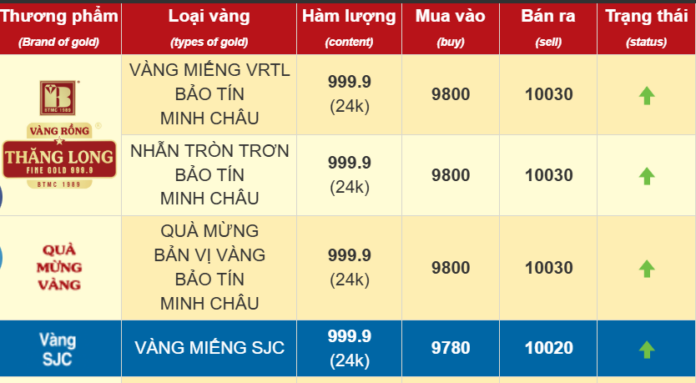

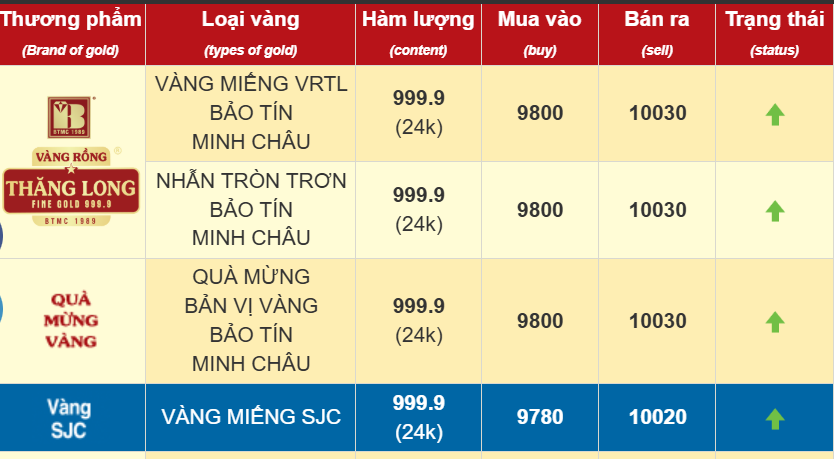

Gold prices have witnessed a notable surge, with rings now priced at VND 98.0-100.3 million per tael at Bao Tin Minh Chau, reflecting an increase of VND 1.1 million and VND 500,000, respectively, for buying and selling rates. Similarly, SJC gold prices at this jeweler also rebounded, rising by VND 1.2 million and VND 700,000 per tael, respectively, for buying and selling, to reach VND 97.8-100.2 million per tael.

Phu Nhuan Jewelry (PNJ) also reported a significant increase in gold ring prices, surging by VND 1 million and VND 700,000 per tael, respectively, for buying and selling, to settle at VND 97.7-100.2 million per tael. The SJC gold prices at PNJ followed a similar trajectory, climbing by VND 1.2 million and VND 700,000 per tael, respectively, for buying and selling, ultimately reaching VND 97.7-100.2 million per tael.

Internationally, gold prices have rebounded above the $3,000 per ounce mark. This recovery comes after a sharp decline during the night of April 7, when gold prices plunged to $2,955 per ounce, the lowest level in three weeks.

This volatility mirrors a similar pattern observed during the previous weekend (April 3-4), when gold prices experienced a rapid drop, only to recover shortly after. The sell-off in the stock market spilled over into the gold market, despite the two markets typically exhibiting opposite trends. Gold, considered a safe-haven asset, usually appreciates during times of economic uncertainty.

According to Reuters, major stock indices worldwide plummeted as US President Donald Trump showed no signs of backing down from his plan to impose sweeping tariffs. In response, China unveiled countermeasures on Friday, including additional tariffs of 34% on all US goods and restrictions on the export of rare earth metals.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, provided his insights: “As the dust settles, the risk of recession increases, the US dollar weakens, real yields decline, and expectations of a more aggressive Fed rate cut should support a gold price recovery.” He also noted that the current correction in gold prices remains mild, with crucial support levels holding firm, particularly the trendline from the January low of $2,975 to the February high of around $2,955.

