“VPBankS Introduces Unprecedented Low-Interest Margin Loans to Empower Investors in Vietnam’s Recovering Stock Market”

The Vietnamese stock market is witnessing a strong rebound after the April tariff-induced crash. Since the April 9 low of 1,094 points, the VN-Index has surged over 23%, closing at 1,347 points on June 3, marking a three-year high. The overall sentiment is turning positive with net foreign buying and a significant increase in new stock accounts, indicating a revival of confidence among individual investors.

However, this recovery is not evenly distributed across the market. The stark contrast between stock performances demands a more selective and strategic approach from investors. In this context, leveraging tools like margin loans, as offered by VPBank Securities (VPBankS), become pivotal to optimizing investment returns.

VPBankS Unveils an Attractive Margin Package: 6.6% Interest Rate, Lifetime Transaction Fee Waiver, and Loyalty Points.

|

VPBankS, the securities arm of VPBank, stands by its clients during this recovery phase by introducing an enhanced margin loan policy. This package, effective from June 9, 2025, through year-end, targets both new and returning clients. The margin loan is designed with two distinct interest rates catering to different debt levels, peaking at VND 3 billion, thus accommodating diverse investor preferences.

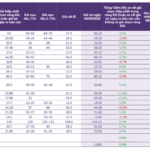

Notably, for debt levels below VND 500 million, the interest rate stands at a record low of 6.6% annually. Unlike some market offerings, VPBankS’ 6.6% interest rate applies to a comprehensive list of 261 basic collateral stocks, with 169 of them eligible for a 50% loan-to-value ratio. This extensive coverage empowers investors to diversify their portfolios.

Additionally, VPBank offers transaction fee waivers for both regular and margin accounts, along with cash rewards of up to VND 200,000 upon account opening and meeting the conditions of the Loyalty policy.

For detailed information about the 6.6% margin loan policy, please refer to: https://www.vpbanks.com.vn/post/margin-66-dau-tu-thanh-thoi-loc-kep-sieu-hoi

Over the past three years, VPBankS, backed by the solid foundation of VPBank, has fortified its financial position with a substantial chartered capital of VND 15,000 billion, ranking among the industry leaders. This robust capital base enables VPBankS to offer competitive interest rates and substantial loan limits in its margin lending business.

Diverse Investment Options

VPBankS also introduces attractive promotions for other loan products, such as eMargin T+ and VIP Margin.

eMargin T+5, T+10, and T+15 are tailored for short-term “surfing” strategies, offering interest rates as low as 0% for 5, 10, or 15 days, respectively. VPBankS raises the bar with a higher limit of VND 15 billion, empowering investors to seize opportunities in short-term market waves while optimizing costs.

The VIP Margin policy, designed for professional investors, boasts a substantial limit of VND 50 billion per account and an attractive interest rate of 8% annually. This policy is one of the few in the market that balances substantial capital needs with swift approval processes, eliminating complex exception procedures.

VPBankS continuously expands its product portfolio to cater to diverse client segments, including stocks, bonds, derivatives, and fund certificates. Recently, the company launched two new ePortfolio investment models focusing on banking and securities stocks, aiming for an expected profit of 18-20% annually. Currently, VPBankS offers ten ePortfolio models across various sectors and themes, such as “Market Upgrade,” “Competitive Advantage,” and “Stable Dividends,” catering to different risk appetites. These models are built on real market data, thoroughly analyzed by VPBankS experts and regularly updated.

– 07:58 12/06/2025

Has the Stock Market Passed the Tariff Test?

If tariffs are considered a stern test of the stock market’s health, then the VN-Index’s journey from 1,300 points, falling below 1,100, and then rebounding to 1,335 can be interpreted in two ways: either as a reflection of the robust fundamentals of listed companies or as a manifestation of investors’ unwavering optimism.

“Stock Recommendations for June: Tapping into Potential with a 33-35% Upside”

The sectors recommended in the May strategic report, including Real Estate, Exports, Oil & Gas, and Retail, are maintaining their positive momentum in the recovery process. Investors are advised to continue holding these stocks and to seize opportunities to increase their holdings when adjustments and positive signals arise.

Market Pulse June 11: VN-Index Caught in Tug-of-War, VGI and CTR Surge Ahead

The market closed with the VN-Index down 1.03 points (-0.08%), settling at 1,315.2; while the HNX-Index dipped 0.17 points (-0.08%), ending at 226.23. It was a mildly positive day for the broader market, with buying interest outpacing selling pressure as 345 tickers advanced against 309 declining names. However, the large-cap universe painted a different picture, with the VN30 basket witnessing a sea of red – 16 tickers declined, 11 advanced, and 3 remained unchanged.

Caution Prevails: A Vietstock Daily Overview for June 12th, 2025

The VN-Index witnessed a slight decline, with trading volume continuing to dip, indicating a clear dominance of cautious sentiment in the market. Without a significant improvement in buying pressure in the upcoming sessions, the index is likely to retest the crucial support level around the 1,300-point mark. At present, the Stochastic Oscillator remains downward-bound after exiting the overbought zone, while MACD consistently widens the gap with the signal line, post its sell signal. These indicators suggest that the risks of a short-term correction persist.