A warning was issued after Sunshine House Business failed to fully meet its payment commitments regarding the SHJCH2125002 bond, valued at 1.1 trillion VND, issued in 2021. This bond was issued to invest in shares or capital contributions of Asset Management Company AMG in Big Gain Investment Joint Stock Company.

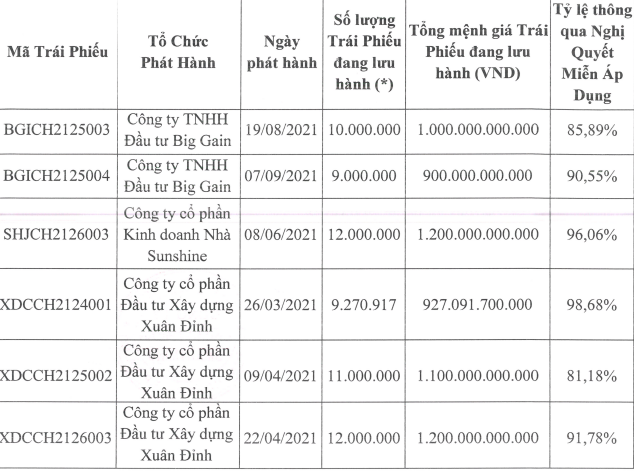

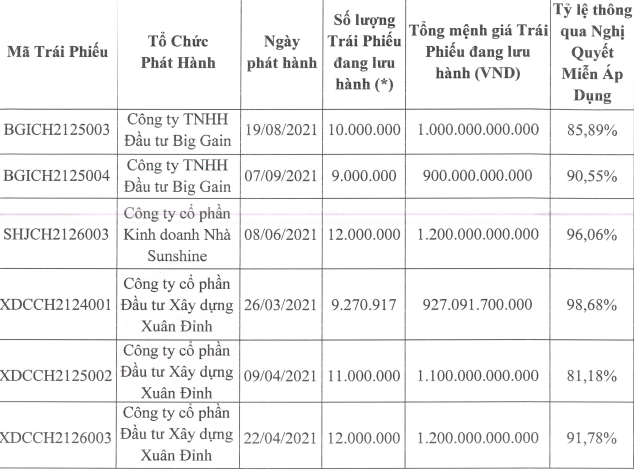

The SHJCH2125002 bond shares the same collateral with several other bonds issued by Big Gain Investment Joint Stock Company (BGIC) and Xuan Dinh Construction Joint Stock Company (XDCC), with a total value of up to thousands of billions of VND.

It is understood that the collateral for the SHJCH2125002 bond and related bonds is the entire asset rights and receivables of Big Gain arising from the project in collaboration with Phat Dat Real Estate Development Joint Stock Company (HOSE: PDR) in the High-rise Housing Area in Phu Thuan Ward, District 7, Ho Chi Minh City (initial commercial name was The EverRich 2, later River City). This asset includes the right to transfer the project when eligible, the right to coordinate and represent the investor in deployment activities, along with a maximum capital contribution of 3.84 thousand billion VND of AMG in Big Gain. In addition, there are debt collection rights, asset disposal rights, and benefits arising from the cooperation contract and authorization. This is the basis for a violation in one bond issue that could have a chain reaction on others.

According to the terms of issuance, if a bond encounters a violation event such as late payment, early maturity declaration, or disposal of collateral, the related bonds are also considered to have corresponding violations. In this situation, investors can request the issuing organization to buy back the bonds before the due date.

|

Related Bond Information

Source: SMDS

|

SMDS sends a notice to the holders of the bonds of Sunshine House Business, Big Gain, and Xuan Dinh. Source: SMDS

|

To limit the spread of risk, the issuing units have sought opinions and passed the “Resolution on Exemption” with a high approval rate to temporarily suspend the above clauses. However, due to the lack of absolute consensus, there is still a group of dissenting investors who are at risk of losing out if the matter is not resolved reasonably.

SMDS stated that the nature of the incident is still unclear and potentially affects the dissenting bondholders. Therefore, the securities company reported the incident to the SSC and Hanoi Stock Exchange (HNX) to fulfill their supervisory and investor protection roles.

Sunshine House Business issued 3 bond lots in 2021 with a total value of 3.3 trillion VND. Two of these have been extended to 2026 and 2027, with most of the principal debt remaining unpaid. The SHJCH2125002 lot has been proposed for a 2-year extension with a consensus rate of over 95%. However, about 4.6% of investors disagreed, and the issuing organization is responsible for fully paying this group by May 26, 2025.

According to a report from Sunshine House Business, the enterprise has not paid any principal or interest to the dissenting bondholders due to capital difficulties. The total amount of overdue payment is over 55 billion VND, including 50.8 billion VND in principal and nearly 4.7 billion VND in interest. SMDS determined this to be a clear violation.

