Mirae Asset has recently updated its outlook on the beer industry, highlighting the potential for a strong recovery and growth in the sector, as indicated by the low P/E ratio.

VIETNAM – THE SECOND LARGEST BEER CONSUMER IN ASIA

The Vietnamese beer market is dominated by four major companies: Heineken, Sabeco, Carlsberg, and Habeco, collectively holding over 90% of the market share (according to Euromonitor). The industry’s total designed capacity is estimated at 6.5 billion liters per year, with Sabeco leading the way with a capacity of 3.01 billion liters per year.

According to Kirin Holding, Vietnam ranks 7th globally and 2nd in Asia in terms of beer consumption (2023), accounting for 2.4% of global beer consumption. Asia is also the world’s largest beer-consuming market by geographic region, with a 32% share.

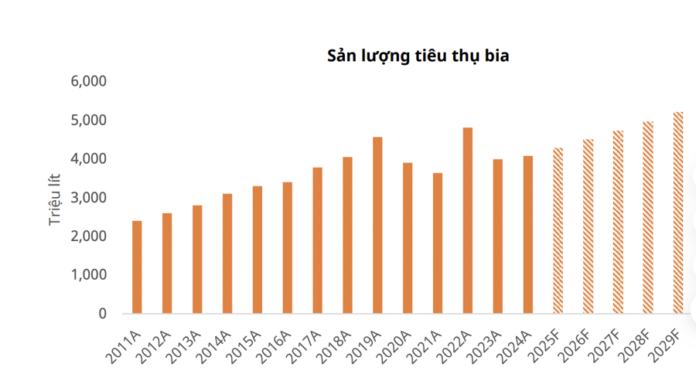

Vietnam’s per capita beer consumption is impressive, standing at approximately 43 liters per person per year. Between 2009 and 2023, it experienced a compound annual growth rate (CAGR) of 4.7%. This trend is expected to continue, with a slight increase of 2% annually from 2025 to 2030, driven by factors such as economic growth, a young population, urbanization, and the rebound of the tourism industry.

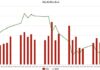

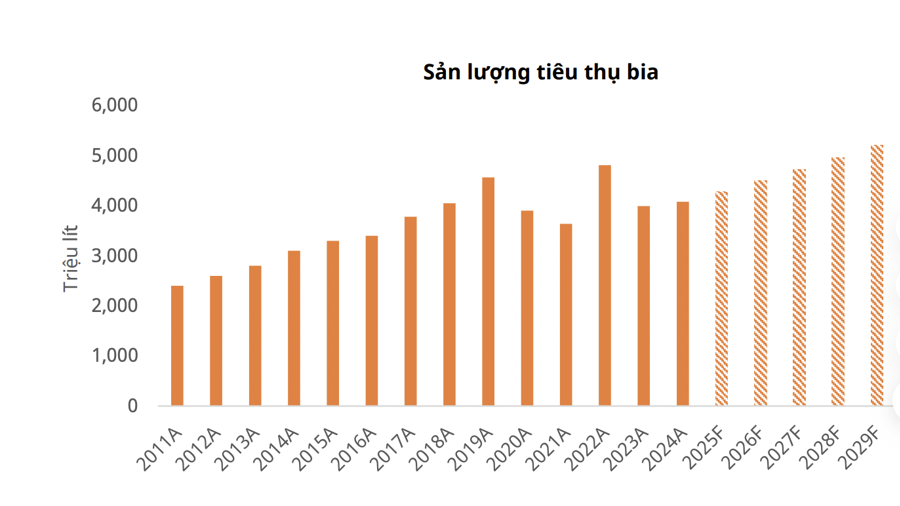

Prior to the Covid-19 pandemic, beer consumption in Vietnam grew steadily at a CAGR of 8% from 2010 to 2019. However, it declined by 22% in 2021 due to the pandemic. In 2022, production recovered by more than 20% as consumer demand bounced back. Nevertheless, economic recession and Decree 100, which tightened regulations on alcohol levels, led to a decrease in consumption in 2023. The recovery momentum is expected to reach only 2.5% in 2024 due to Decree 168, which increased penalties for traffic violations.

According to Euromonitor, about 63% of beer consumption in Vietnam occurred through supermarkets and convenience stores, while the remaining 37% was through restaurants and eateries in 2023.

The long-term outlook for the beer market in Vietnam remains positive due to improving per capita income and a large population within the drinking age range.

Despite the industry’s adjustment to stricter regulations on alcohol levels and the relatively slow recovery of beer consumption, the expected compound annual growth rate (CAGR) for beer consumption in Vietnam is approximately 5% from 2025 to 2030, supported by a strong foundation of domestic consumer demand.

