On the morning of April 11th, domestic gold prices peaked above the 106 million VND per tael mark. Many investors took profits as gold prices reversed course and fell sharply in the afternoon trading session.

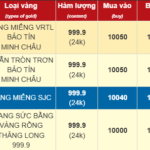

At 2 pm, businesses significantly lowered the buying and selling prices of SJC gold bars and rings. Specifically, Saigon Jewelry Company listed SJC gold bars at 102.2 – 105.2 million VND per tael, a decrease of 1.2 million VND per tael from the morning session. The buying-selling spread was 3 million VND per tael. Other gold businesses also adjusted the price of SJC gold bars down to the 105.2 million VND per tael mark.

The price of gold rings also decreased by a similar amount. Specifically, Bao Tin Minh Chau Jewelry Company listed gold rings at 100.9 – 104.5 million VND per tael, a drop of 1.2 million VND per tael from the morning session.

In contrast to the decline in domestic gold prices, global gold prices continued to surge past 3,228 USD per ounce, surpassing the expectations of analysts.

People lined up to take profits on gold on the morning of April 11th (photo: N.M)

Despite the sharp decline in domestic gold prices in the afternoon, prices have still risen by nearly 4 million VND per tael over the past two days. Since the beginning of the year, gold prices have increased by approximately 18 million VND per tael, prompting many investors to take profits.

During the morning trading session, long queues formed at several gold shops on Tran Nhan Tong street. However, at Bao Tin Minh Chau, the company announced that it would only sell 2 taels per person per day, while purchases were unlimited.

Ms. Thu Hoai from Dong Da, Hanoi, shared: “I’ve been buying gold since 2024, and today I sold 100 taels of gold rings, profiting over 300 million VND. I believe that at this moment, no other investment channel can beat the returns from gold.”

Meanwhile, Mr. Ngoc Anh from Thanh Xuan district, Hanoi, purchased 9 taels of gold rings about 3-4 months ago at 89 million VND per tael. Sensing that it was the right time to take profits, Mr. Ngoc Anh decided to sell. “When I bought it, I never imagined that the price would surge so drastically in just a few months. I made a profit of more than 12 million VND per tael,” he said.

In the “black market,” some sellers offered prices that were surprisingly 1 million VND per tael lower than the listed prices of reputable gold companies. However, at this point, buyers were scarce while sellers were abundant.

Many people successfully took profits as gold prices surged in the morning of April 11th.

A significant gold seller in the “black market” shared: “At large gold shops, the selling quantity is limited to 2-10 taels per day, which is insufficient to meet the investment demands of customers. We provide unlimited quantities, deliver the gold directly to the buyers, and even offer invoices from an intermediary company. We also commit to buying back the gold at any time the investors wish to sell.”

Economist Le Xuan Nghia opined that the gold market is currently influenced more by political factors and investment sentiment than by intrinsic value. Gold prices can surge rapidly but are also susceptible to quick declines if circumstances change.

Additionally, with interest rates remaining high, holding gold may cause investors to miss out on profit opportunities from other assets such as stocks or bonds. If interest rates continue to stay elevated, capital may flow out of gold and into assets offering better yields.

Investing in gold at the current price level entails considerable risk, especially if the economic situation stabilizes or monetary policies shift. Therefore, investors should carefully consider their options before buying gold at this time. If you already hold gold, it may be prudent to take profits instead of continuing to accumulate.

Selling Gold Rush: Queues Form as Prices Soar Past 106 Million VND per Tael

The SJC gold bar and ring prices have taken a turn, dipping after peaking and prompting a wave of sellers to lock in their profits.

Gold Prices Soar Following US’s 90-Day Tariff Reprieve

Global gold prices continued their upward surge during the trading session this morning (April 10th, Vietnam time), despite improved investor sentiment following US President Donald Trump’s announcement of a 90-day delay in retaliatory tariffs and a reduction to 10% for economies other than China.