On the contrary, the HNX-Index did not see a similar recovery and closed slightly lower, down 0.6 points to 227.56.

|

Source: VietstockFinance

|

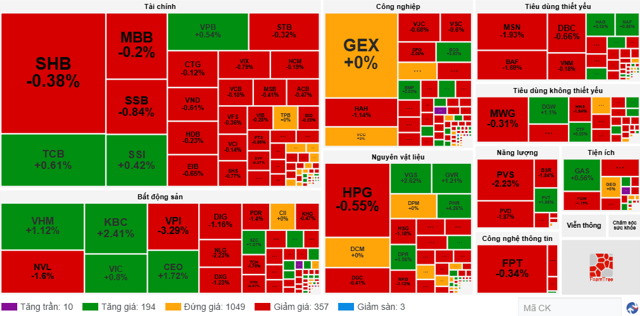

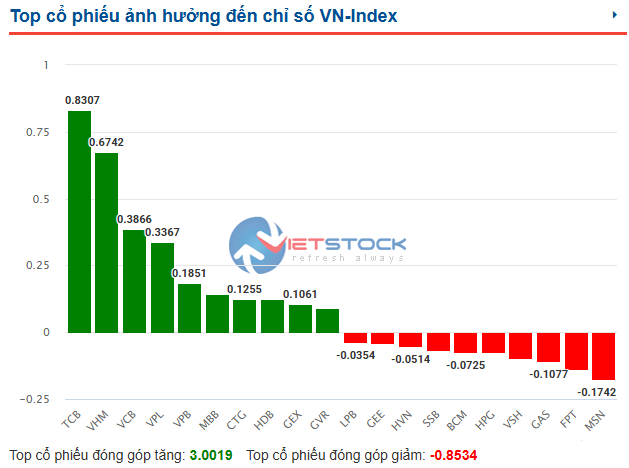

The market breadth was skewed towards sellers, with 340 gainers and nearly 400 decliners. Despite the stronger selling pressure, the index was supported by some large-cap stocks such as TCB, VIC, and GVR, which helped the VN-Index recover. Conversely, no single stock exerted significant downward pressure. The top 10 stocks dragging the VN-Index down only caused the index to lose about 2 points.

In today’s session, TCB rose 3.6%, and CTG gained 1.4%, leading the banking group.

| Top 10 stocks with the most significant impact on the VN-Index on June 19, 2025 |

The market is witnessing an internal divergence within industry groups. Most sectors fluctuated between gains and losses.

The energy group continued its lackluster performance. PVS, PVD, BSR, and PVC all declined slightly.

In the retail group, DGW stood out with a ceiling price session. Since the beginning of June, this stock has surged from the 32,000 VND/share region to 43,850 VND/share at today’s close.

| Price movement of DGW |

Foreign investors had another strong net selling session, offloading stocks worth over 900 billion VND. FPT was the most net-sold stock, with nearly 390 billion VND in net selling value. Today’s trading liquidity was quite high, with a value of more than 20,600 billion VND.

Morning session: Attempt to rebound fails, VN-Index closes lower

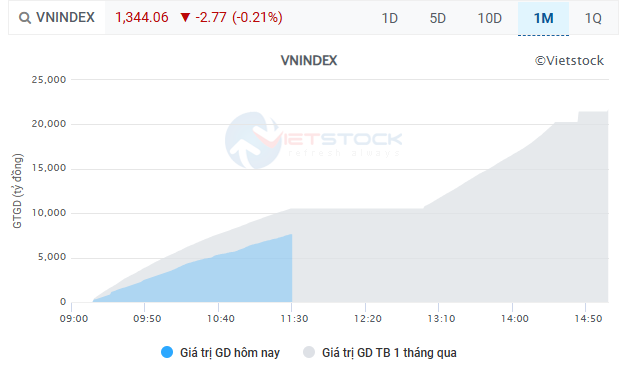

After touching the 1,350-point threshold, the index corrected sharply to the 1,344-point region and continuously fluctuated around this level. The VN-Index closed the morning session down 2.77 points at 1,344.06, while the HNX-Index lost 1.25 points to 226.95, and the UPCoM-Index fell 0.47 points to 98.84.

Notably, the VN-Index made an effort to rebound to the reference level of around 1,347 points but ultimately failed and closed in negative territory.

Source: VietstockFinance

|

The index could have lost more ground if it weren’t for the intervention of some pillar stocks, notably banks such as TCB, CTG, VPB, and BID, along with support from VHM, GVR, GAS, KBC, PHR, and KDC.

