|

Customers transacting at SCB‘s counter – Photo: SCB

|

Long-term dispute risks need to be avoided.

Recently, Mr. Truong Lap Hung, authorized by the Board of Directors of Van Thinh Phat Joint Stock Company, sent Proposal No. 18/2025 to Party General Secretary To Lam, Prime Minister Pham Minh Chinh, Permanent Deputy Prime Minister Truong Hoa Binh, and Governor of the State Bank Nguyen Thi Hong. The proposal expressed a desire to participate in the restructuring or voluntary forced transfer of SCB, linked to the handling of assets in the case.

Accordingly, SCB currently has a chartered capital of over VND 15,231 billion. According to the first-instance criminal verdict No. 157/2024 and the appellate criminal verdict No. 1125/HS-PT, Ms. Truong My Lan owns 91.536% of the charter capital, with 27 legal entities and individuals holding it on her behalf.

Therefore, according to the proposal, if the priority is given to the group of investors who have agreed and cooperated with Lan and Van Thinh Phat to implement the project, it is considered to be in line with the spirit of Resolution 68. This resolution prioritizes the application of civil, economic, and administrative measures first, allowing businesses and entrepreneurs to proactively rectify violations and compensate for damages.

This group of investors is affirmed to have sufficient financial capacity and experience in implementing real estate projects. At the same time, Lan and Van Thinh Phat, as owners of the case’s assets, will have the conditions to proactively optimize the value of those assets.

In a new dispatch sent to the Party and Government leaders to consider the project’s proposal, Nova Group said: “We have prepared a source of capital for the first phase worth 2 billion USD, which we are ready to deposit into a locked account as required.”

|

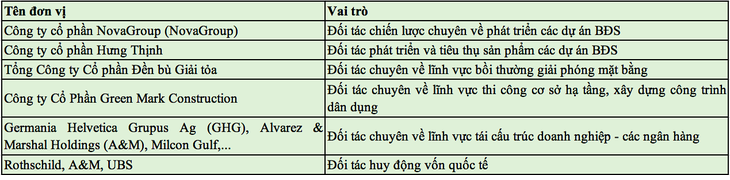

Some investors participating in the project proposed by Van Thinh Phat – Source: VTP

|

In addition to domestic partners, there are also foreign investors who want to participate in the restructuring of SCB, notably Alvarez & Marsal Holdings (A&M), a financial advisory firm in corporate finance and banking established in 1930 in the US, and Germania Helvetica Grupus Ag (GHG), headquartered in Switzerland.

There are also several advisors supporting the development of the project as mentioned by Van Thinh Phat, including banking and finance expert Khawaja Muhammad Salman Younis and Mr. Sohail S. Quraeshi, Chairman of Milcon Gulf Group.

3 phases of implementation

In the first phase, Van Thinh Phat and the group of investors have already had a source of capital of 2 billion USD, equivalent to more than VND 50,000 billion, which will be disbursed immediately upon permission to stabilize SCB‘s operations, ensure liquidity for deposits, repay overdue debts, supplement working capital, and prepare for the completion of some large and feasible projects.

Notably, SCB will not need to borrow additional special loans from the State Bank if this plan is implemented.

The second phase will take place within 5 years from the implementation of the project. Investors will use money and assets from partners and investment funds worth about 8 billion USD, equivalent to more than VND 200,000 billion, to develop projects that have completed legal procedures and use them as leverage to generate revenue.

The third phase will run concurrently with the second phase. Investors will use additional capital borrowed from domestic and international credit institutions to invest in large projects to generate revenue of about VND 580,000 billion.

Some projects expected to generate significant revenue include the Mui Den Do project (estimated to bring in VND 180,000 billion), the Ba Son project (about VND 50,000 billion), the 87 Cong Quynh and 289 Tran Hung Dao projects, Saigon Port, and the Nguyen Hue – Amigo quadrangle (a total of VND 250,000 billion)…

In addition, small-scale real estate projects, stocks, shares that have not been valued, ongoing projects, residential houses, old apartments, etc., which are currently mortgaged at SCB, if properly valued and legally completed, could bring in an additional VND 100,000 billion.

At the same time, Van Thinh Phat and Nova Group have also proposed a series of policies that need state support, such as a 0% interest rate for 12 years on the disbursed amount for SCB‘s borrowing, granting special mechanisms similar to those for handling weak credit institutions, removing asset seizures, allowing the use of proceeds from asset disposal for restructuring, establishing a steering committee or intergovernmental task force to monitor the implementation of the project (similar to the model used for handling Vinashin and VAMC)…

|

The Government Office has assigned the Governor of the State Bank to research and propose solutions to handle the proposals of Van Thinh Phat Group regarding their desire to participate in the restructuring of SCB with the support of many international investors. |

Hong Phuc

– 16:04 19/06/2025

“Seasoned Entrepreneurs Appointed to Key Political Positions”

“Vietnam’s Finance Minister, Nguyen Van Thang, highlighted the recognition and elevation of accomplished entrepreneurs to pivotal roles within the political arena and elected offices. Their invaluable contributions are now steering the country’s future trajectory.”

The $675 Billion Deposit Record in Vietnam’s Banking System: The Big Four Control 47% Market Share

In the span of just three months, customer deposits in the institutional system soared by an impressive 258 thousand billion dong. This significant surge highlights the robust financial health and stability of these institutions, underscoring their appeal to customers seeking secure avenues for their funds.

Reappointment of the Chairman of the Vietnam Deposit Insurance Board

The Deputy Prime Minister, Nguyen Hoa Binh, has signed a decision to reappoint the Chairman of the Vietnam Deposit Insurance Corporation. On June 16, 2025, Decision No. 1166/QD-TTg was issued by the Government, extending the term of the current Chairman.

Opening the Doors to Private Sector-Led Transportation Infrastructure Development

“Resolution 68-NQ/TW of the Politburo on Private Sector Development (Resolution 68) marked a significant turning point in the thinking around private sector growth, especially within the transport infrastructure sector. The Resolution’s strong emphasis on innovation was well-received by the private business community, setting the stage for a new era of development where the private sector not only participates but also pioneers the creation of large-scale national infrastructure projects.”