Latest Updates

Annual General Meeting of Shareholders 2025 of DXG was held on the morning of May 9, 2025. Screenshot photo

|

Discussion:

Will the merger of provinces and cities affect the legal progress of DXG‘s projects?

Chairman of the Board of Management Luong Tri Thin: The policy of merging provinces and streamlining the apparatus of the Party and State is a correct and suitable strategy with the trend, thereby creating a new trend and market for real estate businesses. This is a great opportunity for companies with strategies and capabilities.

On the other hand, there are always difficulties in legal work. But for a professional enterprise like DXG, this is an opportunity to complete the legal procedures and speed up the project progress.

In the period of 2024-2025, the DXG leaders focused on legal work. Key projects have had a 1/500 plan and entered the construction permit phase.

As of the end of Q1, DXG‘s cash balance exceeded VND 5,000 billion. The Management Board will use this resource to develop the business, cooperate with partners, develop new models, and focus on land development to be able to develop sustainably in the period of 2025-2035.

How is the The Prive project going?

Chairman of the Strategic Council Luong Tri Thin: At the same time as organizing the General Meeting, DXG is deploying the kick-off event of The Prive project with 15,000 people, including 6,000 direct participants. This is an unprecedented event with the largest number of agents participating in DXG‘s projects so far, while showing customers’ interest in the project.

The DXG leaders have put all their hearts into building products for The Prive by collaborating with many famous international units. The project will officially be open for sale in early June, when the official price will be announced.

Especially, DXG‘s shareholders can get discounts and incentives when buying the project.

Chairman of the Strategic Council Luong Tri Thin answered shareholders’ questions during the discussion. Screenshot photo

|

Does DXG plan to issue more shares to existing shareholders?

Chairman of the Strategic Council Luong Tri Thin: After the issuance of 150 million shares, in the period of 2025-2027, the Company will not issue any more shares to existing shareholders because it has raised enough resources for the project development and land fund strategies.

This year, DXG plans to pay dividends at a rate of 17% to achieve the goal of increasing charter capital to over VND 10,000 billion to meet the conditions for implementing projects. By 2030, a company with a charter capital of less than VND 10,000 billion is considered a small company, so it must reach this figure to become a medium-sized or larger company.

Assessment of the current and future market situation?

Chairman of the Strategic Council Luong Tri Thin: In the past 5 years, from 2019 to 2023, the real estate market faced many difficulties such as the COVID-19 pandemic, then freezing and recession. However, from 2024 up to now, the market has shown signs of recovery, especially in 2025 with a very good recovery. The whole DXG system recorded double growth in 2025 compared to 2024.

Accordingly, the DXG leaders assessed the period of 2025-2030 as a new cycle and had an appropriate strategy of “New Cycle, New Destiny” through 4 key strategies.

The first strategy is to focus all forces on solving the legal procedures of the project. Currently, the Company has almost completed the procedure with 15,000 products, enough goods for business in the period of 2025-2027.

The second strategy is to transform the model of Dat Xanh Services (HOSE: DXS) from a normal service model to project development through providing a package of 8 solutions. The stronger the market is, and the tighter the law is, the more investors will need the 8 solutions provided by DXS. When this model was officially announced in April 2025, many investors and landowners registered to use DXS‘s services. In terms of brokerage, DXS will continue to maintain its position as the number one brokerage unit in Vietnam.

The third strategy is to focus on finance to complete the chain of 5 projects to develop the satellite urban model, while completing legal and land procedures to implement projects from 2025 to 2030.

The fourth strategy is digital transformation. Currently, DXG is a pioneer enterprise in digital transformation when the Company used a management software system of Vietnam from 2007 but has used software according to international standards from 2022 up to now.

Target profit increases by 44%

Speaking at the opening of the General Meeting, Chairman of the Board of Directors of DXG Luong Ngoc Huy shared that, entering 2025, this is a pivotal year in the goal of heading to 2035. DXG determines to persistently focus on the two core pillars of real estate development and real estate services. Along with that are specific actions such as recruiting high-quality personnel, adjusting flexible sales policies to promptly grasp the market recovery signals. At the same time, promote land development, look for investment opportunities with value. DXG will continue to expand its portfolio through M&A projects with strategic locations, clear legal status, and in line with the long-term development goals of the Group.

