## DPR’s 2024 Revenue Reaches Highest Level Since 2012

| DPR’s 2024 revenue rose to its highest level since 2012, despite a significant drop in consumption compared to the previous year. |

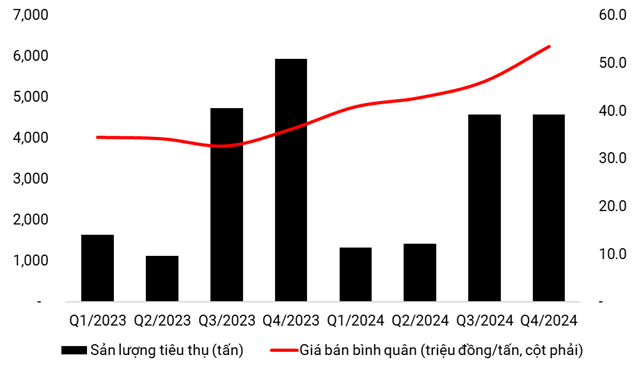

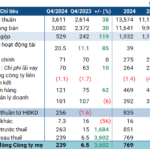

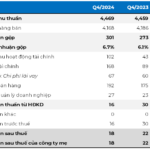

According to DPR’s consolidated financial statements for Q4 2024, revenue for the quarter only slightly decreased to VND 429 billion, despite a considerable drop in consumption compared to the same period last year. This was mainly due to the average selling price of over VND 53 million per ton, almost one and a half times higher than the previous year.

Since the second half of 2023, DPR’s rubber selling price has steadily increased from VND 33 million per ton, resulting in a revenue of nearly VND 1,225 billion for the full year 2024, an 18% increase. This compensated for the lower extraction volume and marked the highest revenue for DPR in over a decade, second only to the years 2011 and 2012 – the peak of rubber prices. The impressive 34% rise in net profit for 2024, amounting to nearly VND 280 billion, was attributed not only to higher selling prices but also to a significant increase in other income.

DPR currently provides high-quality rubber products to several large markets. For instance, SVR 10 rubber is supplied to Belshina Tire (Russia), SVR 3L is exported to South Korea for tape and shoe sole production, and Latex HA/LA is favored in Europe and the US as it does not contain TMTD, a skin allergen. DPR’s main markets include South Korea, Russia, the EU, and the US.

Phu Hung Securities (PHS) forecasts that the price of SVR 10 rubber will remain above VND 45,600 per kg until 2026, supported by increasing demand from electric vehicle tire manufacturing and limited natural rubber supply due to weather conditions. Additionally, the EUDR (European Union’s sustainable forest management) regulations in the EU could disrupt 15-20% of the global rubber supply chain, creating opportunities for Vietnamese companies with sustainability certifications. DPR currently owns over 10,000 hectares of PEFC/VFCS-certified forests, giving it a significant advantage over its competitors.

In Vietnam, rubber consumption is expected to grow steadily until at least 2027, driven by the development of the auxiliary industry, particularly automotive and tractor tire manufacturing. Investment projects by prominent brands such as Sailun Group, Shandong Jinyu Tire, and Kumho Tire are anticipated to boost domestic raw material demand.

During 2025-2027, DPR is expected to increase its revenue by expanding its sales volume and capitalizing on the thriving automotive industry in Binh Duong and Binh Phuoc. A notable project is the Haohua tire factory, with an investment of USD 500 million in Binh Phuoc, capable of consuming nearly 97,000 tons of natural rubber annually. With a processing plant capacity of 16,000 tons per year and over 10,300 hectares of EUDR-certified rubber forests, DPR can reliably supply large partners.

In addition to its natural rubber business, SSI Securities forecasts that the Bac Dong Phu Industrial Park (phase 2), recently approved by the government in January 2025, will drive growth for DPR in 2026. DPR is estimated to earn over VND 1,000 billion in pre-tax profits from the total leased area, starting in 2026, with prices at approximately USD 75 per sq. m per lease cycle. The demand for industrial parks is likely to increase in Binh Phuoc due to the high occupancy rates in Binh Duong and Dong Nai, along with improved infrastructure such as the North-South Expressway extension from Gia Nghia in Dak Nong to Chon Thanh in Binh Phuoc and the road from Ho Chi Minh City through Thu Dau Mot to Chon Thanh.

|

DPR’s rubber selling price consistently increased throughout 2024.

Source: Author’s compilation

|

Tu Kinh

– 08:32 31/01/2025

“A Lean Quarter for Nam Kim Steel: Q4 Profits Down 18% Year-on-Year”

The Nam Kim Steel Joint Stock Company (HOSE: NKG) has reported lackluster financial results for the fourth quarter of 2024, yet managed to surpass its full-year profit plan for the year.

The Ultimate Mid-Range Smartphones: POCO’s Newest Launch in Vietnam. Unlocking Longevity with a 6000 mAh Battery, Starting from Just Over 7 Million VND.

The POCO X7 and X7 Pro are power-packed performers with a fresh design aesthetic. These devices offer a robust configuration, a large battery, and a unique look and feel. With impressive specs and a stylish appearance, they’re set to revolutionize the market and offer an unparalleled user experience.