With 8.1 million shares outstanding, CMF will need to spend VND 40.5 billion on dividends for 2024. The payment is expected to be made by May 8.

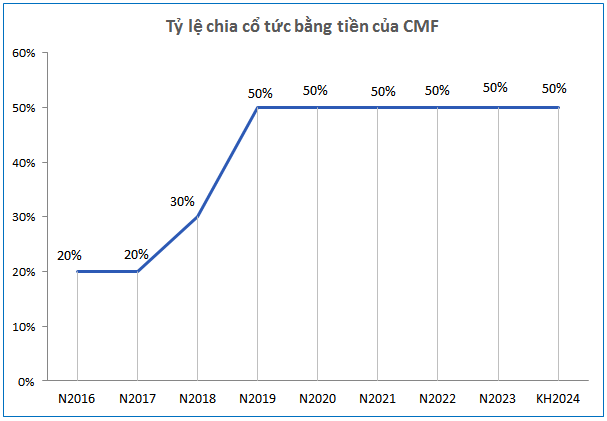

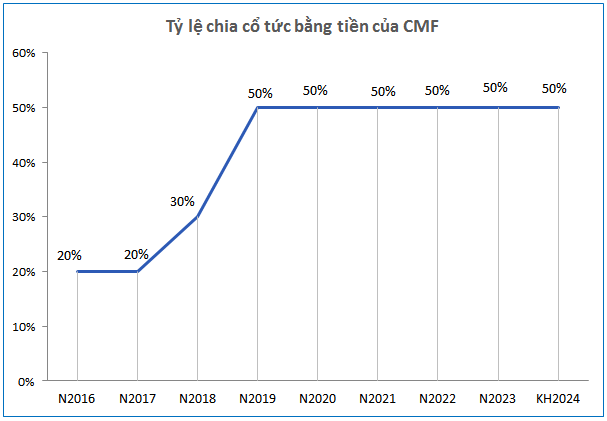

Source: VietstockFinance. (*) Interim 2024 cash dividend of 50% approved

|

Looking back at CMF’s cash dividend policy, the company has consistently maintained a double-digit payout ratio. The dividend rate of 50% has been fixed from 2019 to 2023. For 2024, the company plans to distribute a minimum dividend of 15% per par value.

With the above announcement of the 2024 interim dividend, CMF shareholders will enjoy a cash dividend rate of up to 50% for the sixth consecutive year.

Source: VietstockFinance

|

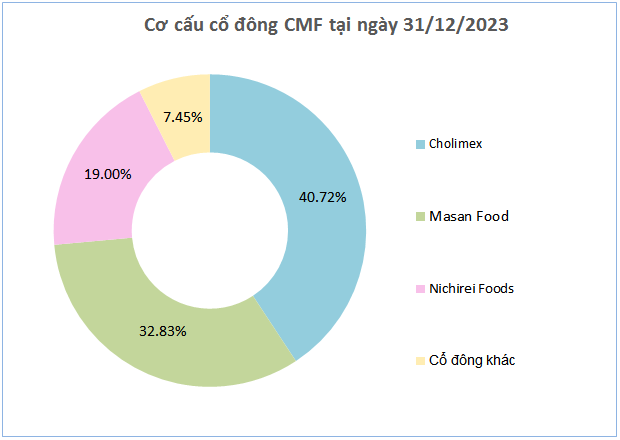

As of December 31, 2023, CMF has three major shareholders: Cholimex Import Export and Investment Joint Stock Company (Cholimex, UPCoM: CLX) holding 40.72% of capital, Masan Consumer Holdings Ltd holding 32.83%, and Nichirei Foods Inc. (headquartered in Japan) holding 19%. Accordingly, these three organizations are expected to receive dividend payments of VND 16.5 billion, VND 13.3 billion, and VND 7.7 billion, respectively, from CMF.

| CMF’s Financial Results for the First Nine Months of Each Year |

Regarding the latest business results announced by CMF, for the first nine months of 2024, the company reported revenue of nearly VND 2,650 billion, an increase of 8% compared to the same period last year. After deducting cost of goods sold and expenses, CMF earned a net profit of VND 189 billion, an increase of 14%.

Compared to the 2024 plan of VND 320 billion in pre-tax profit, an increase of 11% over 2023, the company has achieved 48% of its profit target after nine months.

Along with the announcement of the 2024 interim cash dividend, CMF announced that the 2025 Annual General Meeting of Shareholders is expected to be held on April 22.

– 10:28 26/02/2025

“VISecurities Rebrands as OCBS, Announces Capital Increase to 1,200 Billion”

Vietnam International Securities Joint Stock Company (VISecurities) is gearing up for its upcoming 2025 Annual General Meeting of Shareholders, scheduled for March 14. The company has ambitious plans on the agenda, including a proposed name change and a move to relocate its headquarters from Hanoi to Ho Chi Minh City. VISecurities is also setting its sights on achieving record-high revenue and profit targets, aiming to make this fiscal year the most successful in the company’s 16-year history.

The Companies Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.