|

Illustration photo. (Source: VNA)

|

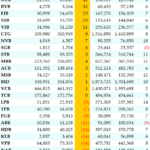

According to the latest bank interest rates, the interest rates for term deposits with a term of 1 year (12 months) range from 3.9% to 6.2% per annum, with interest payable at maturity. Indovina Bank and OceanBank offer the highest interest rates at 6.2% and 6.1% per annum, respectively.

12-month term deposit interest rates for over-the-counter deposits:

- Indovina: 6.2% per annum

- OceanBank: 6.1% per annum

- DongA Bank, Timo by BVBank, and Saigonbank: 6.0% per annum

- BVBank, PGBank, and Bao Viet Bank: 5.9% per annum

- Bac A Bank and NCB: 5.85% per annum

- CBBank and MB: 5.7% per annum

- Nam A Bank and OCB: 5.6% per annum

- ABBank, HDBank, and Public Bank: 5.4% per annum

- KienLong Bank, LPBank, and PVcomBank: 5.3% per annum

- GPBank: 5.2% per annum

- Eximbank: 5.1% per annum

- Sacombank: 5.0% per annum

- Agribank: 4.8% per annum

- BIDV: 4.7% per annum

- ACB: 4.5% per annum

- Hong Leong Bank Vietnam: 3.95% per annum

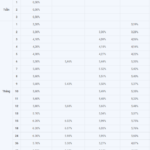

Interest rates for longer-term deposits:

- Eximbank offers interest rates of 6.5-6.8% per annum for long-term deposits ranging from 15 to 34 months.

- KienLong Bank offers an interest rate of 6.1% for term deposits with terms ranging from 12 to 24 months.

- BVBank offers an interest rate of 6.2% for 15-month term deposits and 6.3% for 18-24-month term deposits.

- IVB offers an interest rate of 6.2% per annum for term deposits of 24 months or more, 6.05% per annum for 18-month term deposits, and 6.05% for 13-month term deposits.

- GPBank offers an interest rate of 6.05% per annum for 12-month term deposits and 6.15% per annum for term deposits with terms ranging from 13 to 36 months.

- Cake by VPBank offers an interest rate of 6.1% for 24 and 36-month term deposits. OceanBank and KienlongBank also offer an interest rate of 6.1% per annum for 24 and 36-month term deposits, respectively.

- MBV offers an interest rate of 6.1% per annum for individual customers with term deposits of 18 to 36 months.

- VRB and DongA Bank offer an interest rate of 6.0% for 24-month term deposits.

- VietABank offers an interest rate of 6.0% for 36-month term deposits.

- SaigonBank offers interest rates of 6.0% for 13, 18, and 24-month term deposits and 6.1% for 36-month term deposits.

- HDBank offers an interest rate of 6.0% for 15-month term deposits and 6.1% for 18-month term deposits.

- BAOVIET Bank offers an interest rate of 6.0% for term deposits with terms of 15, 18, 24, and 36 months.

- CB Bank offers an interest rate of 6.0% for term deposits with terms of 12 months or more.

- PVcomBank leads the way with a special interest rate of 9.5% for over-the-counter deposits with terms of 12 to 13 months. However, to qualify for this interest rate, customers must maintain a minimum deposit balance of 2,000 billion VND.

- HDBank offers a competitive special interest rate of up to 8.1% per annum for 13-month term deposits and 7.7% for 12-month term deposits. The minimum balance requirement to qualify for this rate is 500 billion VND. The bank also offers an interest rate of 6.0% for 18-month term deposits.

- MSB offers competitive interest rates for over-the-counter deposits, with up to 8.0% per annum for 13-month term deposits and 7.0% for 12-month term deposits. The eligibility criteria include new savings accounts or automatically renewed accounts opened from January 1, 2018, with a term of 12 or 13 months and a minimum deposit amount of 500 billion VND.

- DongA Bank offers an interest rate of 7.5% per annum for term deposits with a term of 13 months or more, with interest payable at maturity, for deposits of 200 billion VND or more. The bank also offers an interest rate of 6.1% for 24-month term deposits.

- Bac A Bank offers interest rates of 6.0% per annum for 12-month term deposits, 6.1% per annum for 13 to 15-month term deposits, and 6.4% per annum for term deposits with terms ranging from 18 to 36 months. These interest rates apply to deposit amounts exceeding 1 billion VND.

– 08:37 20/01/2025

The Year-End Rush: A Race to Ramp Up Deposits and Accelerating Credit

“Market temperature” for year-end savings deposit mobilization always tends to rise, a tale as old as time. While the interest rate curve in the fourth quarter did not present any surprises, the increase in interest rates for some “key” terms was evident.

Today’s Interest Rates 22-11: How Much Interest Will You Earn on a 1 Billion VND Time Deposit?

The recent uptick in deposit rates has pushed long-term interest rates at many commercial banks beyond the 6% per annum mark.

The Bank That Offers the Highest Savings Rates on the Market

Introducing our bank’s highly competitive interest rates that are sure to catch your eye. With our diverse range of term options, we’re proud to offer market-leading rates that go beyond the standard 1-month maturity period. Discover a world of financial opportunities where your money works harder and smarter, unlocking the path to a secure and prosperous future.