Investor Losses: A Case Study

Mr. Nguyen Minh from Thanh Xuan, Hanoi, invested 5 billion VND in corporate bonds (code DDGH2123001) issued by Dong Duong Import-Export Industrial Investment JSC since May 10, 2021. However, Dong Duong has repeatedly breached its commitments to repay the bond’s principal and interest, despite numerous written promises and adjusted repayment schedules.

According to Mr. Minh, the company failed to make payments as resolved on April 20, 2023, regarding the schedule to repay 30% of the first and second installments, and also did not adhere to the adjusted repayment dates as mentioned in the official letters dated July 31, 2023, November 10, 2023, and December 28, 2023.

Notably, the most recent official letter dated January 3, 2025, regarding the repayment of dues by March 30, 2025, also remained unfulfilled.

Many businesses continue to miss bond maturity dates.

“The company’s repeated broken promises regarding debt repayment have caused significant financial and emotional distress to bondholders. It is uncertain when the company will respond to our requests for interest and principal payments,” said Mr. Minh.

Ms. Bich Hang from Cau Giay, Hanoi, who invested 3 billion VND in the same bond issue, shared a similar sentiment: “The company has repeatedly issued documents requesting deadline extensions but failed to meet them. My investment is the fruit of my hard work, and I don’t know when I’ll get it back. Now, I just want my principal back to take care of family matters, and I’m not even asking for interest, but the company has gone silent.”

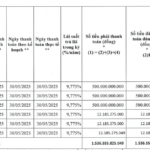

Recently, the Hanoi Stock Exchange published information disclosing the status of principal and interest repayments of Dong Duong Import-Export Industrial Investment JSC at the bond’s maturity date. Specifically, the company was scheduled to repay nearly VND 397.7 billion in principal and interest for the DDGH2123001 bond issue, including VND 300 billion in principal and nearly VND 97.7 billion in interest.

However, as of the maturity date of May 10, 2025, the company had only managed to repay over VND 17.2 billion, with the remaining VND 380.5 billion still outstanding.

In their explanation, Dong Duong attributed the delay to their inability to arrange funds in time for the bond maturity and interest repayment. They are currently in negotiations with investors regarding the delayed repayment of the aforementioned bond issue.

It is worth noting that the DDGH2123001 bond issue was launched on May 10, 2021, with a total issuance value of VND 300 billion, a 2-year term, and an expected maturity date of May 10, 2025.

Mr. Nguyen Hieu from Dong Da, Hanoi, who invested 2 billion VND in the SSHCH2123002 bond issue and refused to grant an extension to the company, found his family in a difficult situation as the company disregarded his decision.

In a rare case at the end of May, two bond issues totaling VND 4,000 billion, issued by a real estate enterprise, were unexpectedly subjected to a “mandatory buyback” provision after the company failed to fulfill its interest payment obligations for the 16th term (from February 12 to May 12, 2025).

Resurgence of Bond Maturity Pressure

During April, no new cases of delayed principal and interest payments were observed. FiinGroup forecasts that the total principal value of corporate bonds maturing in May for non-bank issuers is estimated at VND 11,400 billion, double the previous month. For the second quarter, the total estimated maturing corporate bond principal for non-bank issuers is approximately VND 24,400 billion, a 26.6% increase from the first quarter.

According to Fiingroup’s calculations, the pressure to repay corporate bond principals among non-bank issuers is expected to ease significantly in June compared to the previous month. Specifically, the total maturing corporate bond principal for non-bank issuers is estimated at VND 7,300 billion, a decrease of 33.6%.

Real estate continues to account for a significant proportion, with approximately VND 5,900 billion in bonds maturing in June, equivalent to 61.4% of the total market maturity value for the month. Aside from Nam Long, which has a relatively clear debt restructuring plan, notable issuers with bonds maturing during this period include Saigon Glory (VND 1,100 billion) and Signo Land (VND 1,000 billion).

Fiingroup’s experts estimate that the total maturing corporate bond principal for non-bank issuers in the last eight months of 2025 will be around VND 126,400 billion, of which real estate accounts for approximately VND 79,400 billion (63% of the total maturity value). The maturity pressure for corporate bonds among non-bank issuers is expected to peak in the third quarter.

According to VNDirect’s statistics as of April 15, 118 issuing organizations have reached agreements with bondholders to extend the bond term and have officially reported this to HNX. The total value of bonds with extended terms exceeds VND 178,000 billion. Of this, bonds maturing in 2025 with extended terms amount to more than VND 20,000 billion, accounting for 10% of the total value of privately placed corporate bonds maturing in 2025 and 11.2% of the total value of bonds with extended terms.

Vinfast Repays $87 Million in Principal and Interest on Bonds

Vinfast has made principal and interest payments totaling nearly VND 2,050 billion on four bonds: VIFCB2225001, VIFCB2225002, VIFCB2225003, and VIFCB2225004.

“Vingroup Leads the Pack: A Whopping 21X Surge in Private TPDN Issuance in April 2025”

According to FiinGroup, the private corporate bond market witnessed a resurgence in April, with issuance volume surging 21-fold compared to the previous month and a remarkable 119% increase year-over-year, predominantly driven by the real estate sector. Notably, Vingroup accounted for a significant portion of the new private bond issuance in April, maintaining high-interest rates of 12-12.5% per annum.

The Real Estate Giant Returns to the Bond Market

The corporate bond market, notably silent in the first quarter of 2025, stirred back to life in April with a smattering of issuances from the real estate sector.