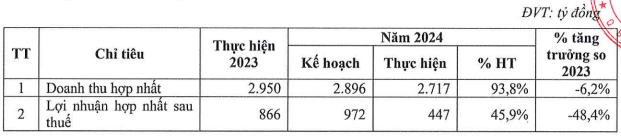

According to the recently published annual general meeting documents for the 2024 financial year, Ha Do Group Joint Stock Company (code: HDG) targets consolidated revenue of VND 2,936 billion and after-tax profit of VND 1,057 billion for 2025. This represents an 8% increase in revenue and a significant 2.4-fold jump in profit compared to the 2024 performance.

It is worth noting that Ha Do’s after-tax profit for 2024 stood at VND 447 billion, achieving only 46% of the set plan. The consolidated total revenue for the year was VND 2,717 billion, completing 93.82% of the target.

Source: HDG

According to the business performance report for 2024, Ha Do recovered only 45% of its capital compared to the plan due to the delayed sale of the remaining units in Ha Do Charm Villas. Meanwhile, the hotel, office, and leasing business segments continued to provide stable revenue, along with property management services.

In parallel, HDG is in the process of integrating industrial real estate into its business operations. The company has received support from Hung Yen, Long An, and Ninh Thuan provinces to research and plan industrial parks and clusters in their respective areas.

In the energy sector, the power generation output of the energy block in 2024 exceeded the plan by 115%, contributing VND 1,891 billion in revenue thanks to the mastery of technology, efficient operations, and favorable weather conditions. By the end of 2024, the company had essentially eliminated the provision for reducing capacity for wind power 7A.

However, some of HDG’s power projects still faced challenges. The Hong Phong 4 Solar Power Project, built on titanium mineral reserve land, has temporarily halted electricity payments since August 2023. The Prime Minister has now directed a resolution to address this issue.

Regarding the Infra 1 Solar Power Project, there is a pending issue with the notification of acceptance of the commissioning results by the Ministry of Industry and Trade after the COD of the plant.

For 2025, Ha Do aims to focus on selling and realizing capital gains from existing projects, seeking and developing additional commercial housing projects in various localities to generate employment and revenue in the 2025-2027 period. Simultaneously, the company will enhance real estate brokerage and project management services outside the corporation.

Ha Do is committed to resolving obstacles and clearing backlogs in already invested projects. They will explore ways to implement the Linh Trung, District 8 projects following the pilot resolution mechanism.

The company will also expedite legal procedures for new development projects in Thai Binh, Yen Bai, and Tan Uyen, while promoting projects in Can Tho and Long An. Additionally, Ha Do will continue to research and develop industrial park, water supply, and logistics projects.

In the energy sector, HDG will maintain power production and operations to stabilize revenue from this segment. For wind and solar power projects that have undergone research and surveys, the company will focus on finalizing legal procedures and preparing capabilities to bid for the projects.

Regarding dividends, Ha Do proposes a 10% stock dividend to shareholders. For 2025, the expected dividend rate will increase to 15%, and the payment method will be decided by the Board of Directors at a later date.

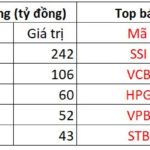

The Great Foreign Turnaround: Overseas Investors Go on a Buying Spree After 30 Sessions of Intense Selling, Spending 250 Billion on a Real Estate Stock

After 30 consecutive selling sessions, foreign investors finally turned net buyers, bringing some balance back to the market.

“Awakening the Capital: Unlocking Dormant Funds in Public Investments”

Despite the positive growth in financial results, the majority of investment bank stocks have remained stagnant and have not seen any significant upward trends in the past year.