Two months after President Donald Trump’s tumultuous “liberation days,” the VN-Index has once again comfortably surpassed the 1,300-point threshold. On the surface, the market appears to have weathered the tariff shock and displayed resilience amidst macroeconomic fluctuations. However, when observers adjust their lens to identify the pillars of this impressive rebound, they will find that the market’s optimism is somewhat concentrated.

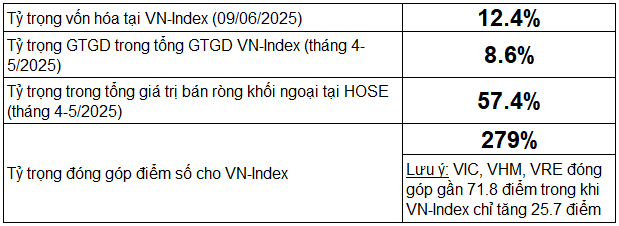

In April and May, the quartet of stocks known as the Vin Group—VIC, VHM, VRE, and VPL—collectively contributed nearly 80.86 points to the VN-Index, while the index only gained 25.74 points. This implies that, excluding the Vin Group, the market actually declined. It also means that any investor not holding Vin Group stocks would have found it extremely challenging to outperform the average market performance. This is the predicament facing the majority of professional fund managers today.

It’s even more daunting for professional investors when the Vin Group’s spectacular rise occurs amidst underperformance from top stocks typically favored by funds, such as FPT or the state-owned bank stocks VCB, CTG, and BID.

|

Helpless with the Market

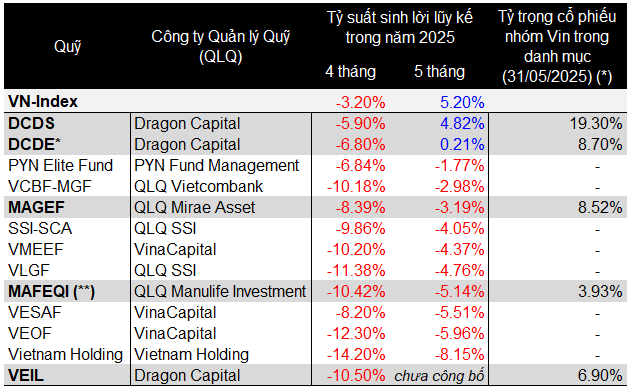

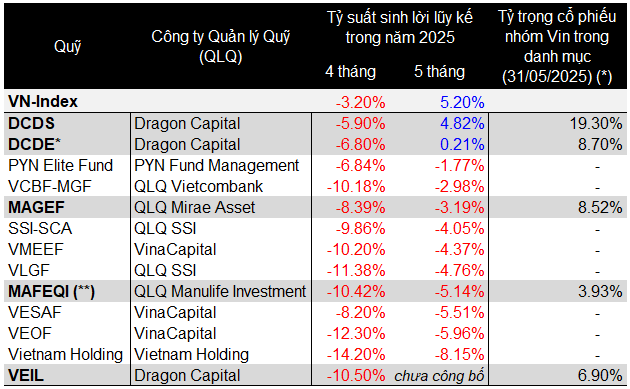

Nearly all the investment funds listed below (except MAFEQI) did not hold significant positions in Vin Group stocks at the beginning of 2025. However, DCDS and DCDE funds quickly increased their allocations to Vin Group stocks and led the investment efficiency race, while the rest lost money. The surveyed funds have assets under management of approximately VND 500 billion or more.

– (*): Survey of fund-disclosed figures. Some funds do not disclose their full portfolio, only revealing their largest investments. – (**): MAFEQI did not continuously hold VHM and VIC but continuously traded them, selling, buying, and then selling again throughout February-May 2025. This explains the fund’s poor performance despite being the only one with Vin Group stocks in its list of largest investments at the beginning of the year. – Source: Author’s compilation |

After a prolonged period of price declines for VIC and VHM since 2022, very few investment funds had the patience to hold on to Vin Group stocks at the start of this year. Simultaneously, there were also very few securities companies initiating coverage or analysis reports on these stocks.

As a result, everyone was left behind. Within just a few months, up until the end of May, VIC’s price had surged by 144%, VHM by 96%, and VRE by 67%. Meanwhile, VPL, which was listed on May 13, 2025, needed only a few trading days to become the fourth-largest contributor to the VN-Index’s cumulative points for the entire five-month period, following only TCB of Techcombank, and after VIC and VHM.

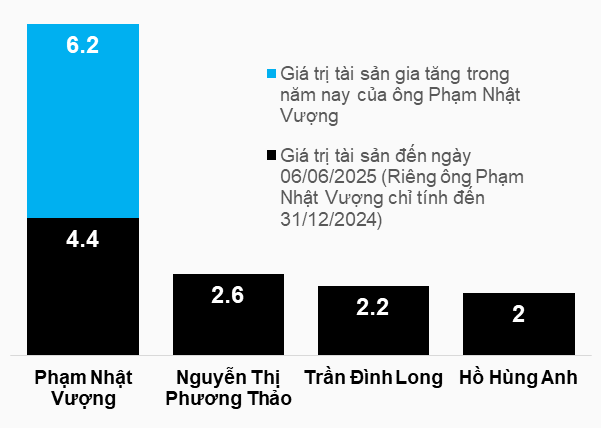

This price surge in listed assets not only posed challenges for funds but also rapidly increased the wealth of Vietnam’s richest man, Mr. Pham Nhat Vuong.

