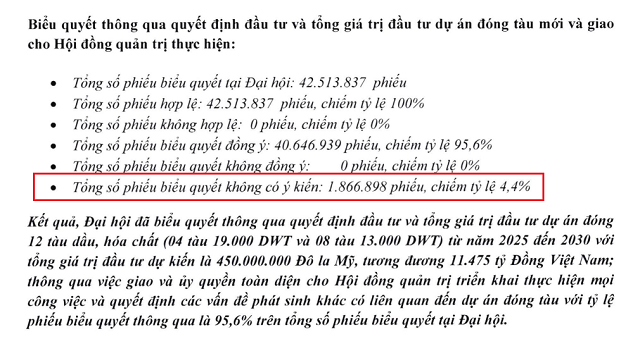

According to the minutes of Au Lac’s 2025 Annual General Meeting, the Company plans to build 12 ships, including four 19,000 DWT vessels and eight 13,000 DWT vessels, with a total investment of approximately $450 million, equivalent to nearly VND 11.4 trillion.

This investment decision comes as the company’s current fleet is almost 20 years old, no longer accepted by many ports, and incurs high insurance costs. The management stated that without fleet upgrades, the company might lose its competitiveness in the next 2-3 years. The investment aims not only to maintain operations but also to increase shareholder value as Au Lac goes public.

2024 was a record year for Ms. Thuy’s shipping company, with a post-tax profit of VND 261 billion, a 32% increase from the previous year. Revenue surpassed VND 1,500 billion, a 28% rise. Profit growth was mainly due to an increased number of vessels as Au Lac acquired three more ships in the first half, bringing the total to eight. Additionally, lower fuel prices also contributed to the positive results.

| Au Lac’s revenue and profit reached new heights in 2024 |

Board members enjoyed increased income, but the dividend payout ratio decreased.

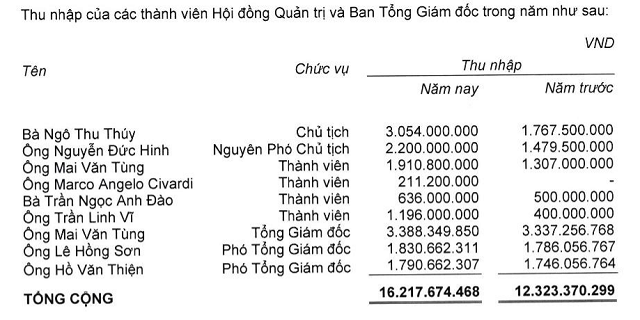

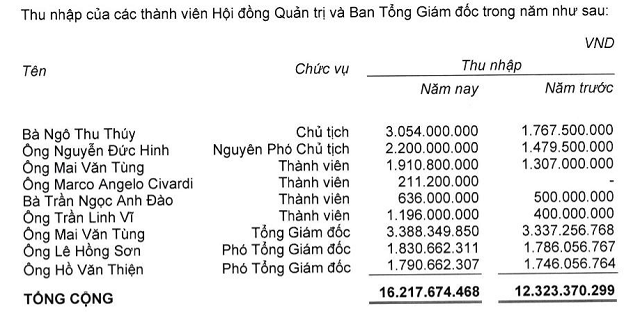

Following a prosperous year, shareholders approved a bonus of VND 10 billion for the Board of Directors and Supervisory Board, slightly higher than the previous year. The management’s total income in 2024 rose significantly by VND 4 billion to VND 16.2 billion, with the majority going to the Board of Directors.

Chairwoman Ngo Thu Thuy received the highest income of VND 3 billion, a 70% increase, while Board member Tran Linh Vi’s income tripled to nearly VND 1.2 billion. In contrast to this increase, the cash dividend for 2024 decreased to 6%, lower than the 8% paid out in 2023.

