According to the letter, these investors’ projects were initially eligible for the Feed-in Tariff (FIT) mechanism for a 20-year period. However, they are now facing the risk of financial plan disruptions. What happened?

The issue lies in a dispute between the investors and the Vietnam Electricity (EVN) group – the sole power purchaser under the government-issued FIT mechanism for renewable energy development. The dispute centers around the “new COD date” and preferential power purchase prices.

To understand the issue, it is crucial to grasp three key concepts: COD (Commercial Operation Date), FIT (Feed-in Tariff), and CCA (Construction Completion Acceptance).

COD or Commercial Operation Date marks the time when a power project officially commences operations and starts selling electricity to the national grid. More importantly, it determines the starting point for the project to enjoy the FIT price, which is a 20-year government commitment to encourage investment in renewable energy sources.

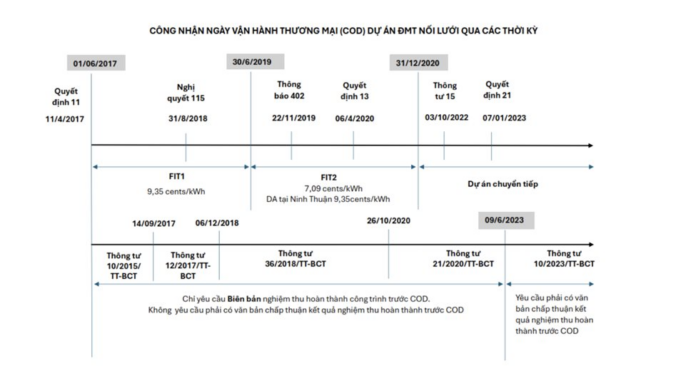

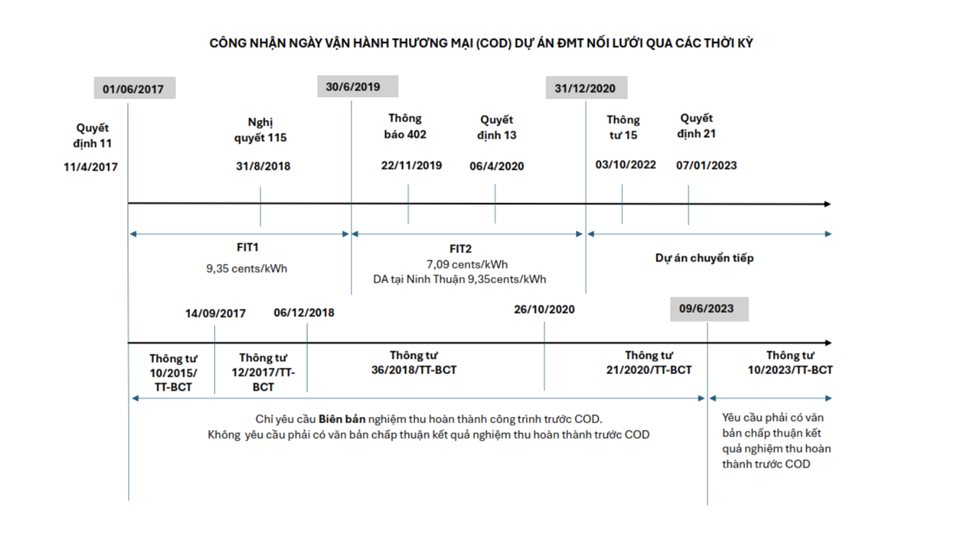

FIT or Feed-in Tariff refers to the preferential power purchase prices for renewable energy projects. FIT1, equivalent to 9.35 cents/kWh, applies to solar power projects with a commercial operation date before June 30, 2019 (with an extended deadline of December 31, 2020, for the first 2,000 MWp in Ninh Thuan).

FIT2, corresponding to 7.09 cents/kWh and 7.69 cents/kWh, is applicable to ground-mounted and floating solar power projects with a commercial operation date between July 1, 2019, and December 31, 2020. Meanwhile, for onshore wind power projects, the preferential purchase price is 8.5 cents/kWh for projects with a commercial operation date before November 1, 2021.

CCA or Construction Completion Acceptance is a certification issued by a government agency, confirming that the project has been accepted upon completion in accordance with the Law on Construction.

The root of the renewable energy investors’ petition lies in the discrepancy between the regulations regarding the “old COD date” and the concept of the “new COD date” proposed by EVN.

At the time these renewable energy projects achieved COD (before 2021), the regulations only required a handover minutes between the investor, construction contractor, and supervision consultant, without mandating CCA as a prerequisite for recognizing COD and applying FIT prices.

However, in a document sent to the Ministry of Industry and Trade in February, EVN proposed the application of a “new COD date,” which would coincide with the date of CCA for the projects.

This means that if a project did not have CCA at its initial COD, the COD date would be pushed back, and the FIT prices would be adjusted accordingly. In reality, more than 170 operating projects are facing the prospect of reduced or eliminated FIT prices if this proposal is implemented.

In their urgent letter to the leaders and authorities, the investor group argued that adjusting the COD date and changing the FIT prices would constitute retroactive law application. In other words, using the new regulations (Circular 10/2023/TT-BCT) to reassess projects that were completed before the issuance of these regulations goes against the non-retroactivity principle of the Law on Investment.

Circular 10/2023/TT-BCT, which took effect on June 9, 2023, requires CCA before granting an electricity operation license, while at the time these projects were approved for COD, the investors claim that the existing regulations did not mandate this certification.

