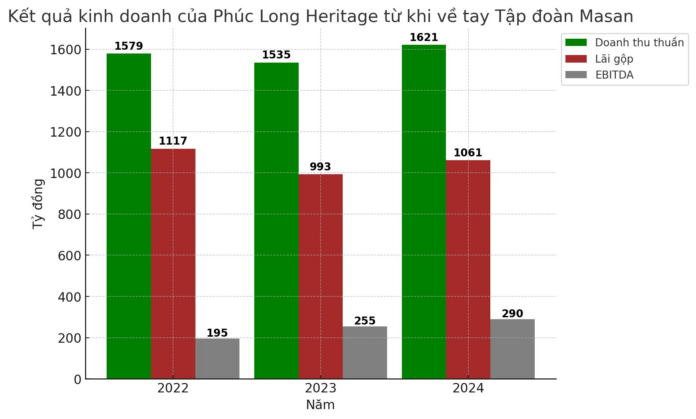

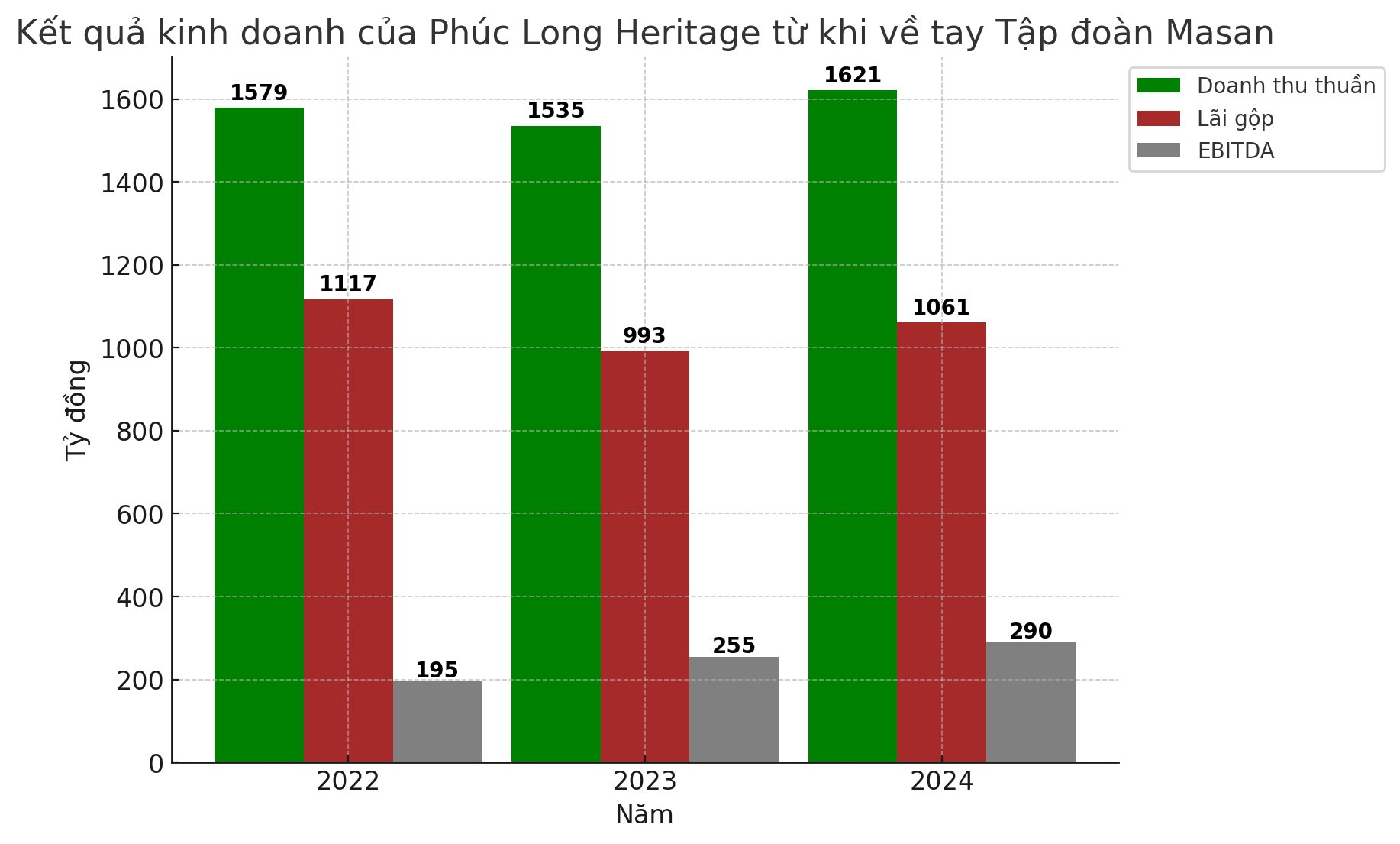

Specifically, Phuc Long Heritage, the entity behind the Phuc Long tea and coffee chain, recorded a revenue of 1,621 billion VND, a nearly 6% increase compared to 2023. The company reported a net profit margin of 7.6%, corresponding to a net profit of approximately 123 billion VND.

In Q4/2024, Phuc Long’s revenue reached 417 billion VND, a nearly 12% increase year-on-year. Cumulatively for the year, the company’s gross profit reached 1,061 billion VND, a nearly 7% increase compared to 2023, while EBITDA increased by nearly 14%, reaching 290 billion VND.

The main growth driver came from the opening of 33 new stores and a strategy to renovate stores to enhance customer experience.

The renovation of 11 stores helped increase the daily revenue of these stores by 13.4% in the on-premise segment. Meanwhile, stores that were not renovated only maintained stable revenue without significant growth.

Masan made its initial investment in Q2/2021 by acquiring 20% of Phuc Long Heritage, followed by an additional 31% in Jan 2022, and 34% in Aug 2022, bringing its total ownership to the current level of 85%.

Vietdata, a provider of Vietnam economic data, evaluated that after the prominent merger of Phuc Long and Masan Group (2021 – 2022), the brand’s revenue increased by 3.5 times but plateaued at 1,500 billion VND in 2023, with a market share of 4.52%.

“Although revenue increased, Phuc Long’s profits have continuously declined for two years due to consumers’ cautious spending policies,” Vietdata commented.