Source: Au Lac’s 2024 Audited Consolidated Financial Statements

|

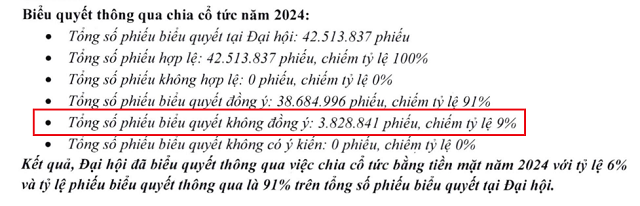

According to the meeting minutes, shareholders believed that the dividend rate was not commensurate, especially considering the company’s retained earnings of over VND 561 billion and the bonus for the Board and Supervisory Board equivalent to a 2% dividend rate. However, Au Lac’s management appealed to shareholders to understand the challenges and focus on the new ship construction project, a critical investment for the company’s survival.

While most shareholders agreed with the investment plan, approximately 4.4% of the total votes at the meeting abstained, and 9% disagreed with the 6% dividend rate.

Source: Au Lac

|

This year’s meeting also reelected the Board of Directors and Supervisory Board for the 2025-2030 term. The incumbent members, including Ms. Ngo Thu Thuy, Mr. Mai Van Tung, Ms. Tran Ngoc Anh Dao, Mr. Tran Linh Vi, and Mr. Marco Angelo Civardi, were reelected to the Board, while Mr. Huynh Duc Truong, Ms. Nguyen Dinh Thuy Tien, and Ms. Dang Thi Hong Loan were reelected to the Supervisory Board.

In terms of shareholder structure, Ms. Thuy’s two children remain the largest individual shareholders, holding 12.81% and 9.82%, respectively. Board member Tran Linh Vi owned 4.47% as of the end of 2024.

First-quarter profit declined

The consolidated financial statements for the first quarter of 2025 showed that Au Lac’s revenue was over VND 292 billion, a 21% decrease compared to the same period last year. Post-tax profit stood at over VND 47 billion, a 35% drop. Although borrowing interest expenses decreased significantly, the unstable geopolitical situation and new trade policies implemented by President Donald Trump were cited as reasons for the reduced demand for fuel transportation.

For 2025, the company set a target of VND 1,400 billion in total revenue and VND 220 billion in pre-tax profit, representing decreases of 12.3% and 32%, respectively, compared to the previous year. After the first quarter, Au Lac achieved 21% of its revenue target and 27% of its profit goal for the year.

As of the end of March, Au Lac’s total assets amounted to approximately VND 2,190 billion, including VND 922 billion in cash and bank deposits, accounting for 42% of total assets. Owners’ equity stood at nearly VND 1,400 billion, including VND 561 billion in undistributed post-tax profits. Short-term deposits increased from VND 144 billion to VND 160 billion, mainly due to deposits made to Tam Luc Real Estate Joint Stock Company for the implementation of a project to build an office building and a crew training center.

| Au Lac’s first-quarter 2025 profit declined but remained at a high level |

“TCH Finalizes Plans to Issue Over 200 Million Shares, Focusing on Two Major Projects in Haiphong”

The Hoang Huy Finance Investment Joint Stock Company (HOSE: TCH) convened an extraordinary general meeting for the 2025 financial year to approve a plan to increase its charter capital to nearly VND 8,700 billion. This move aims to bolster the company’s resources for two key real estate projects in Hai Phong.

“Proposed Discount Shopping Center in Ho Chi Minh City to Lure Tourists”

“Red tape is a significant hindrance to the growth and prosperity of Vietnam’s business community. This is according to the Chairman of the Business Association in Ho Chi Minh City, who highlights the cumbersome administrative procedures as a key issue facing enterprises today. The current bureaucratic red tape is stifling the dynamic and innovative spirit of businesses, hindering their ability to adapt, grow, and contribute to the country’s economic development.”

Entering a Price Appreciation Cycle, Thu Thua Real Estate is in High Demand

Riding the wave of booming investment in Long An, Thu Thua real estate – one of the top three industrial powerhouses of the province – is entering an accelerated growth cycle. With high expectations, the region is poised to rival established players in the market.