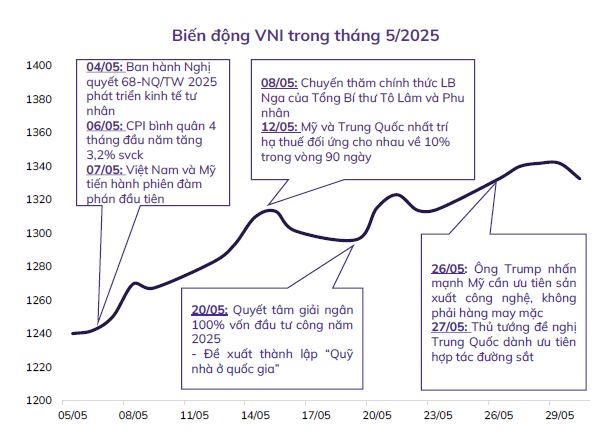

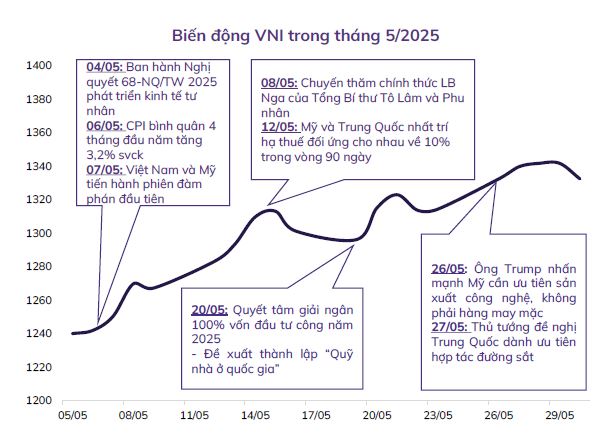

The overall market performed positively in May, moving in tandem with major global stock markets after the US and China agreed to a 90-day tariff delay. This, along with President Trump’s statement that the US is not aiming for self-sufficiency in textile production and other positive macroeconomic news, boosted market sentiment. The market witnessed a broad-based rally led by large-cap stocks, and export-oriented sectors (textiles, seafood, industrial real estate, and logistics) that were directly impacted by trade policies are now showing signs of recovery. Notably, the real estate sector witnessed healthy price gains, attracting market participants.

The VN-Index ended May with an impressive 8.67% gain (closing at 1,348.31 points), forming a strong monthly candle with a small wick, indicating a bullish reversal of the previous month’s sell-off. The high buying volume, coupled with strong upward momentum, suggests further price increases in the coming months.

Source: ABS Research

|

The intermediate-term trend indicates positive momentum going forward. Price action has confirmed a break above the weekly moving average, accompanied by rising trading volume and a bullish MACD crossover. The continuation of upward momentum on the intermediate-term chart suggests a potential test of the 1,395 – 1,430 – 1,475 price region.

According to reports, the market in June will receive corporate earnings reports, which are expected to be positive. Vietnam’s Q2 GDP growth is anticipated to remain robust, exceeding 7%. This period reflects a time when the Vietnamese economy has not yet been negatively impacted by tariffs and has even shown signs of improvement due to accelerated export activities ahead of the negotiation deadline of July 8, 2025, coupled with government efforts to boost economic growth. However, with a 22% rally since mid-April, many stocks have already priced in these positive earnings expectations.

In the latter half of June, trade negotiation outcomes will likely be the market’s focal point. Vietnam is actively implementing measures to meet US demands for fair trade, including recent efforts to crack down on counterfeit goods, improve supply chain transparency, and curb illicit trade. Aside from retaliatory tariffs, Vietnam is also on the US Monitoring List for currency manipulation. While the latest US Treasury report does not label Vietnam as a currency manipulator, there is a possibility of tariffs if Vietnam violates any criteria or if the US expands its assessment to include additional factors.

Given Vietnam’s efforts, ABS Research anticipates a favorable negotiation outcome, with potential tariffs on Vietnamese goods remaining in the 15-25% range.

In terms of valuations, the VN-Index‘s P/E ratio for the last four quarters has risen from 10.86x on April 9 to 13.1x as of June 6, 2025, approaching the three-year average of 13.12x. Large-cap stocks in the VN30 index have a P/E of 11.40x, significantly lower than mid and small-cap stocks in the VNMID (15.95x) and VNSML (14.01x) indices. Aside from the VNMID, these P/E levels are below their three-year averages, suggesting that certain stock categories still have room for price appreciation. The VN30 index’s P/E is only slightly above one standard deviation below its three-year mean of 11.3x.

ABS Research believes that the stock market has a positive medium-term growth opportunity due to favorable trade negotiation outcomes and government initiatives.

Two scenarios are presented for the stock market. In Scenario 1, which has a higher probability, the short-term trend may weaken in early June, suggesting a potential range-bound movement with proposed support levels at 1293 – 1310 points and 1260 – 1283 points, before resuming its larger uptrend toward the 1,400-point region. Sectors such as real estate, exports, oil and gas, and retail have demonstrated resilience during the recovery phase, and investors are advised to maintain their positions and add on dips with a positive price signal.

In the lower probability Scenario 2, if trade negotiation outcomes fall short of expectations and the VN-Index fails to hold its support levels, investors should consider reducing their equity exposure and maintaining a cash position or investing in stocks that have bottomed out around April 22, 2025.

In this scenario, investors can add mid-cap stocks with attractive valuations and solid upside potential to their portfolios. It is recommended to monitor buying opportunities when the VN-Index undergoes a short-term consolidation phase, focusing on sectors such as real estate, industrial real estate, textiles, seafood, public investment and construction, steel, chemicals, oil and gas, utilities, and food processing. This corrective phase presents active traders with more opportunities to adjust their portfolios for the next leg up. Emphasis should be on holding stocks that have performed well during this period, with a view to adding to winning positions.

– 10:32 13/06/2025

“Shareholder Meeting of Tôn Đông Á: Steel Trade Flows are in Turmoil, with a Focus on the Domestic Market Aiming for a 75% Share.”

With a steadfast determination to ascend in the industry, Ton Dong A envisions a strategic shift to the Ho Chi Minh Stock Exchange (HoSE). This move is accompanied by ambitious plans to invest in a new plant, dubbed ‘Plant 4,’ with a formidable capacity of 1.2 million tons per annum. This decisive step propels the company deeper into the value chain of the prestigious coated steel industry.

“Sacombank Embraces ‘Cashless Day 2025’ to Boost the Digital Economy”

Sacombank is proud to continue its leadership in driving modern consumer behavior by sponsoring the “No Cash Day” initiative in 2025. As a Silver Sponsor, we are thrilled to partner with the Payment Department, the Banking Times, Tuoi Tre Newspaper, the Ho Chi Minh City Department of Industry and Trade, and the National Payment Corporation of Vietnam (Napas) to promote a cashless society and accelerate the growth of the digital economy.

Market Pulse for June 13: Banking Stalwarts Struggle to Hold Indices Steady

The market witnessed a failed recovery attempt, with selling pressure intensifying towards the end of the morning session. At the midday break, the VN-Index shed over 10 points, resting at 1,312.48, while the HNX-Index dipped 1.06% to 225.32. The market breadth remained skewed towards decliners, with 502 stocks falling against 190 advancing ones as the afternoon session loomed.