Enterprises “complain” about interest rates and collateral requirements

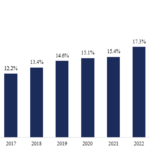

According to statistics, since the beginning of March, approximately 20 banks have reduced their deposit interest rates. Concurrently, lending rates have decreased by 0.8% compared to the beginning of the year, a significant drop from the 1.4% reduction in 2024.

Despite the lower interest rates, many businesses still face challenges in accessing bank loans.

Dinh Thi Thu Ha, CEO of CNC Technology Solutions JSC under the CNCTECH Group, shared that their company’s notable projects have a total investment of nearly VND 1,800 billion, of which VND 1,000 billion (55%) is borrowed capital. Currently, all projects are implemented and operating effectively, with an impressive 80% occupancy rate, generating substantial revenue and cash flow for the company.

During their operations, Ms. Ha mentioned that they also encountered challenges and obstacles regarding access to capital and banking financial services.

Enterprises face challenges in accessing bank loans (Photo: Nhu Y).

“Currently, lending rates at banks remain high, especially in joint-stock banks. This puts a strain on businesses’ production and operations. We propose that the State Bank of Vietnam consider adjusting lending rates to match the actual situation and support businesses,” said Ms. Ha.

She added that while there have been credit guarantee programs from banks, accessing loans remains challenging for businesses, especially those lacking collateral. “We recommend that the State Bank of Vietnam consider implementing more flexible credit guarantee mechanisms, including guaranteeing loans for businesses with potential production and business models but lacking sufficient collateral,” she suggested.

Mr. Luong Quoc Toan, Deputy General Director of Phu Giang Paper and Packaging Company, pointed out that banks only accept real estate as collateral. Many businesses lacking real estate collateral face difficulties when proposing increased credit limits. Therefore, Mr. Toan suggested that banks apply a minimum ratio for real estate and increase the acceptance of machinery, equipment, and inventory as collateral.

Mr. Le Van Hung, Chairman of the Hai Duong Province Business Association, shared an experience where he was invited to borrow from ten banks, with very attractive offered interest rates. However, when adding the service fees, the actual cost turned out to be higher.

State Bank of Vietnam’s Response

A representative from the State Bank of Vietnam stated that lending rates are agreed upon between banks and customers after considering the customer’s credit history, loan proposal, and other factors.

From a regulatory perspective, since 2024, the State Bank of Vietnam has maintained stable policy rates, facilitating businesses’ access to capital at reasonable interest rates.

Additionally, the State Bank of Vietnam has been working directly with commercial banks to stabilize deposit rates and reduce lending rates.

“As of March 10, the average lending rate for new loans has further decreased to 6.5%/year, a 0.4% reduction compared to the end of 2024. To support the economy and promote production and business activities, the State Bank of Vietnam continues to require banks to reduce operating costs and lower lending rates,” the representative said.

According to the State Bank of Vietnam’s leadership, the low credit absorption by enterprises is due to the difficulties and slow recovery of various economic sectors, natural disasters, and epidemics. Many businesses operate at a standstill or cease production and dissolve.

“Some customers have a demand for credit but do not meet the borrowing requirements or face legal procedure obstacles. This is especially true for small and medium-sized enterprises, cooperatives, and small-scale production bases with limited capital, financial capacity, and management capabilities. Their information lacks transparency, and their production and business plans are often impractical, making it challenging for credit institutions to assess and decide on lending,” the State Bank of Vietnam representative explained.

The New Interest Rate Cuts: A Strategic Move by Banks to Boost Their Economy.

As per the State Bank of Vietnam’s (SBV) update on deposit interest rate movements at commercial banks from February 25 to March 18, 2025, a significant 23 banks adjusted their deposit interest rates, with reductions ranging from 0.1% to 1% per annum, depending on the term. Notably, the SBV also recorded up to six instances of banks lowering their interest rates within this period.

The Latest Credit Growth Figures: Unveiling the Banking System’s Performance

“The banking sector is off to a strong start this year, with credit growth outpacing that of the previous year. According to Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, as of March 12, credit growth in the banking system had increased by 1.24% compared to the end of 2024, indicating a significant improvement.”

The Debt Burden’s Drag on Economic Growth

Debt is a pivotal tool in the modern financial system, stimulating consumption and investment while contributing to economic growth. When managed prudently, credit enables businesses to expand their production, enhance operational efficiency, and improve labor income, thereby creating a positive ripple effect on the economy. However, debt growth is not a panacea for perpetual expansion, as the burden of interest payments can become onerous.

“HDBank Aims High: Targeting Profits of Over 20 Trillion VND by 2025 with Plans to Maintain Similar Dividend Payouts”

At the investor conference held on February 18, 2025, representatives from HDBank, one of Vietnam’s leading joint-stock commercial banks, presented an insightful overview of the country’s economic growth potential, along with the bank’s specific plans for the year 2025.