The country’s young population and increasing income are significant positive factors for the beer market. According to the General Statistics Office, Vietnam is currently in its “golden population” period, with 67% of the population belonging to the working-age group of 15 to 64 years old. This period is projected to last for at least another decade. Additionally, individuals aged 18 to 40 years old, who are the primary beer consumers, make up 42% of the population. This demographic advantage, combined with Vietnam’s beer-drinking culture, fosters the growth of beer consumption.

Input price dynamics are favorable for 2025, supporting profit margins for beer companies. The average price of barley in 2024 decreased by 15% compared to 2023 due to favorable conditions that increased production in Australia and France. The average price of barley in 2025 is expected to remain in the low-mid range of 225 USD/ton.

The average price of aluminum in 2024 increased by 7% compared to 2023, reaching a high level due to reduced supply from China amid escalating economic tensions with the US. Citigroup forecasts the price of aluminum for the second quarter of 2025 to reach 2,300 USD/ton, with an estimated average of 2,400 USD/ton for the full year, slightly lower than the 2024 average due to the impact of US tariffs reducing global demand for aluminum in manufacturing.

Vietnam has undergone four rounds of increases in the special consumption tax on beer, with the tax rate rising from 45% in 2010–2012 to 65% in 2018, where it has remained since. Generally, each tax increase has had a certain impact on the industry, slowing down consumption volume growth for about two to three years initially.

However, after this initial adjustment period, the market has typically witnessed a strong recovery in both volume and consumer demand.

OPPORTUNITIES FOR BEER STOCKS

The profit margins of companies in the industry have been relatively unaffected, as a significant portion of the tax burden is passed on to consumers through price adjustments. Habeco’s gross profit margin experienced a significant decline after the imposition of the tax in 2014. However, the company has since stabilized, maintaining an average margin of around 26%, similar to Sabeco, which has consistently held margins at approximately 27%.

The expected adjustment to the special consumption tax is likely to widen the price gap between mid-range and premium products. This shift favors companies in the mainstream and mid-range segments, such as Sabeco, which benefits from its competitive pricing and extensive distribution network. Additionally, low-income consumers tend to opt for cheaper alternatives like draft beer and “bia cỏ” (local craft beer), especially in rural areas and casual eateries.

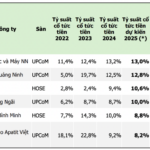

SAB, SMB, and HLB have consistently maintained a return on equity (ROE) above 15%, indicating efficient profitability and a solid financial foundation. In contrast, many other companies in the industry have reported low or highly volatile ROE over the years, reflecting inefficient capital utilization and business challenges.

The current price-to-earnings (P/E) ratios of most beer companies are below their five-year averages, and dividend levels have been stable: SAB (VND 3,500 – 5,000 per share), WSB (VND 3,000 – 5,000 per share), and HLB (VND 1,500 – 2,000 per share). This presents a potential investment opportunity for long-term investors, especially considering that the low P/E ratio suggests the market may not fully reflect the industry’s potential for recovery and growth in the coming years.

Unveiling the Reasons Behind Eurowindow Twin Parks’ Appeal to Investors

Eurowindow Twin Parks enjoys a strategic location in the heart of Gia Lam, benefiting directly from the area’s “districtization” process. This process involves significant investment in transportation infrastructure, creating seamless connectivity and a comprehensive range of social amenities. With real estate prices currently offering attractive rates compared to the market average, this development presents a unique opportunity for prospective investors and homebuyers alike.

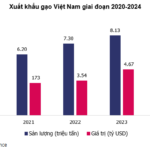

The Rice Industry in 2024: Exporting “Liquid Gold”, Profiting “Grains of Sand”

The rice export industry reached new heights in 2024, with record-breaking figures in terms of value. However, the reality for rice businesses is that their profits are merely a drop in the ocean. With mounting cost pressures, thin profit margins, and internal challenges, the rice industry faces an ironic situation: selling more does not necessarily equate to higher profits.

Unlocking the Export Potential of Vietnam’s Tropical Fruits: BIG Ventures into Agricultural Business with a Focus on Dollar-Valued Produce

To seize the ever-growing opportunities in the agricultural export market, especially for the “king of fruits” – durian, Big Invest Group JSC (UPCoM: BIG) has swiftly expanded its business into the agricultural produce sector. Along with the establishment of two specialized agricultural produce companies, BIG also forged a strong partnership with a leading durian exporter to China in the Southern region.