**Nam Kim Reports Fourth-Quarter Financial Results with a Modest Rise in Revenue and Challenges in Profitability**

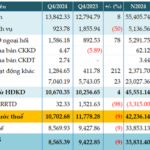

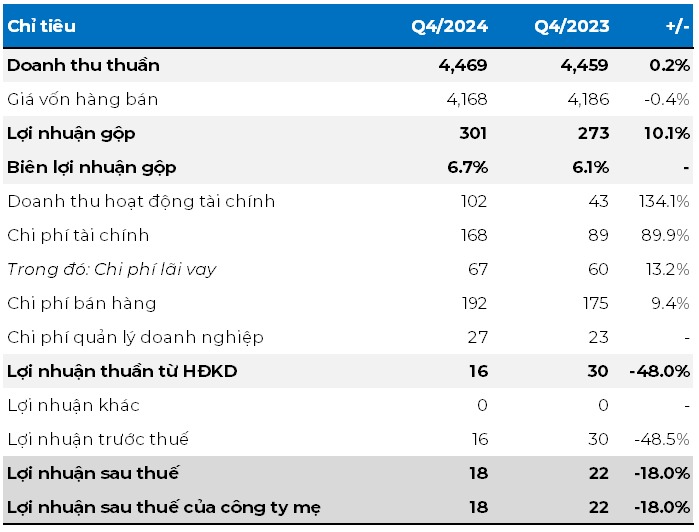

According to the fourth-quarter financial report, the company’s net revenue reached VND 4,469 billion, a slight increase of 0.74% compared to the same period last year. This achievement is attributed to the successful efforts in boosting product distribution in both domestic and international markets. Notably, Nam Kim managed to improve its gross profit margin from 6.1% to 6.7% by effectively controlling the cost of goods sold.

However, the pressure on expenses took a toll on profitability. Selling expenses increased by over 9% to VND 192 billion due to higher consumption volume and escalating transportation charges. Notably, financial expenses soared by 90% to VND 168 billion, mainly due to increased borrowing costs and the impact of exchange rate fluctuations. Consequently, fourth-quarter profit after tax reached VND 18.4 billion, an 18% decline compared to the previous year.

NKG’s Business Results for Q4/2024

Unit: Billion VND

Source: VietstockFinance

|

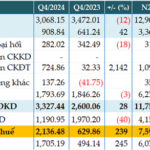

2024 Profit Surges Fourfold Compared to the Previous Year

Despite a rather subdued final quarter, Nam Kim’s overall performance for the full year 2024 was impressive. Net revenue for the year reached VND 20,609 billion, an 11% increase compared to 2023. Remarkably, profit after tax amounted to VND 453 billion, a significant improvement of 286% from the previous year’s figure of VND 117 billion.

This success is largely attributed to the company’s strategic focus on exports, which accounted for 65% of total consumption volume. With these results, Nam Kim exceeded its 2024 pre-tax profit plan by 33% (VND 558 billion compared to the target of VND 420 billion).

Notably, the company’s inventory levels increased significantly to nearly VND 6,700 billion at the end of 2024, much higher than the VND 5,700 billion at the beginning of the year. This move may reflect Nam Kim’s optimistic outlook for the market in the upcoming period.

– 14:40, January 25, 2025

“FE Credit Races Back, VPBank’s Annual Profit Surges by an Impressive 85%”

Seizing the positive shifts in the economy during the year-end period, VPBank accelerated its breakthrough expansion of credit in strategic segments in the fourth quarter, contributing to an outstanding 85% year-on-year profit growth. The bank has been, and continues to, strengthen its foundation, expand its ecosystem, and create a solid launchpad for its sustainable growth strategy in the medium to long term.

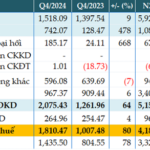

Reaping Rewards from Investment Securities: TPBank’s Q4 Pre-Tax Profits Surge 3.4x YoY

For the fourth quarter of 2024, the Joint Stock Commercial Bank Tien Phong (TPBank, HOSE: TPB) reported a profit before tax of over VND 2,136 billion, a 3.4-fold increase compared to the same period last year. This impressive performance is attributed to a significant reduction in risk provisions and a surge in investment securities income.