Chairman of the Board of Directors Luong Ngoc Huy gave an opening speech at the 2025 Annual General Meeting of Shareholders. Screenshot photo

|

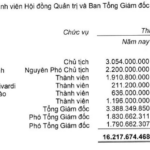

According to the documents of the 2025 Annual General Meeting of Shareholders, DXG sets a target of consolidated net revenue and net profit in 2025 of VND 7,000 billion and VND 368 billion, up 62% and 44% respectively compared to the previous year.

DXG targets 44% increase in 2025 profit, focusing on mid-range and high-end apartment products

Regarding capital raising activities, DXG said that at the 2024 Annual General Meeting of Shareholders, the Company reported the completion of the issuance of shares to the public for existing shareholders according to the resolution of the 2023 Annual General Meeting of Shareholders. However, in the inspection process, the State Securities Commission (SSC) determined that DXG had changed the plan capital usage without the approval of the General Meeting of Shareholders. Accordingly, on December 9, 2024, the SSC issued a decision to sanction the Company.

Dat Xanh Group and Vinam receive fines from the SSC

Regarding the above content, the Board of Directors of DXG explained that part of the capital mobilized from the issuance was temporarily shifted by the Company to short-term purposes to optimize capital usage efficiency during the waiting period for payment of corporate income tax. The shift is temporary and the money has been repaid and disbursed for the right purpose.

As of the conclusion of the inspection, 100% of the mobilized capital has been used in accordance with the resolution of the General Meeting of Shareholders. The Company has drawn experience and committed to comply with the process and competence when adjusting the capital usage plan in the future.

Regarding the issuance of shares to existing shareholders in 2024, from January 14 to February 14, 2025, DXG offered to sell more than 150.1 million shares at a price of VND 12,000/share. As a result, more than 139 million shares were registered to buy, equivalent to a rate of 92.8%. The remaining shares (more than 10.8 million shares) were distributed to 19 individual investors from February 26 to February 28, 2025, at the same price and with a condition of restricted transfer within 1 year.

Thus, DXG has raised more than VND 1,800 billion and increased its charter capital to more than VND 8,726 billion.

Also approved at the resolution of the 2024 Annual General Meeting of Shareholders, the plan to privately offer 93.5 million shares to professional securities investors has not been implemented by DXG as scheduled in 2024 due to the reason that the time for implementing the offering to existing shareholders was extended to 2025.

Therefore, the Board of Directors of DXG proposed to the General Meeting of Shareholders to consider and approve the continued implementation of the private offering to strategic investors. Accordingly, DXG re-submitted the plan to privately offer 93.5 million shares at a minimum expected price of VND 18,600/share, the mobilized capital will be used to contribute additional capital and increase the ownership rate at the subsidiary, generally similar to the plan that has been approved by the 2024 General Meeting of Shareholders.

In addition to continuing the plan to offer to strategic investors, at this year’s General Meeting, the Board of Directors of DXG proposed a plan to issue more than 148 million bonus shares to existing shareholders from after-tax profit and surplus capital stock, equivalent to 17% of the total number of shares outstanding.

At the end of the General Meeting, all proposals were passed.

– 10:12 05/09/2025

“Billions for Boats: Âu Lạc’s Bold Maritime Move”

Eu Lac Joint Stock Company (OTC: ALC), a leading marine petroleum and chemical transportation company chaired by entrepreneur Ngo Thu Thuy, has gained shareholder approval for its ambitious plan to invest in a new fleet of tanker vessels for the 2025-2030 period.

The Big Vimeco Shareholder Sells Off at a Loss, New Investors Scoop Up Bargain Shares.

In less than four months as a major shareholder, Phan Tran Hieu offloaded his entire stake of nearly 22% in Vimeco, incurring an estimated loss of over VND 25 billion. Following the transaction, Vimeco welcomed two new individual shareholders at a time when the company’s stock price took a significant hit.

One of the First Banks to Hold 2025 AGM: Unveiling a 25% Dividend Plan

The annual general meeting season is a highly anticipated time for investors, as it offers a glimpse into the past year’s financial performance and provides insight into the future with new profit plans and enticing dividend prospects.

SIP Posts Highest Q1 Profit in 4 Years, Reaching Nearly 50% of Annual Target

Saigon VRG Joint Stock Company (HOSE: SIP) has announced its Q1 2025 financial results, reporting a net profit of over VND 351 billion, a remarkable 43% increase from the same period last year and the highest since Q1 2021. This achievement marks a strong start to the year, with the company already nearing 50% of its annual profit plan.