It is known that in 2022, ITA had to record a return of nearly 2.2 trillion VND due to the forced termination of a long-term land lease contract related to the Kien Luong Power Center for Tan Tap Energy Development Joint Stock Company (TEDC). As a result, the company had a negative net revenue of over 1.5 trillion VND.

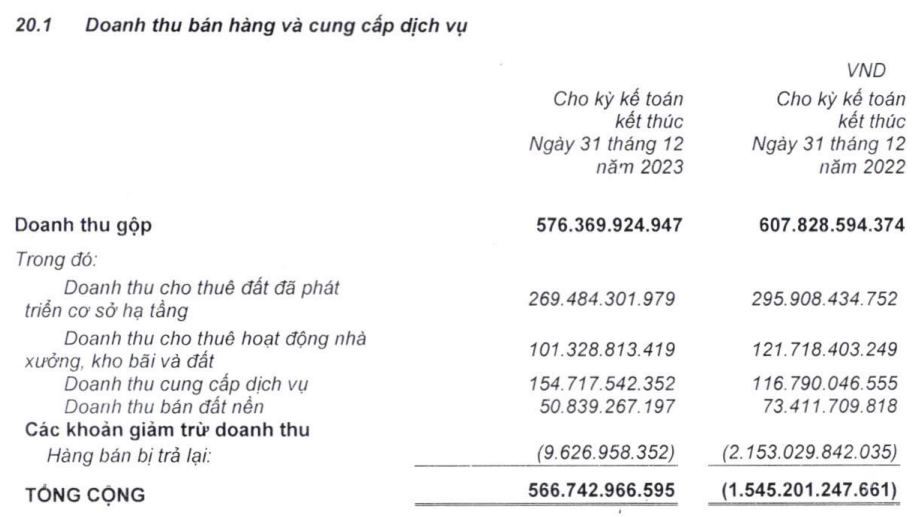

In 2023, thanks to the absence of such returns, ITA recorded a net revenue of nearly 567 billion VND. Among which, revenue from infrastructure leasing still accounted for the largest proportion with over 269 billion VND, followed by revenue from service provision with 155 billion VND.

|

ITA’s revenue structure in 2023

Source: ITA

|

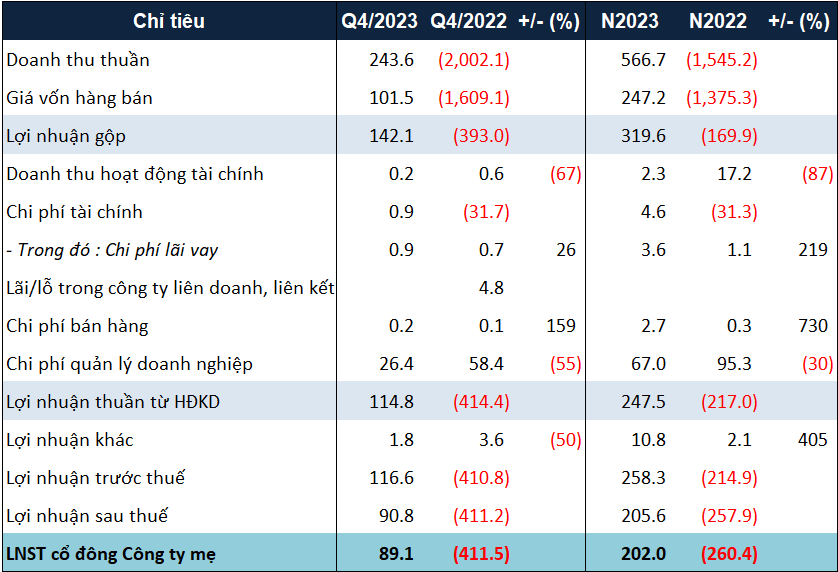

Contrary to the optimistic business performance, ITA’s financial activities have been rather unfavorable. Firstly, the revenue decreased by 87%, to just over 2 billion VND, as there were no more liquidations of investments. On the other hand, the company no longer received a financial cost reserve as it did in the previous year.

After deducting the expenses, ITA achieved a net profit of nearly 202 billion VND in 2023, compared to a loss of over 260 billion VND in the previous year. However, this profit level only reached about 79% of the set target for 2023.

|

ITA’s business results in 2023. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, ITA’s total assets as of December 31, 2023 remained at around 12 trillion VND, nearly flat compared to the beginning of the year. Total accounts receivable increased by 10% to over 3.9 trillion VND. In contrast, the investment value in other units decreased by 35% to over 943 billion VND, as ITA completely withdrew from Tanto 2 Energy Joint Stock Company and Tan Tao Infrastructure Development Joint Stock Company.

Debt decreased by 16%, to nearly 1.8 trillion VND, mostly due to a 9% decrease in other payable amounts (around 576 billion VND). On the other hand, borrowing increased by 37% to over 44 billion VND, as there was a significant increase in short-term bank loans.

Notably, the value of “unrealized revenue + prepaid customers” of ITA sharply decreased by 62%, to nearly 163 billion VND.

Hà Lễ