**Revenue and Profits Soar**

In Q1 2025, VIX Securities recorded a revenue of VND 979.7 billion, a 2.7-fold increase compared to the same period last year. Thanks to this positive revenue growth, the company posted an after-tax profit of VND 372.3 billion, a 2.3-fold increase year-over-year.

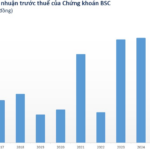

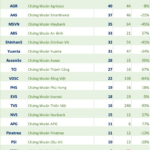

As of April 17, 2025, 24 securities companies had published their Q1 2025 financial reports, with mixed results. Several firms, such as KBSV, BSC, and SBB, reported declining profits, and some even faced prolonged losses.

In contrast, VIX Securities stands out with impressive revenue and profit growth, ranking among the top performers in the market.

A closer look at the financial report reveals that all core businesses of VIX Securities experienced growth. The largest contributor to Q1 2025 revenue was profit from financial assets recognized through profit/loss (FVTPL), amounting to VND 784.5 billion, a 3.8-fold increase year-over-year, and accounting for 80% of total operating revenue.

VIX Securities’ Q1 2025 Financial Report: Impressive Growth Across Core Businesses

The margin lending segment also delivered positive results. Specifically, in the revenue structure, interest from loans and receivables in Q1 reached VND 160.7 billion, a 40% increase year-over-year. This indicates growth in the margin lending business and an expansion of the customer base. Notably, VIX’s loan-to-equity ratio is below 40%, leaving ample room for further growth as it is significantly lower than the 200% regulatory limit.

In recent times, VIX Securities has introduced flexible financial products, such as interest rate promotions by portfolio and the M5 product designed for customers who require fast and continuous transactions with low interest to optimize profits. These products and services have been well-received by the market, reinforcing VIX’s strategy of targeting specific customer segments.

**Opportunities Amid Challenges**

The timing of the securities companies’ Q1 2025 reports coincided with a turbulent period for the Vietnamese stock market due to the US government’s tariff shock. However, most securities firms believe that while there may be negative short-term impacts, the Vietnamese market has reasons to grow in the long term.

Domestically, the Vietnamese stock market is supported by political and administrative reforms and the promotion of the private sector, which provide momentum for achieving economic growth targets. Specifically, the Vietnamese government maintains an 8% GDP growth target for 2025 and aims for double-digit growth in the following years. Expansive fiscal policies, large-scale public investment, low public debt, and increasing budget revenues form a solid foundation.

Regarding market upgrades, the base case scenario anticipates that FTSE may announce an upgrade for Vietnam in its September 2025 review, with potential implementation in March 2026. Based on Vietnam’s net market capitalization of $43 billion from FTSE Russell, net inflows could reach a high of $1.6 billion following the FTSE Russell upgrade, excluding active fund money.

In reality, after the initial shock, the market has shown signs of recovery. Returning confidence has eased selling pressure, and buying interest has returned, attracted by new valuations. On April 9, 2025, the VN-Index’s mixed P/E ratio was 11.6 times, about 25% lower than the average since 2016 and even lower than during the 2018-2019 US-China trade tensions.

Dragon Capital also believes that Vietnam’s growth outpaces that of its regional peers, while its projected P/E (P/E forward) of 10 times is considered the lowest in the region. Thus, the Vietnamese market is highly attractive in the medium and long term. With expected profits for 2025, P/E and P/B ratios could reach their lowest levels in a decade.

With compelling valuations and a stable domestic narrative, the stock market is expected to attract capital from both domestic and foreign investors. In this context, VIX Securities has prepared its financial resources, technology systems, and personnel to meet customer needs and boost business growth.

The Ultimate Guide to Q1 Earnings: VPBank, HSC, and Vietcap Lead the Pack with Impressive Results as the Week Comes to a Close

The financial industry behemoth posted a “multiplied” profit, an impressive feat, while several securities firms reported losses in the first quarter.

The Magic of Chemicals, the Dullness of Fertilizers

The chemical businesses continued their remarkable breakthrough in Q4 of 2024, mirroring the previous quarter’s performance. In contrast, fertilizer companies experienced significant setbacks, despite a few notable exceptions that achieved substantial profit growth.