In 2024, affirming Phuc Long’s revenue target, Mr. Danny Le, CEO of Masan, stated that the company expected to achieve a revenue of 1,790 billion VND to 2,170 billion VND, corresponding to a growth rate of 17% to 41% compared to the same period. Thus, with the current results, the beverage brand in which Masan invested is performing below expectations.

In the future, the CEO of Masan affirmed that the company’s strategy is to “Go Global,” turning Phuc Long into an international tea brand while improving business efficiency in the domestic market. In the US, the brand has opened 2 stores.

Meanwhile, as of Q3/2024, Phuc Long owned 176 stores, second only to Highlands Coffee (800 stores) and surpassing Starbucks, The Coffee House, and Katinat.

The Money-Making Education Boom: A Wealth-Teaching Company Reports a Staggering 800% Surge in Q4 2024 Revenue, the Highest in Three Years.

The company allocated a substantial amount of 6.3 billion VND to invest in securities, specifically targeting stocks of prominent entities. These include BIDV, the Vietnam Rubber Industry Group, Vietnam Oil and Gas Technical Services Joint Stock Corporation, VIX Securities, and the Vietnam Livestock Corporation.

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

The Captivating Craft of Words:

“Dat Phuong’s Profitable Prowess: A Stellar Fourth Quarter with nearly 100 Billion VND in Profit.”

The Joint Stock Commercial Bank for Foreign Trade of Vietnam, or Vietcombank, has announced its fourth-quarter 2024 financial statements, reporting a net profit of VND 97 billion, the highest in the past seven quarters. This figure represents a 15% increase compared to the same period last year, yet Vietcombank has only achieved 88% of its annual profit plan.