**Ricons’ Q4 Revenue Surges, Doubling Profits Year-on-Year**

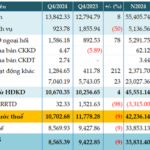

| Source: VietstockFinance

|

Ricons’ Q4 revenue exceeded VND 2,356 billion, a 4% increase year-on-year, with a slight rise in cost of goods sold, resulting in a gross profit of nearly VND 146 billion. The gross profit margin also improved from 4% to 6%.

Notably, this quarter, Ricons did not record any profit from joint ventures or associates (compared to a profit of over VND 150 billion in the same period last year), but this was offset by a significant reduction in total expenses by 53% to VND 135 billion, mainly due to a substantial decrease in financial expenses. As a result, Ricons’ net profit exceeded VND 40 billion, seven times higher than the previous year’s figure for the same period.

For the full year 2024, Ricons’ profit doubled from the previous year to nearly VND 159 billion, the highest in three years (since 2021), while revenue reached almost VND 8,012 billion, a 6% increase. The majority of this revenue came from construction contracts, totaling VND 7,780 billion, a 4% increase, and a significant surge in the real estate sector, generating over VND 224 billion, 4.7 times higher than the previous year.

As of December 31, 2024, Ricons’ total assets were nearly VND 6,835 billion, a 13% decrease from the beginning of the year. This included cash and cash equivalents of over VND 713 billion, a 4% increase, and a 35% rise in short-term financial investments to over VND 1,000 billion, mainly comprising time deposits of over VND 965 billion and bond investments of more than VND 37 billion.

Inventory decreased by 43% to VND 432 billion, comprising construction work-in-progress costs for projects such as the T3 Passenger Terminal (over VND 132 billion), Long Thanh Airport (over VND 70 billion), and SLP Park Xuyên Á warehouse (nearly VND 61 billion), among others.

Notably, according to Ricons’ disclosures, Coteccons (HOSE: CTD) still owes more than VND 322 billion, and JSC Vietnam-Laos Economic Cooperation Corporation owes approximately VND 660 billion. The remaining VND 2,200 billion is owed by other customers who are not specifically mentioned. Ricons has made a provision of nearly VND 306 billion for doubtful debts within this amount.

Total liabilities were over VND 4,241 billion as of the reporting date, a 22% decrease from the beginning of the year. This included short-term borrowings of VND 249 billion, with no long-term borrowings recorded.

– 18:00 26/01/2025

The Infrastructure Boom in the South-Eastern Region: Stepping into a New Era with Full Force

To address the challenges faced in implementing transportation infrastructure projects, a comprehensive approach with multiple strategies needs to be adopted by local authorities.

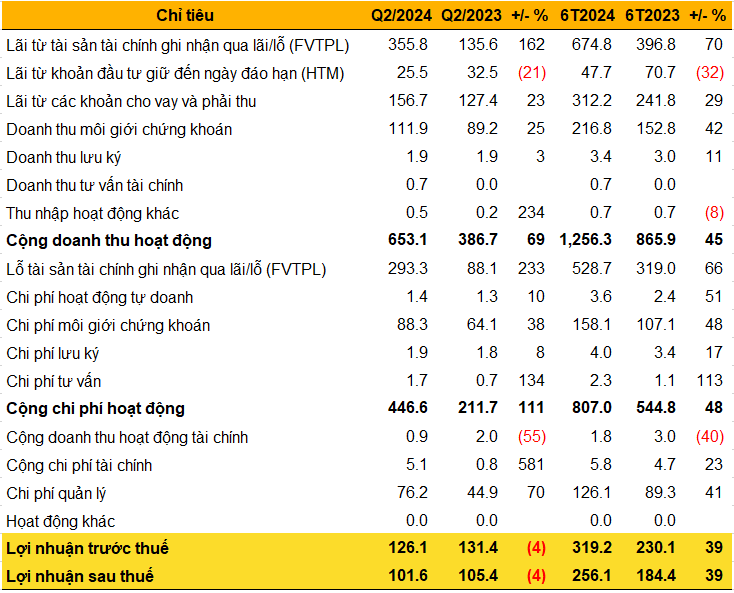

“FE Credit Races Back, VPBank’s Annual Profit Surges by an Impressive 85%”

Seizing the positive shifts in the economy during the year-end period, VPBank accelerated its breakthrough expansion of credit in strategic segments in the fourth quarter, contributing to an outstanding 85% year-on-year profit growth. The bank has been, and continues to, strengthen its foundation, expand its ecosystem, and create a solid launchpad for its sustainable growth strategy in the medium to long term.