much lower than international cargo. Domestic cargo accounted for 27% of the total volume in Q4/23, compared to 23% in Q4/22.

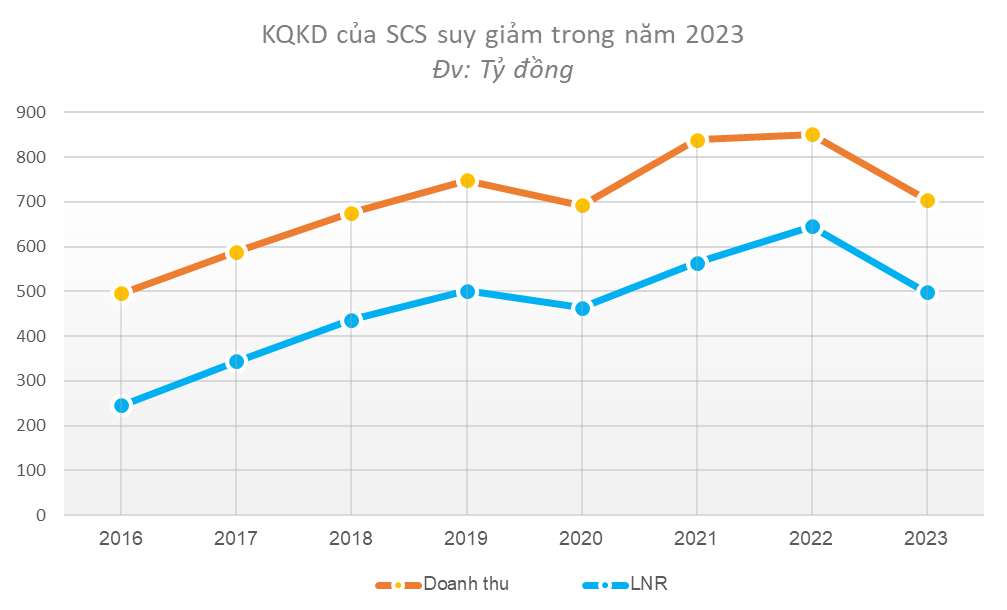

Accumulated in the whole year of 2023, SCS’s net revenue decreased by 17% to VND 705 billion plus increased cost of goods sold resulting in a gross profit margin decrease from 82% to 76%. The net profit for the whole of 2023 decreased by 23% to nearly VND 500 billion.

In 2023, the company set a target of total revenue of VND 860 billion and pre-tax profit of VND 620 billion, a decrease of 5.5% and 11% respectively compared to the previous year’s performance. Therefore, although being cautious, the company only achieved 92% of the full-year profit target.

As of December 31, 2023, Saigon Cargo Service’s total assets reached VND 1,703 billion, an increase of VND 147 billion compared to the beginning of the year. Cash and bank deposits accounted for 62% of the assets, equivalent to nearly VND 1,100 billion.