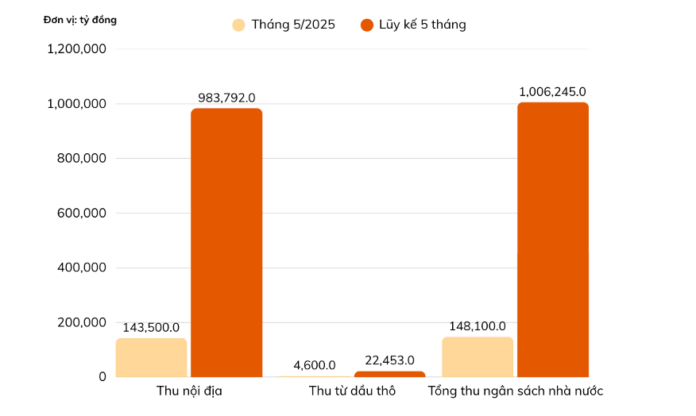

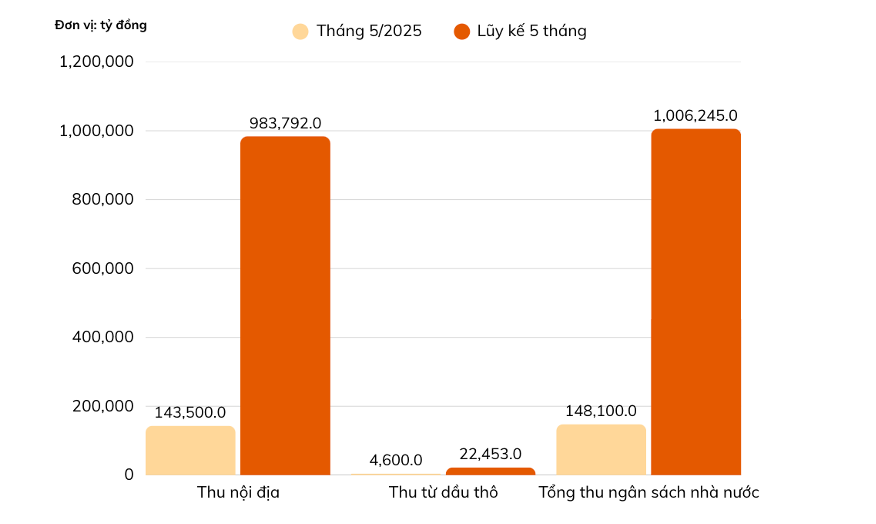

According to a report from the Tax Department (Ministry of Finance), in May alone, state budget revenue from the tax sector reached VND 148,100 billion. This figure is equivalent to 8.6% of the estimate and 107.4% compared to the same period last year. Of which, crude oil revenue reached VND 4,600 billion, accounting for 8.6% of the estimate and 91.8% of the previous year’s performance. Meanwhile, domestic revenue reached VND 143,500 billion, or 8.6% of the estimate and 108% compared to the same period.

Thus, in the first five months of the year, the total state budget revenue of the industry reached VND 1,006,245 billion. This figure is equivalent to 58.5% of the estimate and 128.6% compared to the same period last year. Of which, crude oil revenue reached VND 22,453 billion, accounting for 42.2% of the estimate and 90.9% of the previous year’s performance. At the same time, domestic revenue reached VND 983,792 billion, or 59.0% of the estimate and 129.8% compared to the same period.

State budget revenue from the tax sector in May reached VND 148,100 billion, equivalent to 8.6% of the estimate and 107.4% compared to the same period last year. Cumulative in the first 5 months, the total state budget revenue of the industry reached VND 1,006,245 billion, or 58.5% of the estimate and 128.6% compared to the same period last year.

Tax Department (Ministry of Finance).

Regarding the budget payment situation by locality, 35 out of 63 localities achieved revenue above 50% of the estimate, while only 6 out of 63 localities achieved below 40% of the estimate. In terms of collection areas, 13 out of 20 Regional Tax Departments had a performance rate of over 50% of the estimate, while 7 out of 20 Regional Tax Departments achieved below 50% of the estimate, namely Regional Tax Departments: VII, IX, XII, XIII, XVIII, XIX, and XX.

In the first five months of the year, the tax sector conducted more than 15,800 inspections and examinations, with a total recommended handling amount of VND 20,490 billion, up 142% over the same period last year. Of this, VND 5,632 billion was additional revenue; VND 864 billion was reduced deductions; and VND 13,993 billion was reduced losses.

In terms of taxpayer support, the industry has coordinated with many media agencies to focus on e-invoicing, tax refunds, management of business households, and timely answering questions from people and businesses.

Regarding VAT refunds, as of May 28, 2025, nearly 6,800 refund decisions have been issued with a total refund amount of VND 53,003 billion. This figure is equivalent to 30.1% of the estimate and 108% compared to the same period last year.

Meanwhile, as of June 2, 2025, the tax sector has received more than 787,000 personal income tax finalization declarations requesting refunds. Thus, the system has created refund applications for more than 782,000 cases, of which 342,870 cases are eligible for automatic refunds, with a total amount of VND 1,579 billion. In addition, the tax authorities also issued 265,939 refund orders and transferred the corresponding amount of VND 1,218 billion to the State Treasury for refunds.

For e-invoices initiated from cash registers, from the beginning of the year to May 31, 2025, more than 202,000 establishments have registered, up more than 217% compared to the end of 2024, with 2.3 billion invoices issued.

Mr. Mai Xuan Thanh, Director General of the Tax Department, said that in June, the tax sector continues to focus intensively on reviewing and promoting the progress of professional tasks according to plans and proactively preparing the necessary conditions to effectively implement tax administration.

At the same time, accelerate the implementation of key tasks such as completing the database of business households, standardizing tax identification data, synthesizing and evaluating the effectiveness of the special topic on combating tax losses for high-income individuals, transportation, real estate, and e-commerce.

The Tax Department leader added that they would accelerate digital transformation throughout the system, ensuring readiness to implement the use of personal identification codes to replace tax identification numbers from July 1, 2025. In addition, continue to perfect the big data foundation, new data center infrastructure, and solutions to integrate high-level public services on the National Public Service Portal.

SSI: Established Businesses Like The Gioi Di Dong, FPT Retail, and Masan Benefit from the Crackdown on Counterfeit and Pirated Goods

According to SSI, one of the notable investment themes for June is the stocks of companies that benefit from the crackdown on counterfeit goods.

The 2024 Budget Revenue Reaches a Record High of Over VND 2 Quadrillion

The Chairman’s statement is a testament to the country’s economic growth and stability. The nation’s budget revenue reflects a thriving economy, with stable macroeconomic conditions that ensure social welfare and improved living standards for its citizens.