Year-to-date, gold prices have climbed over 15%, even reaching a record high of $3,167.57 per ounce on Thursday, driven by its safe-haven appeal amid economic and geopolitical turmoil, as well as strong demand from central banks. Notably, the People’s Bank of China added gold to its reserves for the fifth consecutive month in March.

Deutsche Bank offered their assessment: “We believe the positive outlook for gold remains intact despite this week’s correction. As such, we have raised our year-end gold price forecast to $3,350 per ounce.”

Investors are speculating that the heightened risk of a recession could compel the Fed to slash interest rates by 1.16 percentage points this year, with potential rate cuts as early as June. Lower interest rates make gold, a non-interest-bearing asset, more appealing.

Lan Anh

The Golden Opportunity: Unlocking a Profitable Venture with a 300 Million VND Profit from a Wise Investment in Gold Rings

“I’ve been investing in gold since early 2024, and it’s paid off handsomely. I recently sold 100 gold rings, profiting over VND 300 million. I can confidently say that, at this moment, no other investment channel comes close to gold’s returns,” exclaimed Thu Hoai from Hanoi’s Dong Da district.

The Alluring Alloy: A Tale of Fluctuating Fortunes

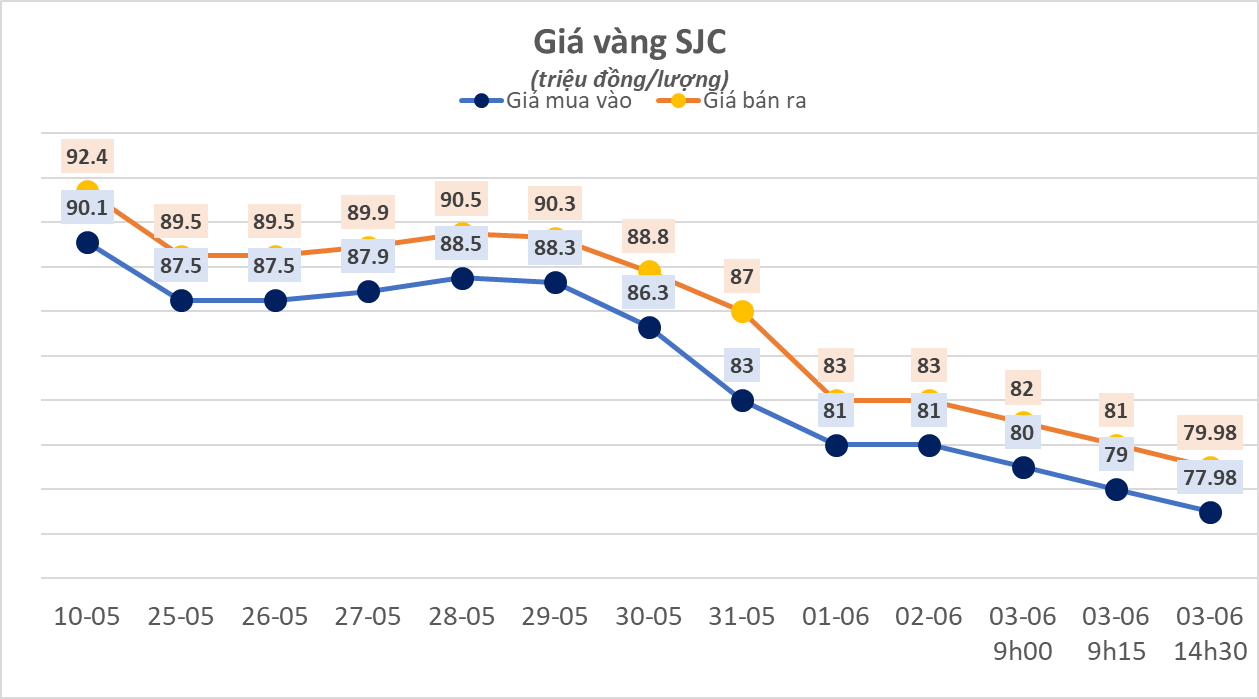

As the sun set on April 10th, the domestic gold price took a downturn, relinquishing its hold on the 104 million dong per tael mark.

Gold prices, including SJC gold and gold rings, have taken a downward turn, falling by an average of 300,000 VND per tael from their recent peak.