The securities company stated that it had notified the related parties and was ready to support negotiations with the issuing organization to clarify the payment plan, ensuring the interests of investors. SMDS is committed to continuing to monitor the performance of payment obligations and will promptly report any unfavorable developments.

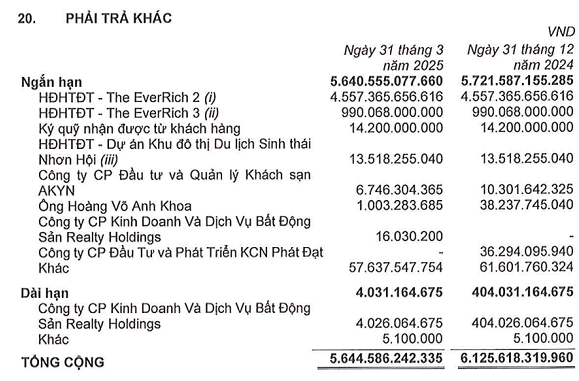

In terms of financial status, reports from Sunshine House Business show that the enterprise is under pressure. In 2024, net profit reached 2 billion VND, up from 111 million VND in the previous year, while profits in 2021-2022 hovered around 3 billion VND. As of the end of 2024, total liabilities amounted to 5.3 trillion VND, of which nearly 3.5 trillion VND was from bonds, and owner’s equity was over 1.67 trillion VND.

According to data from HNX, the bonds of Xuan Dinh Construction and Big Gain Investment, issued in the same period in 2021, have also been agreed by bondholders to be extended for 2 years, following a similar method to Sunshine House Business.

|

About The EverRich 2 Project – Related Asset in the Cooperation between Phat Dat and Big Gain The EverRich 2 (later River City) is the commercial name of the High-rise Housing Project in Phu Thuan Ward, District 7, Ho Chi Minh City, with Phat Dat as the investor. The project was approved by the Department of Construction in 2010 with a total investment of over 8.1 trillion VND. The project covers an area of nearly 11.3ha, comprising 12 blocks of buildings ranging from 12 to 37 stories, along with auxiliary works, providing 4,800 apartments. The implementation period was approved until 2018. In 2015, PDR bought 99.98% of Luyen Can Thep Hiep Phat Joint Stock Company (a company headquartered in Khanh Hoa province) with a charter capital of 5 billion VND. This transaction aimed to facilitate PDR‘s transfer of the project. In mid-2015, PDR announced additional capital contributions to increase the charter capital of the steel company from 5 billion VND to 1,700 billion VND. In August 2015, the People’s Committee of Ho Chi Minh City decided to approve PDR‘s transfer of The EverRich 2 Project to Hiep Phat. In May 2016, the Board of Directors of PDR approved the principle of divesting all capital from Hiep Phat. Just a few days later, PDR completed the divestment and announced that Hiep Phat was no longer a subsidiary. According to the business registration certificate updated in mid-2016, Hiep Phat had a charter capital of 5 billion VND (implying that PDR had not contributed additional capital to increase it to 1,700 billion VND as declared in 2015); of which, Mr. Nguyen Van Phat (holding the position of Chairman of the Members’ Council and legal representative) held 99.998%, and Mr. Nguyen Anh Tuan held 0.001%. Although not related in terms of ownership, Mr. Phat is the elder brother of Mr. Nguyen Van Dat, Chairman of PDR. Updated changes from mid-June 2016 to the present show that Hiep Phat has maintained its capital at 5 billion VND. At the end of 2017, to handle maturing loans and bonds, the Board of Directors of PDR approved the plan to transfer a part or the whole project to investors, including Big Gain, which later signed an investment cooperation contract for a part of the project. According to the agreement, Big Gain transferred more than 4.5 trillion VND to Phat Dat’s group of companies, which was still recorded in Phat Dat’s short-term payables until the first quarter of 2025. The cooperation term is 5 years, and Big Gain has the option to buy back 99% of the interest in the cooperative part of the project after Phat Dat completes the legal procedures and receives the land use right certificate. In case Phat Dat transfers this part of the project to a third party, the Company must refund the total contributed capital of Big Gain, plus the agreed interest. In the financial statement notes, Phat Dat stated that it is still in the process of completing the legal conditions to be eligible to transfer the remaining part of the project according to regulations. At the annual general meetings of shareholders from 2018 to 2022, Phat Dat’s leaders repeatedly emphasized that the enterprise no longer had any authority or responsibility for the transferred part of the project. Big Gain had received site handover, while Phat Dat was waiting to complete the legal procedures to issue invoices and recognize the corresponding reduction in inventory and debt on the books. “The Company has sold and received full payment, and the rest is the partner’s responsibility,” said the minutes of the 2022 annual general meeting, quoting Phat Dat’s leadership. As of the first quarter of 2025, the inventory at The EverRich 2 still accounted for the largest value in Phat Dat’s inventory structure, at nearly 3.6 trillion VND.

|

– 10:45 13/06/2025