Oil prices rose on Friday, boosted by positive US-China trade talks.

Oil Rises on US-China Trade Talk Optimism

Oil prices climbed nearly 2% on Friday, marking the first weekly gain since mid-April, as positive trade talks between the US and the UK raised investors’ hopes ahead of negotiations between senior officials from Washington and Beijing.

Brent crude futures rose by $1.07, or 1.7%, to settle at $63.91 a barrel, while West Texas Intermediate crude futures gained $1.11, or nearly 1.9%, to settle at $61.02. Both oil benchmarks rose over 4% on a weekly basis.

On Friday, US President Donald Trump stated that China should open its markets to the US, and the 80% tariffs on Chinese goods seemed reasonable. This came a day after he announced a deal to reduce tariffs on cars and steel exported by the UK, along with other agreements with the country.

LNG Prices Edge Higher

Spot liquefied natural gas (LNG) prices in Asia inched higher this week but are expected to ease as Chinese demand remains subdued. The average LNG price for June delivery to Northeast Asia was $11.50 per million British thermal units (mmBtu), up from $11.00/mmBtu last week.

European gas prices also rose this week after the EU planned to phase out Russian gas. Starting next month, the European Commission will propose legal measures to phase out the EU’s entire import of Russian gas and LNG by the end of 2027 and ban EU spot imports by the end of 2025.

Gold Advances as Dollar Weakens

Gold prices climbed over 1% on Friday as the US dollar weakened ahead of US-China trade talks over the weekend. Spot gold rose 1.1% to $3,340.29 an ounce, gaining 3.1% for the week, while June 2025 gold gained 1.1% to $3,344.

Bullion, known as a safe haven against geopolitical and economic turmoil, has surged over 27% since the beginning of the year. The dollar weakened by 0.3%, making gold cheaper for holders of other currencies.

As representatives from the US and China prepare for trade negotiations to ease tensions between the world’s two largest economies, President Trump stated that an 80% tariff on Chinese goods seemed reasonable.

Iron Ore Trades in a Narrow Range

Iron ore futures traded in a narrow range on Friday as investors weighed the impact of easing US-China trade tensions against weak seasonal demand from top consumer China. The September iron ore contract on China’s Dalian Commodity Exchange (DCE) closed 0.57% lower at 696 yuan ($96.06) per ton, registering a 1.2% decline for the week.

The June iron ore contract on the Singapore Exchange rose 0.65% to $97.15 a ton, up 1.5% for the week. China’s average daily output of hot-rolled steel, often used to gauge iron ore demand, increased by 0.1% from the previous week to 2.46 million tons as of May 8, the highest since October 2023.

Copper Steady Ahead of US-China Trade Talks

Copper prices steadied on Friday ahead of the US-China trade negotiations, with the market focusing on tighter near-term supply, reflected in the rise of the spread between LME cash and three-month copper to its highest in two and a half years.

Three-month copper on the London Metal Exchange (LME) gained 0.3% to $9,456.50 a ton.

Rubber Extends Gains for Seventh Straight Session

Rubber futures in Japan extended their gains for the seventh straight session, rising nearly 1.5% for the week, as hopes for easing trade tensions ahead of US-China trade talks, along with higher oil prices, supported the commodity. The October rubber contract on the Osaka Exchange (OSE) closed up 0.6 yen, or 0.2%, at 301.2 yen ($2.07)/kg, climbing 1.45% for the week.

The September rubber contract on the Shanghai Futures Exchange (SHFE) fell by 75 yuan, or 0.51%, to 14,620 yuan ($2,017.86)/ton. June rubber traded on the Singapore Exchange fell by 0.5% to 171.4 US cents/kg.

Coffee Prices Climb

Arabica coffee prices rose by 0.4 cents, or 0.1%, to $3.8775 per lb, while robusta coffee fell by 0.7% to $5,226 per ton.

Colombia produced around 703,000 bags of arabica coffee in April, a 5% decrease compared to the same month in 2024. The 2025/26 Brazilian coffee crop outlook has been adjusted upwards to 65.51 million bags from the previous estimate of 62.45 million bags due to improved weather conditions.

Soybean and Corn Prices Rise Ahead of US-China Trade Talks

Soybean and corn prices in Chicago rose on Friday as traders covered short positions ahead of Saturday’s meeting between senior US and Chinese officials and the US Department of Agriculture’s monthly report on Monday. The June and July 2025 wheat contracts fell to historic lows due to favorable weather in the US Plains and weak export demand.

The June Chicago wheat contract fell by 7-1/2 cents to $5.20-3/4 per bushel, while the July contract hit an all-time low of $5.21-1/2 per bushel. Soybean prices climbed by 6-3/4 cents to $10.51-3/4 per bushel, and corn gained 2-1/4 cents to $4.49-3/4 per bushel.

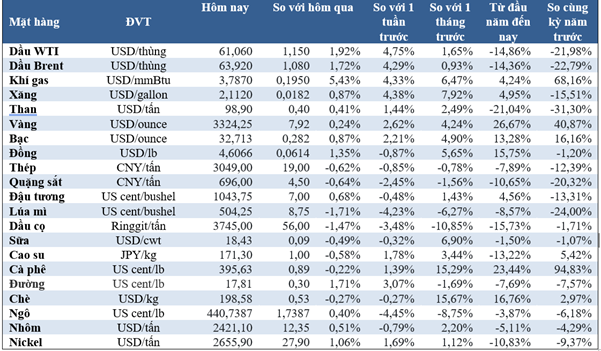

Commodity prices as of May 10, 2025.

The Golden Opportunity: “Sharks” SPDR Gold Trust Show No Signs of Cooling Off

“The surge in gold prices to $3,500 per ounce happened too fast, and the market needs to take a step back to digest this rapid ascent and its implications. This sharp rally has caught many off guard, and a period of consolidation or even a modest pullback would be healthy to ensure the sustainability of this upward trend.”

The Golden Rush: Soaring Prices of Gold Rings and SJC Gold

Late in the afternoon of April 8th, domestic gold prices rebounded, surging back above the 100 million VND per tael mark after a sharp decline earlier in the day. This dramatic turnaround saw the price of gold jewelry and SJC gold reclaim their lofty perch, offering a glimmer of hope to investors and enthusiasts alike.