Special AI and Crypto Advisor to the President, David Sacks, chats with President Donald J. Trump as he signs executive orders in the Oval Office of the White House on January 23, 2025, in Washington, DC.

|

In a post on X, David Sacks, the White House’s Special Crypto and AI Advisor and Silicon Valley venture capitalist, revealed that the bitcoin reserve would be built entirely from bitcoins seized by the government in criminal and civil cases, ensuring taxpayers aren’t burdened financially.

According to estimates, the federal government currently holds approximately 200,000 Bitcoins, a massive amount worth billions of dollars in the current market.

Notably, Trump’s order also mandates a comprehensive inventory of all digital assets held by the US government. It prohibits the sale of Bitcoin from the reserve, firmly establishing Bitcoin’s position as a long-term store of value for the nation.

Additionally, the order establishes a US Digital Asset Reserve, overseen by the Department of the Treasury, to hold other confiscated cryptocurrencies.

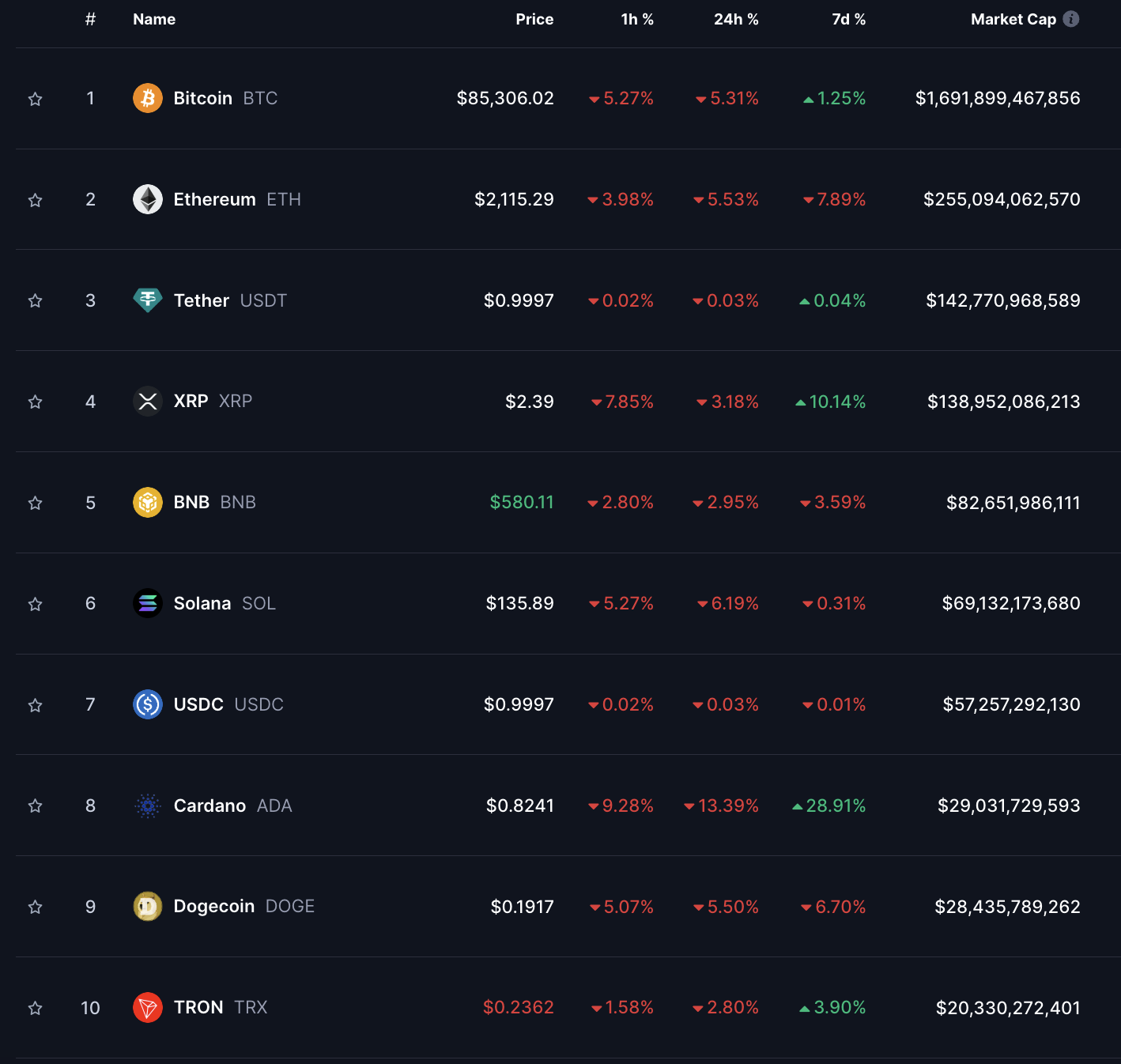

Following the news, Bitcoin prices continued their downward trend, falling towards $85,000 USD. Similarly, other top-ten cryptocurrencies saw red.

Source: CoinMarketCap

|

Sacks applauded the decision, calling it a milestone in making the US the “crypto capital of the world.” He previously noted that the US had lost out on over $17 billion in potential value by selling seized Bitcoin too early.

The focus now shifts to Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick as they devise strategies for purchasing Bitcoin without burdening the national budget.

– 08:00 07/03/2025

Trump’s Tough Talk Leaves EU in a Bind: “Buy More American Energy or Face Higher Tariffs”

Former US President Donald Trump has threatened to impose tariffs on the European Union if its member states do not increase their purchases of American oil and natural gas. In a characteristic display of his aggressive trade policy approach, Trump is demanding that the EU boost its imports of US energy resources or face economic consequences. This bold ultimatum underscores Trump’s unwavering commitment to protecting and promoting American economic interests on the global stage.

Trump’s Second Term: Global Financial Fallout

Donald Trump’s second term brought about significant changes to the financial system, particularly in its approach to Basel III – the global standard for bank risk management. The delay and adjustment of Basel III implementation in the US not only impacted the domestic financial system but also had far-reaching effects on international markets, including Vietnam.