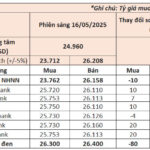

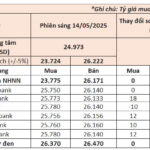

On May 15, the State Bank of Vietnam set the daily reference exchange rate at 24,970 VND per USD, a decrease of 3 VND from the previous day.

Commercial banks also reported a significant drop in USD rates. Vietcombank offered a buying rate of 25,740 VND per USD and a selling rate of 26,100 VND, a decrease of 20 VND from the previous day.

Eximbank adjusted its buying rate to 25,740 VND and the selling rate to 26,090 VND.

Compared to the peak rate of 26,200 VND in late April, the USD rate has decreased by approximately 0.38%.

The unexpected cooling of USD rates in Vietnam comes despite the continued strength of the US dollar in the international market.

The US Dollar Index (DXY) is currently trading at around 100.8 points, reflecting a 2.6% increase from its late April low. The index has also maintained its high level in recent days.

Cooling USD rates at commercial banks

|

Despite the drop in USD/VND rates, analysts suggest that there will still be pressure on the exchange rate in the coming period. This pressure stems from factors such as the Vietnamese Treasury’s purchase of USD from commercial banks in April 2025, totaling 110 million USD, which tightened foreign currency supply.

“In the context of trade uncertainties and unpredictable tariff policies from the US, businesses tend to have higher foreign currency demands,” said Tran Khanh Hien, Head of Analysis at MBS Securities Company. “The sharp drop in interbank interest rates to a 13-month low at the end of the month caused the VND-USD interest rate differential to turn negative, reaching its highest level since the beginning of the year. These factors have put significant pressure on the exchange rate.”

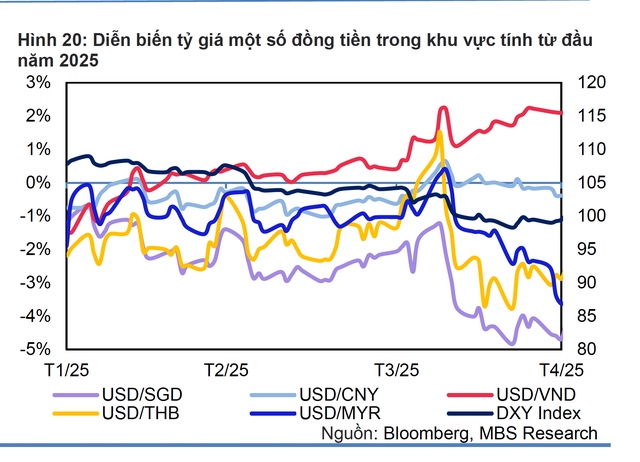

Previously, economist Can Van Luc also noted that while the USD/VND rate has increased by over 2% since the beginning of the year, it remains lower than initial predictions. However, the VND is still depreciating against the USD and other regional currencies.

“The VND remains a weak currency compared to its regional peers. The demand for foreign currency in import-export activities during the first four months of the year has been more volatile, and there are concerns about hoarding foreign currencies and gold. The exchange rate is predicted to increase by about 3-4% for the whole year,” he added.

Exchange rate movement of selected regional currencies since the beginning of 2025 |

Thai Phuong

– 14:02 15/05/2025

“May 14th: Central Bank Keeps USD Exchange Rate at Peak, Significant Differences in Gold Ring Prices Across Brands”

The USD exchange rates at banks witnessed a mixed trend as the SBV kept the daily reference rate unchanged at 24,973 VND/USD. Domestic gold bar prices witnessed a slight dip on Thursday morning, while gold ring prices showed a significant variation across brands.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)