Looking at the market landscape, red dominated with 404 declining stocks, excluding 6 stocks hitting the floor price. On the other hand, there were only 221 advancing stocks, while 982 stocks remained unchanged. Red prevailed, and a few sectors with scattered green areas included food, securities, distribution, metals and mining, and slightly more in banking, real estate, and chemicals.

The total trading value of the market reached over 8,474 billion VND, of which the HoSE contributed more than 7,642 billion VND, significantly lower than the recent average for the same period of the previous session. Today was also the futures expiration date, giving investors another reason to stay on the sidelines.

Source: VietstockFinance

|

In this context, foreign trading was not very active, but there was a significant imbalance between selling and buying. Foreign investors net sold nearly 653 billion VND, with net selling of nearly 1,078 billion VND and net buying of about 425 billion VND. The main selling pressure in the morning session came from FPT stock, with a net selling value of nearly 153 billion VND.

Under pressure after touching 1,350 points

The market faced pressure as the VN-Index reached the 1,350-point mark and quickly corrected to 1,345.46 points by 10:25 am. Red also appeared on the HNX-Index and UPCoM-Index.

The number of declining stocks increased sharply to 360, including 3 floor stocks. Conversely, 204 stocks advanced, while the remaining 1,049 stocks were unchanged.

Source: VietstockFinance

|

According to VS-SECTOR, 18 out of 23 sectors declined, led by energy, down 1.67%. PVS fell 2.23%, PVD dropped 1.87%, and PVC decreased by 4%… The two other sectors that fell more than 1% were household appliances and personal items, down 1.41%, and telecommunications, down 1.11%.

On the other hand, only five sectors posted gains, including real estate, which edged up 0.24% thanks to the momentum from the duo of VIC, up 0.8%, and VHM, up 1.12%, along with other stocks such as CEO, up 2.87%, KBC, up 2.41%, and SZC, up 1.37%…

Apart from Vietnam, other Asian markets also witnessed a sea of red, notably the All Ordinaries, Hang Seng, Nikkei 225, Shanghai Composite, and Singapore Straits Times…

9:30 am: Blue chips make the difference

As of 9:30 am, the market was mixed, with the VN-Index up 2.7 points to 1,349.53, while the HNX-Index fell 0.05 points, and the UPCoM-Index dropped 0.13 points. Market liquidity reached nearly 77 million shares, equivalent to a trading value of over 1,502 billion VND.

Looking at the market landscape, there was a balance with 212 gainers and 199 decliners, while 1,202 stocks remained unchanged. In this context, the positive performance of some pillar stocks, notably banks, which rose 0.35%, made the difference and pushed the VN-Index into positive territory.

In the top 10 stocks with the most positive impact on the VN-Index, six were banks, led by TCB, contributing more than 0.8 points, followed by VCB, VPB, MBB, CTG, and HDB. The index was also boosted by other pillar stocks such as VHM, VPL, GEX, and GVR.

Source: VietstockFinance

|

Last night, as expected by the market, the Federal Open Market Committee (FOMC) kept the key interest rate unchanged at 4.25-4.5%, a level that has been maintained since December.

Along with the interest rate decision, the FOMC projected two rate cuts in 2025, according to the dot plot. However, the Fed removed one cut for both 2026 and 2027, bringing the total number of expected future rate cuts to four, equivalent to a full percentage point.

Fed Chair Jerome Powell signaled that he would wait to see the impact of President Donald Trump’s tariff policies on inflation before making any changes to interest rates.

This decision affected the US stock market, with the Dow Jones closing down 44.14 points (equivalent to 0.10%) at 42,171.66, the S&P 500 losing 0.03% to 5,980.87, and the Nasdaq Composite advancing 0.13% to 19,546.27.

– 15:42 19/06/2025

“Vietstock Daily: Anticipating a Liquidity Rebound”

The VN-Index surged, successfully surpassing the 1,350-point resistance level. For this upward trend to solidify, confirmation from trading volume is necessary. The Stochastic Oscillator is pointing upwards and has already given a buy signal, while the MACD is narrowing its gap with the signal line, potentially providing a similar indication. These signals bode well for the index’s short-term positive outlook.

The Ticking Time Bomb of Maturity: Blue-chips Bounce Back, VN-Index Soars Past 1,350 Points

The VN30 stock group’s impressive recovery this afternoon propelled the VN-Index on an upward trajectory for almost the entire session. The index closed above the reference level, with trading volume on the HoSE surging 24.3% compared to the morning session. This marks the first time since May 2022 that the VN-Index has closed above the 1350-point mark.