EVN’s proposal stems from Inspection Conclusion No. 1027/KL-TTCP dated April 28, 2023, issued by the Government Inspectorate, which mentions the review and consideration of FIT eligibility for projects without a government acceptance certificate. EVN has used this conclusion as a basis to re-examine the renewable energy projects.

Adjusting the COD date and FIT prices could lead to financial plan disruptions for these renewable energy projects, with a total investment of nearly $13 billion. Many projects are facing the risk of debt default, which could have a ripple effect on credit institutions.

“Since September 2023, many projects have had their payments indefinitely postponed or received only partial payments under the signed power purchase agreements (PPAs) with EVN, without any clear legal basis other than a reference to the inspection conclusion,” the investors’ letter states.

The sudden changes have raised concerns among international investors about the stability of Vietnam’s investment environment. If the situation continues to deteriorate, it could impact FDI inflows into the renewable energy sector.

“In reality, some countries that have withdrawn the FIT policy after a few years have faced international lawsuits,” said Professor Ha Duong Minh, a senior scientist at the National Center for Scientific Research (CNRS) in France.

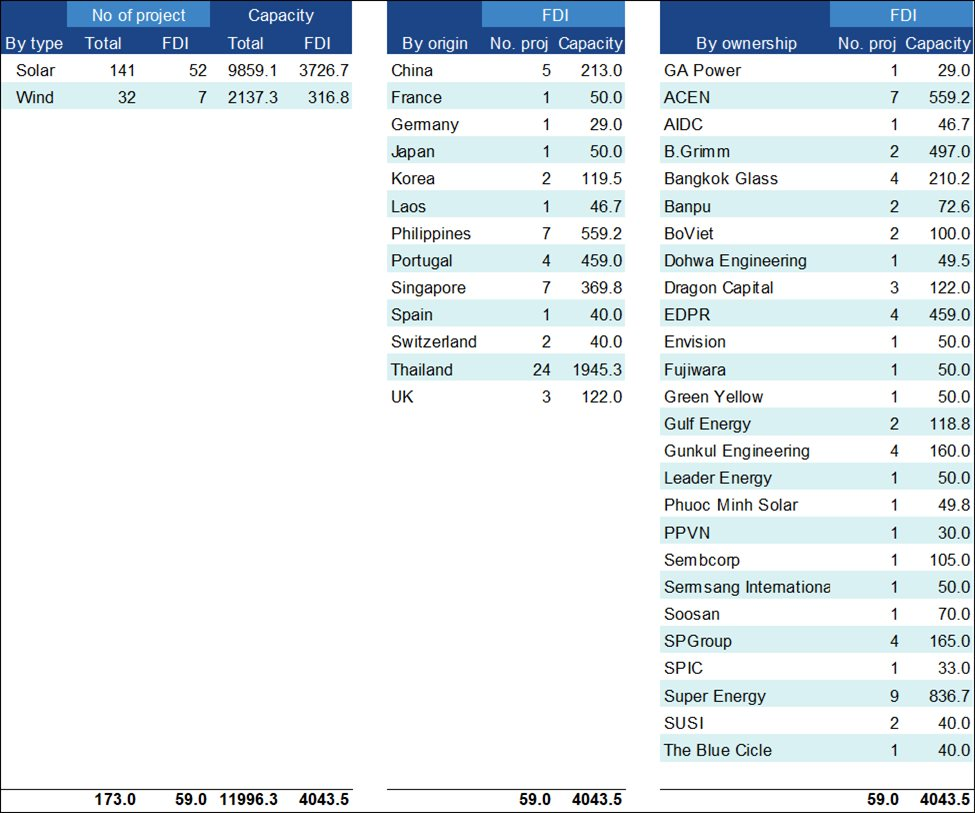

Vietnam’s clean energy development goals, including Electricity Planning 8 and net-zero commitments, could be affected. Of the over 170 projects without CCA at the time of COD, about 30% involve foreign investors, with a total affected investment value of approximately $4 billion.

Foreign investors among the 173 projects without CCA at the time of COD according to the inspection conclusion

In their urgent petition to the high-level leaders, the investors called for maintaining the “old COD date” to safeguard their legitimate rights and appealed for the non-retroactivity of laws.

Regarding EVN’s proposed adjustment of electricity prices based on the “new COD date,” the investors have not agreed to these options. Recent meetings between the parties involved have not yet reached a final conclusion.

The Race for Industrial Land: Vietnam’s $30 Billion FDI Attraction by 2025

The Ministry of Finance’s Statistics Bureau has revealed that foreign investment (FDI) into Vietnam reached an impressive $6.9 billion in the first two months of 2025, a 35.5% increase compared to the same period last year. This surge in FDI not only fosters sustainable economic growth but also positions Vietnam as a powerhouse for high-tech manufacturing in the region.

“A Call for Doubling Down on Efforts: Aiming for 8% and Beyond”

Achieving a growth rate of 8% or higher in 2025 will pave the way for even higher growth rates in the following years, with aspirations to reach double digits, surpassing 10%. However, to attain this new growth target, it is imperative that all ministries, sectors, and local authorities demonstrate an even stronger resolve, doubling their efforts from previous years.

The Power of Words: Crafting a Captivating Title

“EVN Embraces the Future: Official Handover of the Phu My 2.2 BOT Power Plant”

“Upon acquisition and the subsequent handover of the power plant, the Vietnam Electricity Group will take over its operations and management. With a projected annual contribution of approximately 4.6 billion kWh of electricity to the National Power System, the plant is set to play a significant role in meeting the country’s energy demands.”