The Year of the Dragon saw Vingroup (stock code: VIC) and billionaire Pham Nhat Vuong make dynamic moves to restructure their investments. Over the past year, Vietnam’s richest man demonstrated his vision to expand Vingroup’s ecosystem into technology and robotics.

Vingroup Establishes Multiple Tech and Robotics Companies

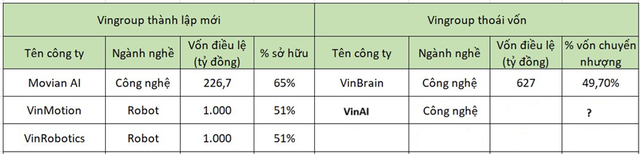

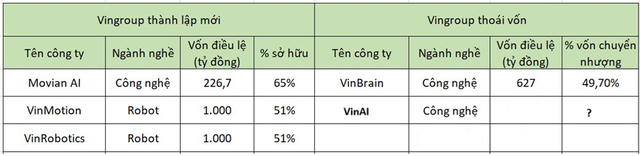

During this eventful year, Vingroup founded three new companies: Movian AI (spun off from VinAI), VinMotion Multipurpose Robotics Research, Development, and Application JSC, and VinRobotics Multipurpose Robotics Research, Development, and Application JSC.

These ventures mark the group’s entry into the robotics industry, which is projected to reach a value of $7 trillion by 2025.

Interestingly, VinRobotics and VinMotion, as “twin” companies, share a charter capital of VND 1,000 billion each and a similar shareholder structure, with Vingroup holding 51%, Pham Nhat Vuong owning 39%, and his two sons, Pham Nhat Quan Anh and Pham Nhat Minh Hoang, each holding 5%.

Both companies are engaged primarily in the manufacturing of industrial and intelligent robots for various purposes. Ms. Nguyen Mai Hoa serves as the legal representative for both entities.

Vingroup has consistently ramped up investments to enhance its capabilities in technology, particularly high-tech. The group’s tech and industrial ecosystem now comprises five members: VinFast, VinSmart, VinAI, VinBigdata, and VinHitech. With the addition of these two new robotics companies, Vingroup will have a total of seven technology companies under its umbrella.

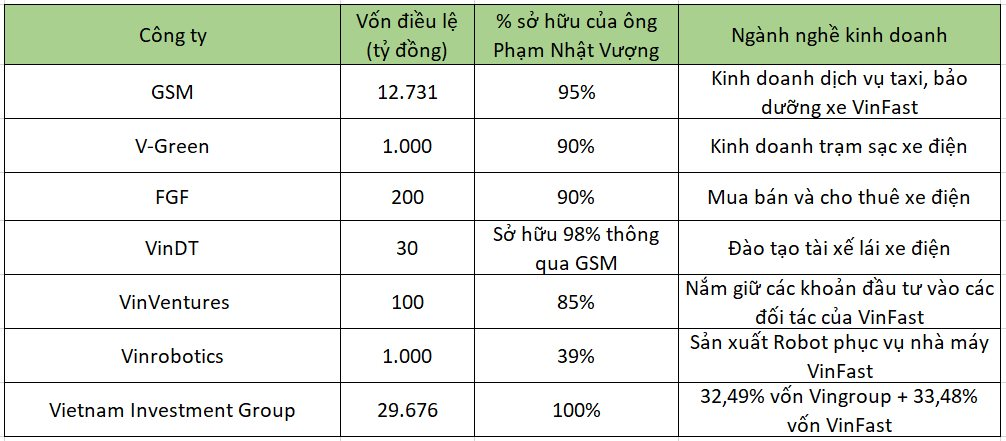

Billionaire Pham Nhat Vuong has also personally established tech and robotics companies to support this transition, especially to bolster VinFast. In the past year, Vietnam’s richest man founded FGF, VinDT, and V-Green, with core businesses related to electric vehicles and technology.

On the selling side, Vingroup concluded the year by divesting VinBrain to Nvidia. The financial details of the transaction were not disclosed.

In addition to selling VinBrain, in October 2024, Tech in Asia reported that Vingroup was looking to sell its stake in VinAI. VinAI was initially established as a research institute under Vingroup and later became a subsidiary in 2021 with a capital of VND 425 billion (USD 17 million).

Vingroup Divests from Multiple Real Estate Companies

One of the most notable events during the Year of the Dragon was Vingroup’s historic divestment from Vincom Retail (VRE). The group sold 41.5% of Vincom Retail’s capital by transferring 99% of SDI’s capital. As a result, neither SDI nor Vincom Retail is a subsidiary of Vingroup anymore.

The total value of this transaction amounted to VND 39,100 billion (approximately USD 1.56 billion). Vingroup has received the full amount.

Past Restructuring Efforts

In the past, Vingroup has been known for its aggressive restructuring strategies. One of its earliest notable divestments was the sale of its entire stake in Vincom Securities (VincomSC).

In late 2019, the market was stunned by news of Vingroup’s share swap with Masan Group (stock code: MSN), resulting in the transfer of VinCommerce, owner of the VinMart supermarket chain and VinMart+ convenience stores. With this move, Vingroup exited the retail sector.

As part of the same deal, Vingroup also sold VinEco to Masan Group. Additionally, the group decided to shut down its VinPro electronics and technology stores and the Adayroi e-commerce platform.

In early 2020, Vingroup unexpectedly announced the discontinuation of its Vinpearl Air project, withdrawing from the air transport business to focus on its strategic goals in technology and industry.

This decision came just months after the group’s initial steps into the aviation industry and less than seven months before Vinpearl Air’s planned launch.

Since 2009, Vingroup has launched and discontinued numerous projects, including VinDS (a clothing and footwear brand within Vincom malls), Vinlink, VinExpress (a logistics company), and Emigo (a fashion company under VinFashion).

The Japanese ‘Big Boss’ Partners with Billionaire Pham Nhat Vuong: A Peek into Their Vietnamese Ventures

Nomura Real Estate Strengthens Vietnam Footprint with Vinhomes Partnership.

A strategic MOU between Nomura Real Estate and Vinhomes will see the former bolster its investment in Vietnam’s thriving urban landscape. With a focus on sustainable and innovative development, this partnership is set to elevate the country’s real estate sector.

Electric Dreams: Igniting Opportunities in Central Vietnam with VinFast’s New Plant

Vingroup has just kick-started an exciting new project with the development of the VinFast electric car factory in Central Vietnam. This marks a significant step forward for the group as they venture into the electric vehicle revolution. With this new initiative, Vingroup is poised to make a powerful impact on the automotive industry, not just in Vietnam but potentially on a global scale.

Ramping Up: Expediting the Appraisal of Vingroup and Sun Group’s Mega-Project Proposals in Bac Ninh

The Bac Ninh province has issued a document urging the appraisal of the approval dossier for investment policies for new urban area construction projects by Vingroup and Sun Group.