According to Forbes, as of June 6, Vuong’s net worth had reached the $10.6 billion mark—a more than 140% increase since the beginning of the year. The additional wealth Vuong accumulated in just half a year is larger than the total wealth of the next two richest people on the list combined.

|

The Giant Soars High

Pham Nhat Vuong’s net worth exploded this year as VIC, VHM, and VRE stocks skyrocketed, and VPL was listed on the HOSE. Unit: Billion USD

Source: Forbes

|

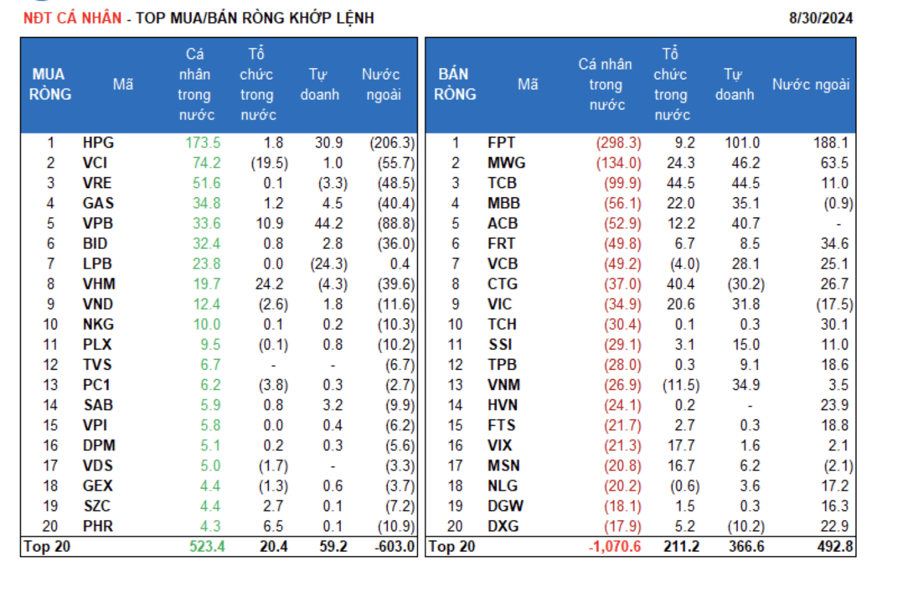

Domestic money has been the driving force behind the surge in market prices of Vietnam’s largest private companies, valuing them at billions of dollars in a short period. However, from the beginning of April to June 9, 2025, foreign investors net sold VIC, VHM, and VRE, with net selling values of VND 4,320 billion, VND 3,740 billion, and VND 449 billion, respectively.

Thus, the story of the Vin Group involves domestic money pushing up stock prices and turning this group into the market’s pillars, while foreign investors retreat as the stocks climb higher.

With their combined weight of nearly 16% of the total market capitalization on the HOSE, the price increases of VIC, VHM, VRE, and VPL naturally boost positive sentiment in the market, encouraging participants to confidently invest in other stocks. Although it is challenging to quantify this impact precisely, a hot stock price surge can trigger fear of missing out among individual investors, leading to buying decisions that may not be thoroughly considered.

Fund managers may also face unique pressures regarding peer performance, as underperforming the market and a small number of funds holding Vin Group stocks with superior returns can be concerning. This pressure is amplified by the fund industry’s recent focus on attracting individual investors—who are often attracted by short-term results. Underperformance relative to peers can result in being overlooked by potential clients.

|

Position of VIC, VHM, and VRE on the HOSE

– Trading volume weight is lower than capitalization weight, but the contribution to the index is outstanding. However, foreigners continuously withdraw capital. – Outsiders have no way of understanding the intentions of the parties buying Vin Group stocks strongly in recent days. VPL data is not included as it was only listed on May 13, 2025.

Source: VietstockFinance |

Thua Van

– 11:26 13/06/2025

Profiting from Chaos: Domestic Firms Cash Out with Nearly 900 Billion Sell-Off Today

The domestic institutional investors recorded a net sell-off of VND 684.6 billion, with a striking VND 851.1 billion sold in the matched orders alone.

Market Pulse June 12: Afternoon Jitters Shake Markets, Late Rally Boosts VN-Index by Almost 8 Points

The market opened the afternoon session with a strong rally, surging towards the 1,326-point mark, but this momentum was short-lived as it quickly faced resistance and entered a corrective phase, dipping to 1,317 points. It was only in the final hour of trading that the market staged a recovery, returning to the morning’s price levels.